Ratesetter will expand its p2p lending operations to Australia in 2014 and says this will serve as the stepping stone to further launches in Asia. It is also exploring launches in association with financial services partners closer to home in Europe.

Ratesetter has secured investment of $3 million from local and international investors to kick-start its offering from its Sydney offices.

Headed by Daniel Foggo, a former banker with Barclays Capital and NM Rothschild in Sydney and London respectively, the company says it will be the only Australian P2P company offering market-beating savings rates to individuals who lend funds on its platform and accessible loan rates to everyday borrowers who are tired of banks’ hidden fees and profiteering.

Ratesetter will go live in Australia this summer. Ratesetter says, it will be the first P2P lender in Australia to be fully regulated from the outset, allowing all Australians to participate on its  platform, not just professional investors. To make the platform available to retail investors at launch, Ratesetter has been working for a year on licensing.

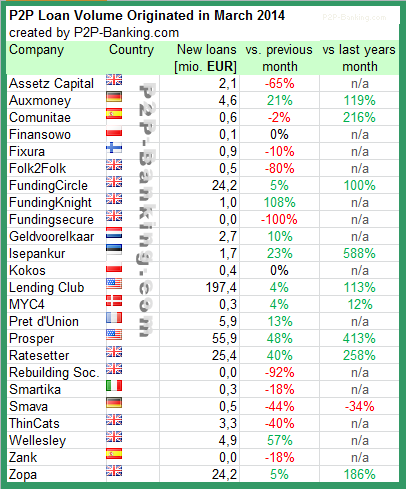

Ratesetter, launched in October 2010 in the UK was also the first P2P lender to launch a ‘Provision Fund’ – the largest in the UK at 3.8 million GBP – to help protect savers’ funds in the event of a borrower default. In March 2014, Ratesetter also originated the largest monthly inflows in the UK p2p lending sector. Since October 2010 the total p2p loan volume originated by Ratesetter has been over 208 million GBP.

Rhydian Lewis, founder and CEO of Ratesetter, said: “When looking at international markets in which to expand, Australia was the obvious choice as it bears great similarity to the UK before the advent of p2p lending. Its saving and loans industry is ripe for disruption as banks have been offering below-par deals for too long with little true competition.†Continue reading

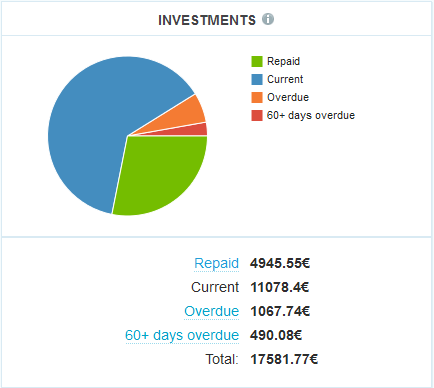

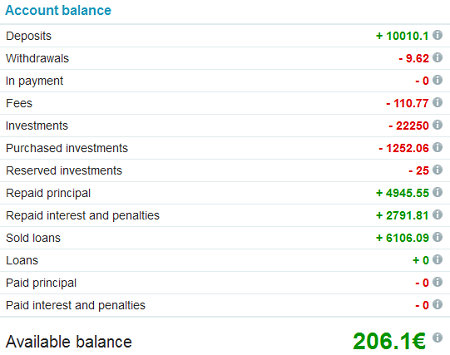

P2P Lending marketplace Isepankur yesterday rebranded as

P2P Lending marketplace Isepankur yesterday rebranded as