P2P Lending site Prosper.com changed its business model today.

P2P Lending site Prosper.com changed its business model today.

The company announced: ‘Our site has a new look, and we’ve eliminated the auction and simplified our loan process so that we can connect lenders and borrowers more efficiently. Borrowers will receive pre-set rates and lenders cannot be outbid. We hope you’ll appreciate this streamlined and even more prosperous experience.‘

Prosper is still lagging far behind competitor Lendingclub in monthly loan volume funded. While Prosper’s new loan funding process resembles the one of Lending Club more after Prosper did away with the auction it remains to be seen if it will help Prosper to regain market share.

The main problem of Prosper was not the auctions, but high default rates leading to lender churn.

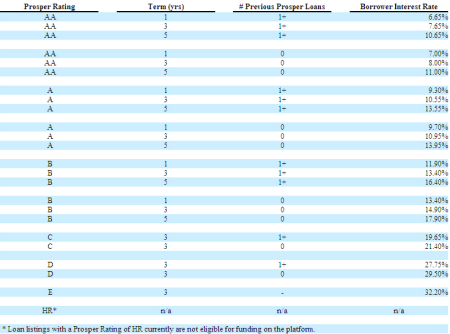

Another change, according to a recent SEC filing, is that Prosper now allows partial funding of loans.The current interest rates set by Prosper are:

Prosper says they will review and change interest rates monthly dependent on market conditions.

I suspect this will kill prosper.

peer to peer lending is about your lenders being able to choose which HR rated borrower they would like to lend to …. tell me how prosper is different from a big bank now.

I’ll ride my loans out and head back to the stock market after this.

New Coke anyone?

I think Prosper Lender is right,

I think this is the worst thing Prosper could have done. With investors like me who have only $1k invested, there is no way for me to compete with lenders like reflective-rupee or ArtisanBlue who have no problems dishing out a grand or two on every loan. Before, I could always get in on notes by offering a better rate than these goliaths.

I’ve watched this now for a few days. There are no A, B, or C listings anymore. All the safe listings are filled quicker than we can get to them. I’m guessing that most of us smaller lenders will get fed up. I will be riding out the notes I have already invested and start moving money back to mutual funds.

This sucks.