This is part I of a guest post by British investor ‘GSV3Miac’.

About the author.. I spent 25 or so years in software engineering, programming everything from IBM mainframes to microchips in early Hotpoint washing machines. I must have been halfway competent (or not) since I wound up managing a software development group, a large IBM computer centre, workstations of networks and PCs. When my (American owned) factory shut down I spent the last year (in between managing the closure) retraining as an IFA. I qualified, but I never actually practised – I took my redundancy / pension and headed for the hills (of Shropshire). That was a while ago, so don’t expect me to know chapter and verse on the latest tax wrinkles! *grin*

How did I get into P2P (misnamed .. it’s largely P2B these days .. much of is headed for B2B!) lending? Blame my mother .. she died, and left me a sum of money which was not expected, and not really critical to my future. Having no children (there being, IMO, no people shortage on the planet) it is probably all headed for charities one day, so I thought I might as well have some fun with it. Before I did that, I had, of course, gone through the approved checklist .. i.e.

‘Emergency’ easy access cash account(s) .. tick.

Pay off the mortgage .. tick.

ISA(s) .. tick

Pension Provisions .. tick

Stock market investments / bonds / shares / funds ..tick

OK, anything left can be risked a bit. (I accept that stocks and shares and even cash has =some= risk attached, but now we are looking at ‘high wire with no net’ type options .. VCTs, EIS schemes, and yep .. P2P lending). If you want to plan for ultimate disaster (Ebola pandemic, nuclear war and global financial meltdown) then probably investing in long dated canned food, and an underground shelter on an island upwind from everywhere, is your best bet. More modest (and likely) risks can be mitigated by spreading your investments around a lot, and by being conservative in your assumptions of what you might get back.

I started my P2P journey (in 2013) with Funding Circle (henceforth ‘FC’) and ZOPA, both of which I had heard about from a friend, and I dipped my toes in rather gingerly at first. ZOPA had been going for some time, and I probably missed their best years (when you could decide who to lend to, and later when you could at least still decide at what rate you’d lend). ZOPA had just introduced their ‘safeguarded’ lending, and started fixing the rates, so even their name (‘Zone Of Possible Agreement’) no longer made sense. I stopped lending with them after less than 6 months .. the rates were just not attractive (and unpredictably so). On the plus side, the exit from ZOPA was fairly cheap and painless.

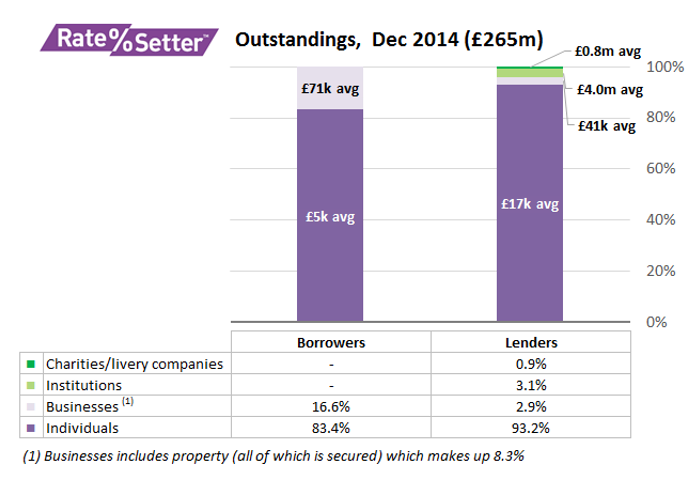

As an alternative to ZOPA I went to look at Ratesetter (RS), which still lets you set the rate(s) you are willing to lend at over 1,3 or 5 years (or monthly). No control over who gets it, but at least some control over what they pay; and (like modern ZOPA) there is a provision fund which should hopefully protect you from bad debts. Exit from RS can be quite expensive though, so best to lend for no longer than you are sure you can do without the money for. Basically they charge you the difference between the rate you would have got for the actual period you lent for, and the rate you got by lending for a longer period. I still like them, for simplicity with just enough control to make it interesting, and I lend / recycle in the 3 and 5 year markets depending on the rates at the time (typically I expect at least an extra 1% for signing up for the extra 2 years). Continue reading →

Continue reading