As the end of 2010 approaches here is a selection of main peer-to-peer-lending news and developments covered by P2P-Banking.com:

- January: Focus on Zidisha with an Zidisha review and an interview with Zidisha founder Julia Kurnia; P2P Lending companies Monetto and Bankless Life close

- February: Isepankur introduces B2B Loans

- March: Smava turns 3, merges polish operations into Finansowo; Prosper raises more capital

- April: Moneyauction wins Savings Bank as Lender; Lending Club raises 24.5 million US$ series C round

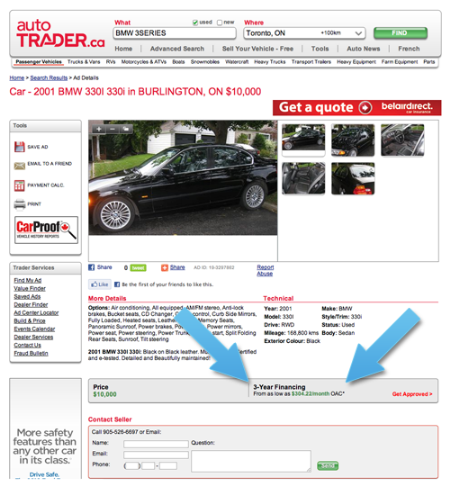

- May: Auxmoney uses cars as collateral for p2p loans

- August: Guest article: Does P2P Lending work for microfinance?; FundingCircle Launches P2C lending in UK; map of p2p lending sites in Europe; Zopa expects record loan growth

- September: Interview with CEO of new British player Yes-Secure

- October: Ratesetter and Quakle are more newcomers in UK

- November: Kotikonttori family and friends beta launch; Aqush gets Venture Capital; Zopa Rapid Return Secondary Market starts

- December: Money360 is the first site to try p2p real estate loans; Prosper abandons auction model; CommunityLend starts interesting FinanceIt service.

(Photo by paul (dex))

Canadian P2P Lending company

Canadian P2P Lending company