Gareth Rumsey of Experian analyses how economic shifts could impact the loanbooks of UK p2p marketplaces lending to SMEs.

P2P Lending in Slovakia

This is a guest post by Roman Feranec, CEO of Žltý melón (full bio at the end of the article)

Slovakia is an Eastern European country with 5.5 million inhabitants. The country borders with Poland, Czech Republic, Hungary and Ukraine. Regarding its real GDP per capita exceeding 10 thousand EUR, it is one of the most developed countries in eastern European region. Slovakia is a NATO and EU member and in 2009 the country joined Eurozone and started using EURO as its currency.

Peer to peer lending, also known as Marketplace lending, started in Slovakia at the end of 2012. In just two years of operation it proved that it could be an interesting financial alternative with valuable benefits for people in need of money, as well as for people looking for a stable and good appreciation of their savings. This all despite the fact that Slovaks are generally more conservative than their peers in western countries and banks in Slovakia were almost no hit by the recent financial crises.

The Slovak market of unsecured consumer lending reaches a volume of approximately 150 million EUR in new loans every month. There is a big competition between 12 retail banks keeping the average interest rate at about 14 % p.a. P2P loans at the moment represent just a tiny fraction of the market with 0.1 % market share. This can also show a huge growth potential for this alternative.

The Slovak market of unsecured consumer lending reaches a volume of approximately 150 million EUR in new loans every month. There is a big competition between 12 retail banks keeping the average interest rate at about 14 % p.a. P2P loans at the moment represent just a tiny fraction of the market with 0.1 % market share. This can also show a huge growth potential for this alternative.

The first and so far the only domestic P2P loans provider is called Žltý melón. The company was set up by a team of people with long-term experience in banking and financial industry. Žltý melón was launched at the end of 2012 and since then it has provided about 2 million EUR of loans with current volumes of 160 – 200 thousand EUR of new loans per month. It provides ordinary unsecured retail consumer loans – purpose or non-purpose. Recently it has also introduced loans for financing real estates with a guarantee for investors covered by real estate and also company guarantee of major development company. The new product is one of the outcomes of a bigger partnership between Žltý melón and local leading residential developer Cresco Group. Continue reading

Funding Empire Now Offers Asset Backed Loans

![]() Funding Empire entered a cooperation with the Business Lending Exchange (BLX) to offer asset backed loans on the marketplace. These new asset backed loan investments will be backed by realisable security and go through BLX’s proven and experienced credit assessment process – they will be available to Funding Empire investors from tomorrow.

Funding Empire entered a cooperation with the Business Lending Exchange (BLX) to offer asset backed loans on the marketplace. These new asset backed loan investments will be backed by realisable security and go through BLX’s proven and experienced credit assessment process – they will be available to Funding Empire investors from tomorrow.

Loans under this model will be for a maximum of 50,000 GBP over a maximum term of 3 years providing monthly capital and interest repayments to lenders. Loan requests will typically last between 5-7 days and will operate as fixed rate auctions. They will end either when the loan request is filled or it expires. Loan parts from this model can be traded as normal on our secondary loan market. Continue reading

Mintos Expands Into Estonia – Offers P2P Loans Secured by Vehicles

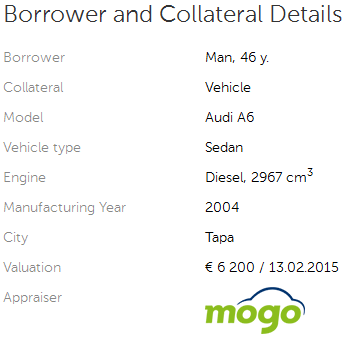

Today Latvian Mintos expanded by now offering loans to Estonian borrowers on the p2p lending marketplace. These loans are secured with a car as collateral. Today 15 loans were posted on the platform. Typical (nominal) interest rates for these loans seem to be between 11 and 13%. LTVs are as of today in a wide range from 26% to 90%.

Today Latvian Mintos expanded by now offering loans to Estonian borrowers on the p2p lending marketplace. These loans are secured with a car as collateral. Today 15 loans were posted on the platform. Typical (nominal) interest rates for these loans seem to be between 11 and 13%. LTVs are as of today in a wide range from 26% to 90%.

