This is a guest post by Tomoyuki Sugiyama, Representative Director of Crowdcredit, Inc (full bio at the end of the article).

Advent of P2P lending in Japan

maneo, Inc. and Exchange Corporation KK were the first P2P lending platform operators in Japan. In 2007, maneo, Inc. was established and it started the registration processes with Japanese authorities which were necessary to run the platform. And it launched the platforms – maneo – in 2008. Exchange Corporation launched its P2P lending platform AQUSH in 2009. Also SBI group established a subsidiary to run P2P lending platform – SBI Social Lending Co., Ltd. – in 2008 and launched the platform in 2011.

maneo at first focused on consumer loans, but soon changed its focus to SMEs loans. AQUSH focused on consumer loans and widened its line-ups to real-estate collateralized loans, overseas consumer loans (investments are made in the loans originated by LendingClub) and loans of which borrowers are solar energy power plant operators in early 2013. SBI Social Lending focuses on securities collateralized consumer loans.

From regulatory perspective, any legal entity (person or company) which lends money in Japan must make registration under Money Lending Business Act, which prevents the P2P lending platform operators to offer a platform which personal investors lend money directly to the borrowers. Hence in Japan, personal investors effectively lend their money to the borrowers through investing in the P2P lending platforms’ businesses which they lend money to the borrowers as the operators of investment funds (Anonymous Partnership Agreements under Japanese commercial law).

Recent trend in Japan

Recent trend in Japan

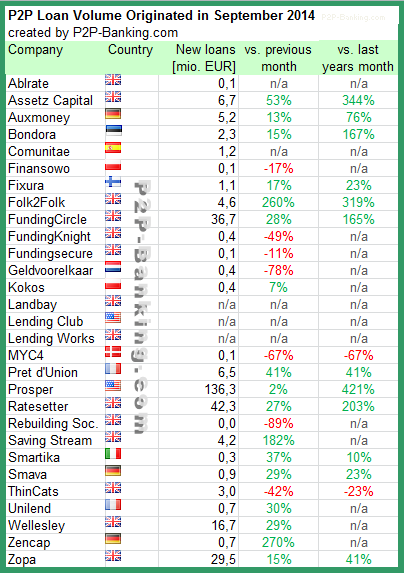

Compared to the growth of P2P lending markets in the UK or in USA, Japanese P2P lending market grew moderately – currently the amount of outstanding loans managed by the largest P2P lending platform, maneo, is estimated to be around 60 million dollars. This is assumed due to over-banking in Japan – in Japan, national average loan to deposit ratio of traditional banks is below 70% and the banks lend quite aggressively, which is quite different from the situation in the UK or in USA where the banks are lending less and less in de-leverage process of their balance sheet in post Lehman crisis period. Borrowers in Japan can much more easily access to traditional financial system compared to the borrowers in the UK or in USA and national average lending interest rate of the banks in Japan is currently 0.887%.

As a result, no operator entered into P2P lending market in Japan after SBI Social Lending and there were only three P2P lending platforms in Japan until 2013.

In late 2012, Crowd Securities Japan Co. Ltd. (previously Midori Securities) announced to launch the fourth P2P lending platform in Japan – Crowd Bank – in 2013 and they launched it in late December in 2013. Crowd Bank offers SMEs loans, real-estate collateralized loans and also overseas microfinance loans which the platform lends to MFIs in Asian region.

Also in early 2013, Crowdcredit, Inc. announced to launch the fifth P2P lending platform in Japan and it was launched in June 2014. Crowdcredit became the first P2P lending platform in Japan which focuses only on cross-border P2P lending. Crowdcredit, as the operator of the platform, has invested in credit market in Peru in Latin America as a start. Continue reading

One advantage of

One advantage of