On March 24th Smava.de launched its peer-to-peer lending service in Germany. Time for a recap on how Smava fared in its first 6 month of operation. How Smava operates can be read in this earlier article.

But despite receiving very positive and extensive media coverage Smava so far failed to achieve mass appeal. While Smava says it has over 13000 registered users, Wiseclerk figures show approximately 250 active lenders and 180 active borrowers.

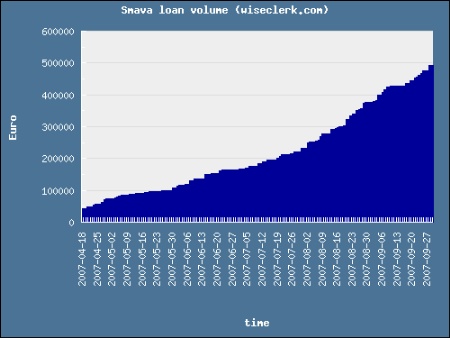

Source: Wiseclerk.com

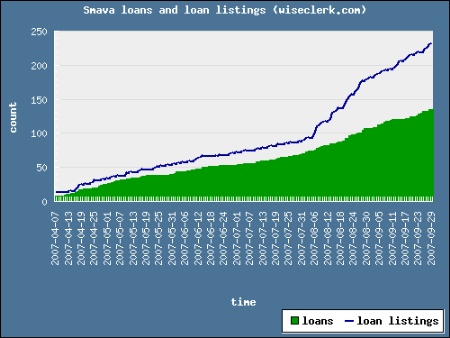

In the 6 month Smava handled a loan volume of 500000 Euro (approx 0.7 million US$), rather tiny compared to the loan volumes Prosper and Zopa handle. One move to foster growth was that Smava opened to lower credit grades in the beginning of August. While this led to a rise of loan listings (see chart below), fewer of the new loan listings were funded. But still over 50% of loan listings do get funded. It is to early to judge how the low credit rate loans will impact the default ratio.

Source: Wiseclerk.com

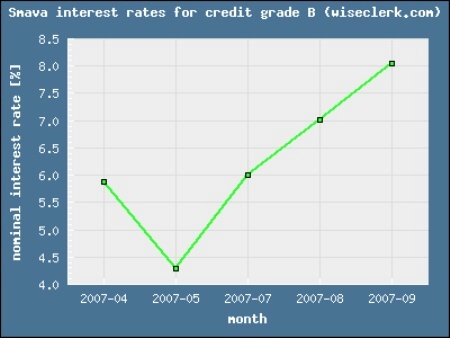

Possibly the main reason for Smava’s slow growth is the effficiency of German banking. German banks have automated the consumer loan process and small consumer credits have interest rates (APR) of as low as 4 to 5% (for best credit grade). At Smava the interest rates at which loans are funding have risen compared to launch date, voiding the argument that Smava offers better rates then a bank for many cases.

Source: Wiseclerk.com

Smava is still faring well in the absence of serious peer to peer lending competion. With Dutch Boober troubled by regulation worries, the long announced plans of Boober to expand into Germany have yet to happen. Smava avoided regulatory problems in the first place because it partnered with a bank, which fulfils all regulation requirements.

Like Prosper Smava has yet to define the benefit of groups, which exist but have no plausible way of influencing/reducing the default risk.