This is a guest post by Tuomas Talola, CEO of coming Finnish P2P lending site Lainaaja and blogger at Cloudfunder.

Peer-to-peer lending has been growing rapidly since the inception in 2005. Lending amounts are small compared to traditional banks, but potential is immense. What would it take to really break into mainstream and become a potential option to large customer masses?

What Is the Chasm and Target Customers?

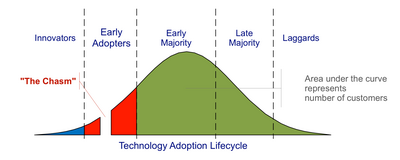

Geoffrey A. Moore wrote a highly appraised book called Crossing the Chasm in 1991. The book was about high-tech products marketing during the early stages and the difficulties of reaching majority of customers. In this post I’ll take a look what can be learned from the insights of the book and how to apply it to P2P lending.

Crossing the Chasm - Source:Wikpedia

According to Moore, there is a chasm between early adopters (technology enthusiasts and visionaries) and the early majority (pragmatists). Visionaries and pragmatists have very different expectations and this might be the reason why many technology products fail. Selling to the Early Adopters is easier, they are people who are always looking the new revolutionary technologies. As a group, they are easy to sell but very hard to please.

To sell to the Early Majority, P2P companies must provide reliable and tested platform, high quality support and reliability that company has future. Once a start-up has earned its spurs with the pragmatist buyers within a given vertical market, they tend to be very loyal to it, and even go out of their way to help it succeed. Number one source of success in peer-to-peer lending is creating a community and enabling word of mouth.

Overall, to reach pragmatists, you must be patient. Companies must listen to their customers, participate in discussions and appear as transparent as possible. Visibility in trade shows and business publications is always preferred but also more mainstream coverage should be targeted. One way to gain credibility is form an ally or partnership with specific vendors. P2P lending companies need to earn a reputation for quality and service, because they live and die by their reputation.

4-Step Roadmap to Cross the Chasm

Moore uses military terms to describe key success factors crossing the chasm; I’ll do my best to imitate.

1. Target point of attack

The niche of peer-to-peer lending companies across countries is pretty much the same; unsecured consumers loans. Some companies offer loans to entrepreneurs, but none offers to both customer groups. This way they are creating a totally new niche lending to your neighbour. High yield bonds and bond funds are closest asset class, which resemble it. All this follows Moore’s idea, attack the niche and achieve leadership. Niche is clear, leadership isn’t.

Banks have some economies of scale and experience in underwriting that peer-to-peer lending companies don’t have yet. But what P2P companies have is momentum. They enable a truly different way of borrowing and lending, and media has responded favourably while traditional banks take hits. As Sun Tzu puts it: ‘Opportunities multiply as they are seized.’

2. Assemble an invasion force

‘Invasion force’ means creating the whole product. It also includes your compelling reason to buy and all supporting systems.

The core product in peer-to-peer lending is a website where people can apply and bid for loans. The service provider must also identify users, handle invoicing and possible collections. This is the barebones of a business, where early adopters join in and start to give feedback about further development. In military terms, you have a base camp, a platoon of old lags and a watchtower. These are the elements you employ to build the regiment with air force, infantry, artillery, navy and paratroops.

Peer-to-peer lending is ready to capture the Early Majority when they can provide seamless service; reliable system, forecast-able and low default ratios, favourable word of mouth and enchanting story. The story is ready, success requires patience. In the mean time companies must engage and discuss with their customers relentlessly.

3. Define the battle

That is, create the competition, define your position, develop the elevator pitch, and build this into all your company communications. Translated to military terms; identify your enemy, evaluate your strengths and weaknesses, propagandize the need of war to leaders and people and motivate your troops.

First thing is to focus the competition within the market segment. P2P lending has established itself as an alternative to banks, a social way of lending and borrowing and offering better rates for borrowers and lenders. Moore emphasizes the importance of communications by repeatedly using sentence that identifies your primary competition and how you are differentiated from it. This varies between companies, but it could something like: ‘A more fair alternative to you than banks.’ This claim must be also proved by persuasive examples and testimonials.

4. Launch the invasion

Moore is proponent of direct sales, or using military terms, man-to-man battles. This is kind of tricky, since P2P companies work without branches. But it is true that personal sales is the most effective way of sales. Social media enables direct contacts between company’s employees and customers, these contact can be nourished and turned into meetings outside the web. Personal contacts are the most effective way to build trust and companies should undertake every possible opportunity to create personal connections.

One thing that strikes me most is the usage of social media, or the lack of usage. Banks don’t seem to understand web 2.0 but it’s incredible that many peer-to-peer companies don’t seem to understand it either. Social media is a golden opportunity for small companies to listen, participate and influence customers. No, your blog feed in Twitter is not participating.

Comments are closed.