CEO MÄrtiņš Å ulte told P2P-Banking.com: ‘From today we also offer investors opportunity to invest in loans secured by vehicle. We provide these loans in cooperation with Mogo (http://mogofinance.com), the market leader in car loans with operations in Latvia, Lithuania, Estonia, and Georgia. … as part of our international expansion we have set up a company in Estonia and are working on entering Lithuania and Poland to boost our loan origination capacity‘. Continue reading

CEO MÄrtiņš Å ulte told P2P-Banking.com: ‘From today we also offer investors opportunity to invest in loans secured by vehicle. We provide these loans in cooperation with Mogo (http://mogofinance.com), the market leader in car loans with operations in Latvia, Lithuania, Estonia, and Georgia. … as part of our international expansion we have set up a company in Estonia and are working on entering Lithuania and Poland to boost our loan origination capacity‘. Continue reading

Lendico Adds SME Loans

![]() German p2p lending service Lendico today added SME loans to its marketplace which previously focussed on consumer loans. This is in my view a peculiar move as now Lendico poaches in the realm of Zencap, which is already focussed on SME loans, considering that both startups were backed by Rocket Internet. Continue reading

German p2p lending service Lendico today added SME loans to its marketplace which previously focussed on consumer loans. This is in my view a peculiar move as now Lendico poaches in the realm of Zencap, which is already focussed on SME loans, considering that both startups were backed by Rocket Internet. Continue reading

P2P Lending – a View from Australia

This is a guest post by Leo Tyndall, CEO and founder of Marketlend.

The peer-to-peer lending industry remains embryonic in that there are only two Australian peer-to-peer lenders, Society One and Marketlend. The remaining peer-to-peer lenders RateSetter and ThinCats are spin-offs of their UK operations -RateSetter Australia is by now only partly owned by Retail Money Market.

The focuses of both Society One and RateSetter are personal loans whereas ThinCats and Marketlend focus on commercial lending. Legal structure by Society One and RateSetter is a managed investment scheme. ThinCats legal structure is unclear aside from that they are an authorised representative of an Australian Financial Services License similar to Society One and Marketlend. However, Marketlend has opted for the more traditional debt structure by establishing trusts that issue tradable bonds by an independent trustee.

The focuses of both Society One and RateSetter are personal loans whereas ThinCats and Marketlend focus on commercial lending. Legal structure by Society One and RateSetter is a managed investment scheme. ThinCats legal structure is unclear aside from that they are an authorised representative of an Australian Financial Services License similar to Society One and Marketlend. However, Marketlend has opted for the more traditional debt structure by establishing trusts that issue tradable bonds by an independent trustee.

The Australian peer to peer market is operating in the commercial banking market which is 2123 billion of client loans according to BMI Research as of November 2013. P2P Lending remains a new concept and irregularly reported albeit growing exposure is occurring through crowd funding publicity and statements by new investors like Murdoch investor group and James Packer investor group.

Crowdfunding saw commentary from the regulatory authorities in the form of a guidance and reference in a financial system review in last quarter of 2014. The essence is that it should be encouraged however, there are significant legislative hurdles at this time and consideration should be given to making it easier to commence such endeavors.

At this time if you offer a financial product, service, loan or investment to a retail person, a credit license is needed for lending and you are required to hold an AFSL or be an authorised representative of an AFSL holder who has sufficient licenses to enable it to advise, and offer financial products to the retail market. Furthermore, if you chose to offer a product, through a managed investment scheme, you need a responsible entity or must be a responsible entity (RE) to offer the securities. In layman terms, the RE is a similar entity to a trustee. A notable exception to this includes, operating to offer to wholesale investors and offering only business loans. Each of these has it’s own idiosyncrasies.

As recent as 15 March 2015Â CBA top executive Kelly Bayer Rosmarin questioned whether peer to peer lending is driven by supply side factors in a low interest rate environment and wondered if the peer to peer model can sustain an entire cycle. This shows a lack of concern or possible complacency by the mayor banks. However other smaller or progressive banks have looked to discuss with peer to peer lenders about possible cooperation or investment.

For peer to peer lenders we welcome the benign attitude of the larger banks as it is the type of attitude that drives investors and borrowers towards this market. Australia is marketplace where the internet is a well-accepted forum for doing business and the financial services industry is already using it to develop their own businesses. This type of lending is a graduation of the electronic age of the financial services industry in Australia and here to stay.

For peer to peer lenders we welcome the benign attitude of the larger banks as it is the type of attitude that drives investors and borrowers towards this market. Australia is marketplace where the internet is a well-accepted forum for doing business and the financial services industry is already using it to develop their own businesses. This type of lending is a graduation of the electronic age of the financial services industry in Australia and here to stay.

There is talk of at least 3 new arrivals this year: Money place, Lend2fund and another that has operations offshore.

Marketlend is a business peer-to-peer lender who offers loans only to business in the form of working capital, traditional business lending and commercial property. Using intuitive software to take applications and automated proprietary software within a matter of minutes, Marketlend can complete external credit checks and rate the likelihood of loan repayment. The software is provided by third parties who offer similar solutions to government departments and public companies. A financial analysis is performed on available financials to determine debt coverage service ratios, leverage ratios and general health of the borrower. These data points, historical payment history and approximately 65 input items are used to determine the rating of the risk. Continue reading