Societyone, an Australian p2p lending service, presented a mobile app at Finovate Asia. Previous apps offered by p2p lending services either optimised the display of website data for the mobile interface or offered basic bidding functions for investors. This one goes far beyond that. It promises the borrower a loan application and funding within 3 minutes.

To do this Societyone implemented the following steps:

- Only a few fields are required in the application (that is not a revolution but rather common sense and already used in many online application processes for loans)

- The borrower allows the app to retrieve transaction data from the past 3 months directly and automatically from the bank account he links

- The borrower allows the app to access his credit history data

- Like other p2p lending services Societyone offers lenders an automatic bidding feature that bids directly if a new loan request matches the desired parameters

- From the information in 2. and 3. Societyone calculates the maximum loan amount which the borrower has capacity to repay. From the information in 4. Societyone can determine which maximum loan amount could be instantly filled by existing automatic bids. Both information combined result in a maximum approved loan amount which is displayed to the borrower

- The borrower now enters the loan amount he wants and immediately Societyone displays which lenders fund his loan (in the example in the video 12 persons fund the loan)

- If the borrower confirms the loan applications the money is transferred to his bank account.

If you look further than whether there is a need by consumers to apply for loans from mobile devices rather than PCs there are a some very interesting key take-aways from this App. Continue reading

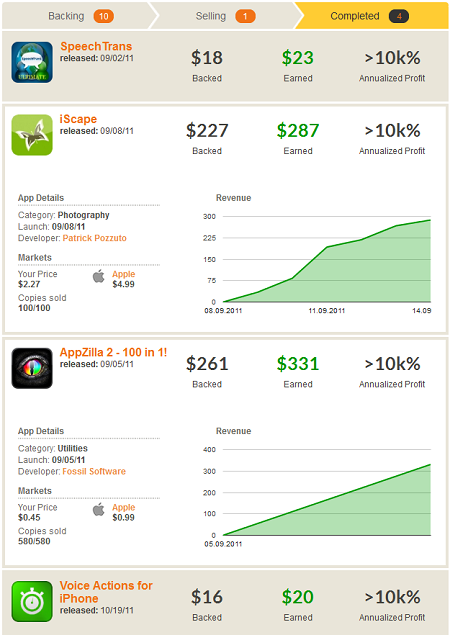

There are two major problems with Appbackr

There are two major problems with Appbackr

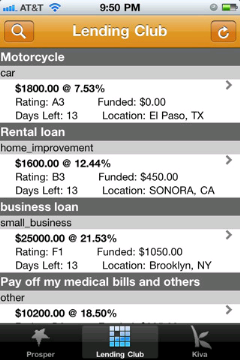

I just saw the first iPhone

I just saw the first iPhone