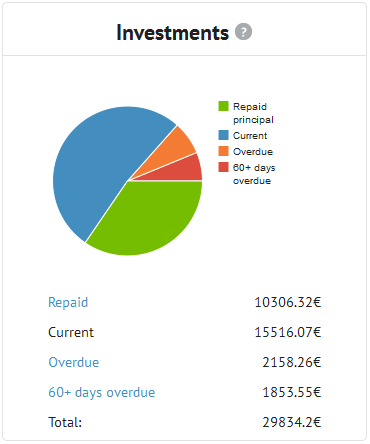

In October 2012 I started p2p lending at Bondora. Since then I periodically wrote on my experiences – you can read my last report here. Since the start I did deposit 14,000 Euro (approx. 17,000 US$). My portfolio is very diversified. Most loan parts I hold are for loan terms between 36 and 60 months. Together the loans add up to 19,528 Euro outstanding principal. Loans in the value of 2,158 Euro are overdue, meaning they (partly) missed one or two repayments. 1,853 Euro principal is stuck in loans that are more than 60 days late. I already received 10,316 Euro in repaid principal back – this figures includes loans Bondora cancelled before payout. I reinvested all repayments.

Chart 1: Screenshot of loan status

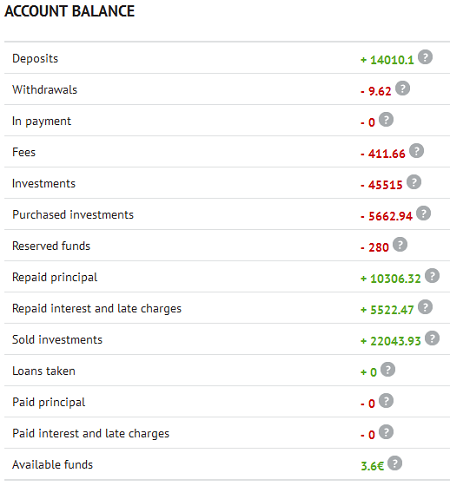

At the moment I have 280 Euro in bids in open market listings and 3 Euro cash available.

Chart 2: Screenshot of account balance

Return on Invest

Currently Isepankur shows my ROI to be over 27.56%. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 25.0%. Continue reading

Continue reading

Being a platform that facilitates the exchange between lenders and borrowers, we believe it is our responsibility to bring the best practices, such as credit scoring, to peer lending; thus, making it an effective, efficient and mutually beneficial process for both parties. Eventually, Bondora Ratings will allow credible borrowers get a better rate for a loan, while investors will receive a predictable return level.

Being a platform that facilitates the exchange between lenders and borrowers, we believe it is our responsibility to bring the best practices, such as credit scoring, to peer lending; thus, making it an effective, efficient and mutually beneficial process for both parties. Eventually, Bondora Ratings will allow credible borrowers get a better rate for a loan, while investors will receive a predictable return level.