Last Thursday I attended the Symvest conference ‘P2P Lending – the New Frontier in Finance‘ in Prague, which was organised by Michael Sonenshine of Symfonie Capital in cooperation with the university of Economics, Prague. Speakers and panelists were mainly from Eastern Europe, though some made the trip from UK, Austria and Italy. The audience consisted predominantly of representatives of Czech finance (banks, investment companies) and students. A main motivation for the conference was to create awareness for p2p lending in general, which is a new phenomenon in the Czech Republic. Sonenshine announced his plans to launch SymCredit, a p2p lending marketplace catering to SMEs in Poland and the Czech Republic.

Matching the audiences experiences some of the content presented was introductory, like ‘What is p2p lending?‘, ‘What are the risks?‘ and a recap of what happened abroad in the past years of development in p2p lending. Regulation was also discussed. Sam Ridler of the P2PFA gave an overview on the UK situation and Danica Sebestová of Squire Patton Boggs did a very informative presentation on what the applicable legal environment is in the Czech Republic. Actually the hurdles for launching a p2p lending marketplace there are rather low – there is no specific regulation for p2p lending. While some applicable laws are to be obeyed, summed up it amounts to registering to start trading – at least as long as the loan volume originated is lower than 3 million Euro in the last 12 month.

Speakers pointed out that a hurdle to establish p2p lending is that Czechs are very conservative investors. Backing it up with figures, they explained that Czechs prefer to deposit their money in short term deposits at banks yielding only about 0.15% interest or invest into real estate rather than to look for higher yield investments.

The best part of attending conferences for me is the ability to network with so many people working in p2p lending in one place. I had lunch with Jevgenijs Kazanins, Chief Marketing Officer of Bondora. He wouldn’t disclose which markets Bondora will be entering next. Discussing investor wishes around the new portfolio manager, which does limit selection choices, he said that in Bondora’s view the new API will address this, as it will allow many parameters for selection. He would not disclose when the new API will be available.

I also had a long talk with Siim Maivel, CEO of Investly. He has interesting plans for new offerings. As soon as those are launched, I will write about them here in the blog. With David Bradley-Ward, CEO of Ablrate, I chatted about the scondary market and the loan pipeline. The secondary market will be completely overhauled and the new version launched in April. A small anecdote: He mentioned that it is not uncommon that 200,000 pounds would be spend on legal costs and due diligence of one of the aircraft loans on the platform. He therefore thinks it is porbably safe to call it the most extensive vetting of all p2p lending platforms.

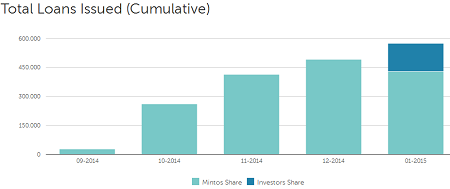

With Martins Sulte I catched up on the last happenings around Mintos. He assured me that he does not expect the talks with the consumer protection body to have any impact on operations. I asked him for the reason for the high interest rates of the Mintos loans, after all these are secured loans. He explained that the Latvian banks are not interested in small loans (<50,000 Euro) backed by real estate, as for them the costs associated with the process are too high. Mintos is receiving many loan applications and so far approve only 3 to 5% of them. Sulte has expansion plans, both in product offering (moving into other secured loan types) and geographically (moving into more markets with Estonia being the next).

Concluding I would like to express my thanks to the organizers for this free to attend conference. It was well organized – they even had simulteneous interpreters translating every panel from Englisch into Czech language.

Recently launched p2p lending marketplace

Recently launched p2p lending marketplace