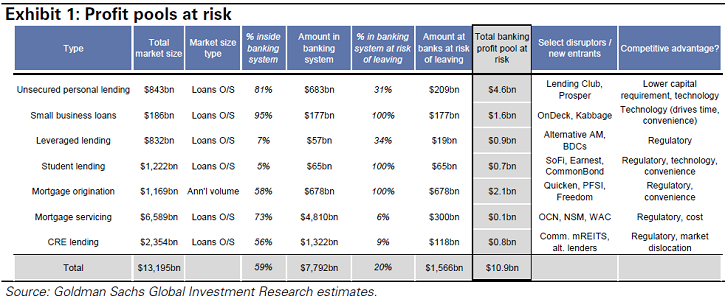

Goldman Sachs published the research paper ‘The Future of Finance’ analysing the potential impact of alternative finance companies, especially p2p lending marketplaces, on the US banking sector.

Goldman Sachs states ‘We see the largest risk of disintermediation by non-traditional players in: 1) consumer lending, 2) small business lending, 3) leveraged lending (i.e., loans to non-investment grade businesses), 4) mortgage banking (both origination and servicing), 5) commercial real estate and 6) student lending. In all, [US] banks earned ~$150bn in 2014, and we estimate $11bn+ (7%) of annual profit could be at risk from non-bank disintermediation over the next 5+ years.‘

Between the Towers in March

Yesterday I attended the ‘Between the Towers‘ event in Frankfurt, which is organized by Mainincubator, the Commerzbank backed fntech incubator. The event format features a keynote speaker, followed by 4 startups delivering 7 minute pitches. Continue reading

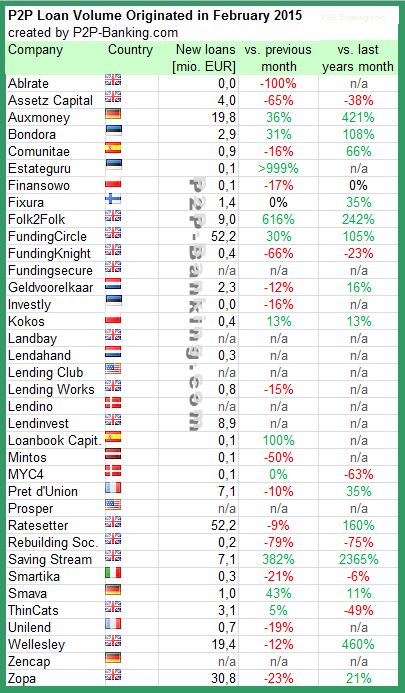

International P2P Lending Services – Loan Volumes February 2015

Table: P2P Lending Volumes in February 2015. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed: Continue reading

P2P Lending Marketplace Bondora Fuels European Expansion Plans

P2P lending service Bondora, headquartered in Tallinn, announced that they raised 5M US$ Series A round led by Valinor Management to fuel further expansion plans for cross-border lending in Europe. Richard Fay and Ragnar Meitern also invested. Bondora was the first p2p lending service doing cross-border lending for retail investors. Bondora is currently facilitating loans to borrowers in Estonia, Spain, Finland and Slovakia from investors in all European countries. Bondora states that investments on the marketplace have consistently yielded premium returns to investors while simultaneously delivering competitive rates to borrowers through efficiency and lower interest rate spread.

P2P lending service Bondora, headquartered in Tallinn, announced that they raised 5M US$ Series A round led by Valinor Management to fuel further expansion plans for cross-border lending in Europe. Richard Fay and Ragnar Meitern also invested. Bondora was the first p2p lending service doing cross-border lending for retail investors. Bondora is currently facilitating loans to borrowers in Estonia, Spain, Finland and Slovakia from investors in all European countries. Bondora states that investments on the marketplace have consistently yielded premium returns to investors while simultaneously delivering competitive rates to borrowers through efficiency and lower interest rate spread.

Uniting European markets under the roof of a single platform creates a huge opportunity given the size of the population in the continent and the volume of outstanding debt. Thus, Eurozone countries alone account for 340 million people and EUR 1.1 trillion in outstanding consumer credit debt, a market equivalent to US. Lending to borrowers in markets that are independently relatively small (even Germany, the largest economy in Europe is only approximately twice the size of California in terms of GDP) allows earning premium returns due to lack of competition among traditional lenders.

Pärtel Tomberg, CEO and co-founder of Bondora, said he hoped the cash infusion from Valinor Management, the hedge fund run by David Gallo, will allow his company to build the more complex infrastructure needed to make more cross-border loans. ‘The goal is really to become a global market,’ Pärtel Tomberg said in an interview. ‘There are no precedents in the world on many of the things we want to do.’

The company also wants to attract institutional lenders from the US.

A possible mid-term competitor might be Lending Club. But Lending Club said in the investor conference call on Tuesday that they will focus on the US market and will not use the capital raised in their December IPO on international expansion plans in the near future. Renauld Laplanche is however monitoring international developments in the market: ‘We’ll see what model is really the winning model in any particular geography.’ Continue reading

Interview with Koen The, CFO of Lendahand

What is Lendahand about?

Lendahand is a Netherlands-based online lending platform with the objective to stimulate employment in emerging countries. Small and Medium Enterprises (SMEs) in these countries do not have proper access to financing as they are too small for banks and too large and complex for microfinance institutions. Hence they are not able to grow and percentage-wise only provide half of the jobs that SMEs in developed countries deliver. Financing the ‘missing middle’ leads to significant social impact while leaving room for a solid financial return. On our platform individuals can unlock this potential by choosing promising SMEs to lend to. We call this meso-credit.

What are the three main advantages for investors?

