Barclays Africa Group Limited (BAGL) has acquired a 49% stake in South African p2p lending service Rainfin. The investment amount is stated to be ‘tens of millions of rands’. Rainfin says it wants to use the money to grow the business and improve the product.

Barclays Africa Group Limited (BAGL) has acquired a 49% stake in South African p2p lending service Rainfin. The investment amount is stated to be ‘tens of millions of rands’. Rainfin says it wants to use the money to grow the business and improve the product.

Rainfin launched in July 2012.

CEO Sean Emery on the investment of BAGL:

We have known for a while that we would need a partner to take RainFin to the next level, and chose BAGL after a loan search because it has a vision that aligns closely with ours. BAGL’s support will enable us to offer exciting new products in areas such as supply chain finance, enterprise development funding, fixed asset purchases and even mid-sized corporate debt. It will also clear the way for us to expand into new markets.

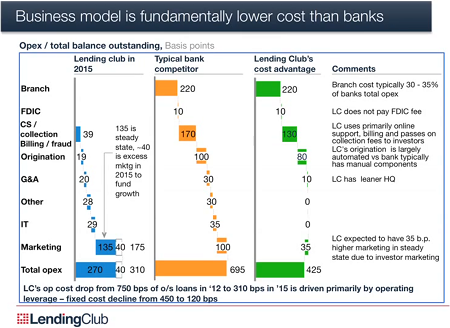

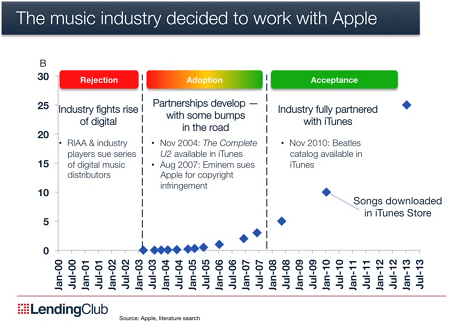

The BAGL investment in RainFin comes at a time when there is a lot of movement in the global peer-to-peer industry from the UK and US to China and India. In the US, peer-to-peer lenders such as Lending Club and Prosper are enjoying triple digit growth and venture capital firms like Sequoia Capital and Blackrock are investing in the industry.

Worldwide, we see banks, hedge funds, and institutional investors all exploring ways to collaborate with peer-to-peer lenders with City Group, Capital one, Bank of Montreal and Deuce Bank buying up loans originated through those platforms. With institutions moving into the market, peer-to-peer loans have truly come of age. BAGL will do the same to make our concept of peer-to-peer lending a mainstream finance option in South Africa.

Whether you’re a lender or borrower, rest assured that our main focus remains on bringing together creditworthy borrowers and smart lenders so that both parties can benefit. Our platform will remain as transparent as ever, and we will continue to put you first as we move forward into the future with our partners at BAGL.

We thank you for your early support of our business and of the early stages of peer to peer lending in South Africa. We look forward to moving into the future with you and with our new partners at BAGL.

Update: An earlier version of this article reported figures which were not up to date. Please see the comment by CEO Sean Emery for recent figures.

German

German  German p2p lending service

German p2p lending service