Sage, the business software and services provider, announced two partnerships that will help SMEs unlock the UK’s growing alternative finance industry, which was worth 1.74 billion GBP in 2014.

Integrating with one of Europe’s peer-to-peer business lenders for short term finance, MarketInvoice, Sage’s flagship small business accounting package – Sage 50 Accounts – now enables small businesses across the UK and Ireland to apply for business-critical funds more quickly and easily than ever before.

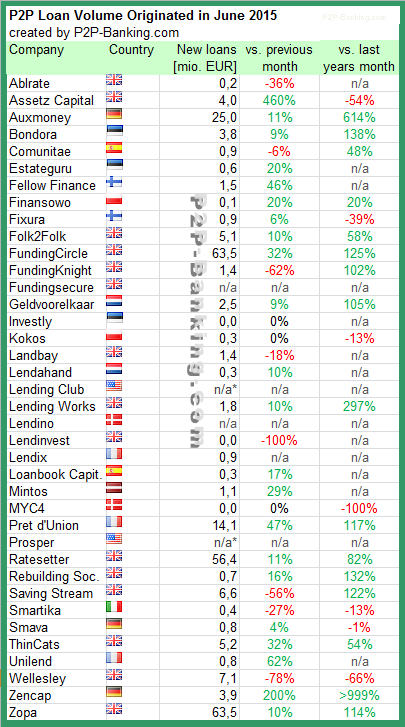

Working with Funding Circle, an marketplace for business loans, Sage aims to help even more businesses across the country understand how they can borrow all important growth capital between 5,000 GBP and 1 million GBP (and up to 3 million GBP for property finance) in days not months.

‘Sage has been at the forefront of payment and funding innovation for years, and alternative finance is no exception,’ said Lee Perkins, EVP and UKI Managing Director for Sage Group plc. ‘Sage Pay already provides a key piece of the business growth puzzle, and when it comes to small business accounting, Sage 50 Accounts offers the deepest and broadest hybrid accounting capabilities on the market. By partnering with MarketInvoice and Funding Circle, we’re giving Small & Medium Businesses in the UK the ability to swiftly and easily apply for additional funding to support their business development and growth.â€

Lack of finance remains a critical issue for UK companies, with almost 40 per cent stating it holds them back from growing, according to UK Bond Network. Whether they need to invest in stock, new premises, product development, or even cover day-to-day costs, alternative finance can provide faster, more convenient lending than traditional sources. Marketplace lending platforms have provided over 2.1bn GBPÂ in funds to UK small businesses in recent years.

James Meekings, co-founder of Funding Circle, said: ‘The Funding Circle marketplace is currently the fifth largest net lender to small businesses in the UK, in just under five years. But there’s still a long way to go – many small business owners remain unaware of the choice they now have when looking for finance. Partnering with Sage will allow us to grow awareness and trust, bringing more competition and efficiency to the small business lending market.’ Continue reading