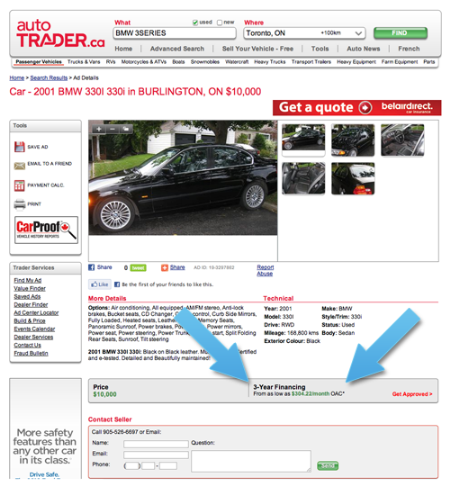

![]() Today Lending Club has unveiled a new product offer. Borrowers in California will be able to refinance auto loans through Lending Club. Lending Club says that the opportunity is huge with currently more than 1 trillion US$ in auto debt outstanding, while just a fraction of that – 40 billion US$ – refinanced annually. The company states this represents huge potential for both Lending Club’s platform and the millions of Americans who could save by refinancing into a more affordable product. Lending Club estimates the average APR for borrowers on new loans through Lending Club will be about 1-3% lower than their current loan, translating into an average savings of up to 1,350 US$ over the life of the loan.

Today Lending Club has unveiled a new product offer. Borrowers in California will be able to refinance auto loans through Lending Club. Lending Club says that the opportunity is huge with currently more than 1 trillion US$ in auto debt outstanding, while just a fraction of that – 40 billion US$ – refinanced annually. The company states this represents huge potential for both Lending Club’s platform and the millions of Americans who could save by refinancing into a more affordable product. Lending Club estimates the average APR for borrowers on new loans through Lending Club will be about 1-3% lower than their current loan, translating into an average savings of up to 1,350 US$ over the life of the loan.

“Tens of millions of Americans borrow over half a trillion dollars every year to buy cars. The practices and processes of the auto lending industry offer consumers limited options and a lack of transparency. This has created a gap between the rates consumers pay and the rates they might otherwise qualify for, unnecessarily driving up debt burdens,” said Scott Sanborn, Lending Club’s President and Chief Executive Officer. “We are excited to leverage our technology and core capabilities to put thousands of dollars back in consumers’ pockets.”. “This is Lending Club’s first offering of access to a secured loan with an overall risk and return profile that’s complementary to the unsecured loans available through our platform. It’s a big step in the evolution of our platform, a win for consumers, and will give our investors access to another proven asset,” Sanborn said.

Loans will be for amounts from 5K to 50K US$ with terms of 24 to 72 months and APRs ranging from 2.49% to 19.99%.

Lending Club strives to offer a much simpler application process than competitors. While the loans are initially limited to borrowers in California it seems likely that Lending Club will expand that. An article with more details is on Lendacademy.

Today UK p2p lending service

Today UK p2p lending service

British p2p lending marketplace

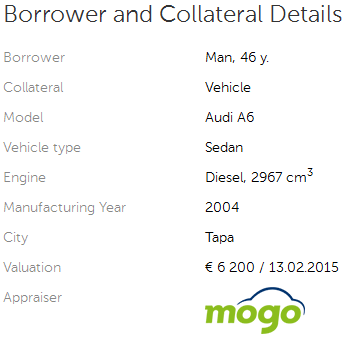

British p2p lending marketplace  Latvian p2p lending marketplace

Latvian p2p lending marketplace