We’ve asked each and every new investor what they like about Lendahand and the three advantages that stand out are:

- You know exactly how your money is used (in control)

- You get a fair interest rate of 3-4% per annum (financial return)

- You help creating jobs in poor countries (social return)

What are the three main advantages for borrowers?

One of my colleagues went to the Philippines where Lendahand’s first local partner is based and interviewed 15 borrowers. Key takeaways:

- For some of the companies, the only alternative are so-called ‘Bombays’. These are men (usually from Indian descent, hence the name) that provide 1-month loans without credit checks. The interest rate is around 20% per month. Lendahand together with its local partner provides loans with interest rates that are closer to what banks are charging

- Most of the companies are not eligible for bank loans because they’re too small. If they are able to get a bank loan then they need to go through a process that takes a couple of months before they actually get the money. These companies need funds quickly (e.g. a large order comes in) and can’t wait that long. At Lendahand’s local partners they get the funds within weeks if not days

- Lendahand has set up a foundation that provides non-financial support to SMEs in the form of demand-based training. The funds come from NGOs that donate to the foundation. We’ve held three training sessions so far with a total attendance of 117 SME owners. Once Lendahand is profitable it will donate at least 10% of its earnings to the foundation

Lendahand cooperates with MFIs. Which criteria do you use when choosing the MFIs you work with?

Lendahand cooperates with MFIs. Which criteria do you use when choosing the MFIs you work with?

Lendahand carefully selects its local partners by going through a rigorous due diligence process where it assesses, amongst others, the financial position, portfolio quality, and governance. Typically a local partner has a loan portfolio of more than €5mio, a write-off ratio smaller than 2% and equity capital of at least 10% of the total assets. Although the local partners are for-profit organizations, it is a necessary condition that they have a social mindset and intend to offer competitive interest rates to their clients and screen them for environmental and social impact. The local partners take the full credit risk to the SMEs and so have skin in the game.

How did you start Lendahand? Is the company funded with venture capital?

Lendahand is a social enterprise, i.e. it has a social objective but is run as a business. It was founded in 2011 by Peter Heijen who got intrigued by the ‘missing middle’ and envisioned a solution in crowdfunding. Beginning of 2014 a team was formed: Peter Stolze for marketing and myself for finance and scalability.

Lendahand’s funding mix reflects its status as a social enterprise. It was first funded by a subsidy from the Dutch Ministry of Foreign Affairs and a Dutch NGO. Then angel investors came on board. We’ve also obtained funding through crowdfunding (both equity and convertible debt). Later this year we hope to speak to a few VCs as we are planning on a somewhat bigger funding round.

Is the technical platform self-developed?

We’ve hired an IT agency to develop the platform. We are the owners of the platform. Continue reading

Lending Club Fourth Quarter Results

![]() Lending Club just announced the 4th quarter numbers in the investor conference call.

Lending Club just announced the 4th quarter numbers in the investor conference call.

CEO Renauld Laplance stated: “We have continued to expand our reach through 2014 by doubling the size of the business again, while continuing to invest heavily in future growth and risk management. Our IPO in December was an important milestone in the life of the company, and everyone at Lending Club is excited about the next 5 to 10 years and committed to delivering more value and a great experience to our customers. 2015 is going to be another investment year, and we intend to continue growing originations and revenue at a fast, yet deliberate pace.”

Fourth Quarter 2014 Financial Highlights

Originations – Loan originations in the fourth quarter of 2014 were $1,415 million, compared to $698 million in the same period last year, an increase of 103% year-over-year. The Lending Club platform has facilitated loans totaling over $7.6 billion since inception.

Operating Revenue – Operating revenue in the fourth quarter of 2014 was $69.6 million, compared to $33.5 million in the same period last year, an increase of 108% year-over-year. Operating revenue as a percent of originations, known as our “revenue yield”, in the fourth quarter was 4.92%, up from 4.79% in the prior year.

Adjusted EBITDA(3)  – Adjusted EBITDA was $7.9 million in the fourth quarter of 2014, compared to $6.5 million in the same period last year.

Net Income/Loss– GAAP net loss was ($9.0) million for the fourth quarter of 2014, compared to a net income of $2.9 million in the same period last year. Lending Club’s GAAP net loss included $11.3 million of stock-based compensation expense during the fourth quarter of 2014.

Earnings (Loss) Per Share (EPS) Â – Basic and diluted loss per share was ($0.07) for the fourth quarter of 2014 compared to EPS of $0.00 in the same period last year.

Adjusted EPS(3)– Adjusted EPS was $0.01 for the fourth quarter of 2014 compared to $0.02 in the same period last year.

Cash and Cash Equivalents – As of December 31, 2014, cash and cash equivalents totaled $870 million, with no outstanding debt.

“We are entering 2015 with strong momentum on many fronts, and we intend to continue to execute on our strategy of fast yet disciplined growth,” said Carrie Dolan, CFO of Lending Club. “We will also continue to aggressively invest in product development, engineering, process automation, and the buildup of support and risk management functions to pave the way for our long term growth opportunity.”

Outlook

Based on the information available as of February 24, 2015, Lending Club provides the following outlook:

First Quarter 2015

Operating Revenues in the range of $74 million to $76 million.

Adjusted EBITDA(3) in the range of $6 million to $9 million.

Fiscal Year 2015

Total Revenues in the range of $370 million to $380 million.

Adjusted EBITDA(3) in the range of $33 million to $42 million

(3) Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures

Strategy is to focus on the US market in the near future. There is no urgency to expand into international markets. There is not a lot of clarity which of the different models in particular geographies might prevail in customer adoption and get blessed by regulator.