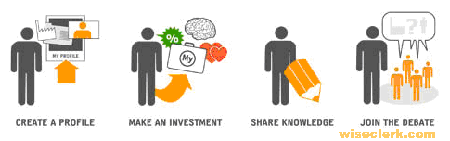

Danish startup C4 World on it's platform MyC4 allows lenders to finance micro loans to African entrepreneurs (Afripreneurs). P2P briefly featured the MyC4 plans earlier. The goal is to "eradict poverty through business". The service is currently in beta, but signing up and lending at MyC4 is already possible.

Danish startup C4 World on it's platform MyC4 allows lenders to finance micro loans to African entrepreneurs (Afripreneurs). P2P briefly featured the MyC4 plans earlier. The goal is to "eradict poverty through business". The service is currently in beta, but signing up and lending at MyC4 is already possible.

MyC4 differs in its approach from Kiva: At MyC4 lenders do earn interest on the loans. Currently interest rates of 20-24% are typical with loan terms of 6 or 12 month.

P2P-Banking.com joined the Beta as a MyC4 Builder. The gathered experiences are published in an exclusive P2P-Banking.com review of MyC4:

http://www.wiseclerk.com/myc4-p2p-banking-review.pdf (0,4 MB, 3 pages)

I’d be interesting in seeing what the collection procedures for defaulted loans are.

My understanding is that these cases will be handled by the local partner (called “provider”).

Not that the borrower can offer collaterals at MyC4 and in many loan request the collaterals offer cover more than 50% of the loan amount