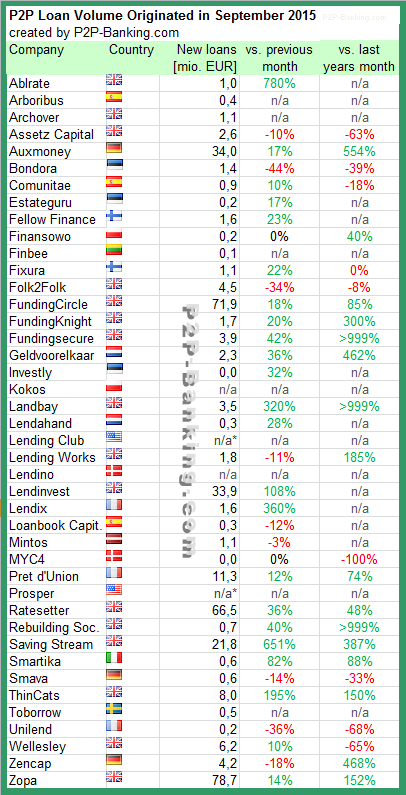

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

![]() Harmoney, the first p2p lending marketplace in New Zealand, has raised 200M NZD from P2P Global Investments fund (P2PGI) to launch in the Australian market. The agreement includes both debt and equity. In its first year in operation in New Zealand Harmoney already originated 100M NZD in loans to consumers. Continue reading

Harmoney, the first p2p lending marketplace in New Zealand, has raised 200M NZD from P2P Global Investments fund (P2PGI) to launch in the Australian market. The agreement includes both debt and equity. In its first year in operation in New Zealand Harmoney already originated 100M NZD in loans to consumers. Continue reading

This is a guest post by Dutch lawyer Coen Barneveld Binkhuysen (see full bio at the end of the article)

Crowdfunding is growing exponentially in the Netherlands. Although the Dutch market has not yet reached the astronomical levels of the United States and the United Kingdom, many people have heard about the phenomenon and are intrigued by this potential alternative investment opportunity. While the Dutch market speaks a lot about crowdfunding, it is less familiar with the term p2p-lending (it is commonly available though). As this article covers investments in loans, convertible subordinated loans and equity, I will use the general term crowdfunding instead of p2p-lending.

In the first 6 months of 2015, almost 50 million Euro was raised via crowdfunding, which is double the amount raised in 2014. There are over 80 crowdfunding platforms active in the Netherlands, which makes it difficult for potential investors to gain an overview of the viable available investment opportunities. This article provides a general overview of the most important platforms active in the Dutch market. Furthermore, I will discuss some relevant topics in relation to crowdfunding, such as: diversification options, costs, default risks, cash flow, types of investment and the added value of a properly managed crowdfunding platform.

Overview investment options

In general, crowdfunding platforms in the Netherlands offer the option to invest in loans, subordinated convertible loans and equity (besides donations and the purchase of products). Each of these different investment options has benefits and drawbacks in terms of cash flow, risk and the potential upside can vary significantly:

Loans provide a direct cash flow to the investor as loans are usually repaid in monthly instalments. Loans only have a limited potential upside, maximized at the offered interest rate. Due to the monthly repayments, the risk decreases every month. Most crowdfunding platforms determine the interest rate based on the envisaged risk. As far as I am aware, there are no platforms active in the Netherlands that provide the option to “bid” on loans in auctions.

Convertible subordinated loans (also called convertibles) are considered to entail more risk than normal loans as convertibles are subordinated to (normal) loans and other claims. Investors generally expect a higher return in exchange for a higher risk. Instead of offering a higher interest rate, companies issuing convertibles via crowdfunding offer the option to convert these loans into certificates of shares.[1] The option to convert may be restricted by certain conditions such as (i) a specific period in which conversion must take place and/or (ii) the condition that a sophisticated investor invests at least amount “X” during the term of the loan. For an investor it is important to identify any conversion conditions that may apply. If the loan is not converted into certificates of shares during its term, the investor will receive the principal plus interest payments at the end of the term of the loan. These investments might not be interesting for investors looking for a steady cash flow, but they can be interesting for those who want to have a shot at a serious return.

Equity is normally being offered in the form of certificates of shares (equal to the convertibles described above). Again, investing in equity does not create a steady cash flow for the investor. The terms and conditions related to the certificates of shares may (and normally will) restrict the option to sell them. Therefore, investors are expected to wait for the moment the entire company is being sold to an investor, which can take a long time. Investing in equity might only be interesting for investors looking for long-term investments. Then again, these investments do have the largest potential upside as the investor will profit from every increase in value once the company is being sold.

Balancing risks

Each investor takes, or at least should take, the risk of default into account, especially when investing in high-risk companies such as start-ups. Business cases of start-ups have not yet been properly tested and most do not, or hardly have, any financial buffers. Should the financed company go bankrupt, practice shows that only in rare cases (only part of) the loan can be recovered. Normally, preferred creditors such as banks and the tax authorities will receive the benefit of all assets left in the company and there is nothing left for others. Some platforms try to reduce the risk by requesting a personal guarantee of the entrepreneur, but this is of little use if the person does not have any assets.

The actual difference between investments in loans, convertibles and equity from a risk perspective is small. Investors having certificates of shares have a larger potential upside than the holders of loans. One could say that investors almost bear the same risk, but with different potential upsides. In my opinion the most important reasons to choose for normal loans are the fixed term and monthly repayments. If you are not in a hurry to make a profit and are going for the highest potential return, convertibles and equity might be a more interesting option.

Overview largest platforms in the Netherlands

After selecting the preferred investment instrument, it is important to select one or more of the available crowdfunding platforms. Without aiming to be complete, I list the largest and most active platforms active in the Netherlands below:

Geldvoorelkaar.nl is the national market leader and funded over 825 projects, with a total sum of over 66,000,000 Euro. The platform focusses on p2p-lending and only provides investors the opportunity to invest in loans. Interest rates range from 4% to 9% depending on the risk score determined by Geldvoorelkaar.nl. All loans are being repaid in monthly instalments as of the first month. By investing in projects via this platform, it is fairly easy to generate a decent cash flow. Up to now, 3.5% of my investments on the platform have defaulted. As the principal of one of the defaulted projects was almost fully paid back, my average ROI still accounts for about 6.5% per year. The other defaulted project was probably a case of bankruptcy fraud, which I expect to happen more often in the future. The platform opens several dozen new projects every week, which creates sufficient opportunities to diversify your portfolio and reinvest your money. An investor must pay a fee equal to 0.3% * loan duration (in years) * invested amount (which amount will be refunded if the project defaults).

Geldvoorelkaar.nl is the national market leader and funded over 825 projects, with a total sum of over 66,000,000 Euro. The platform focusses on p2p-lending and only provides investors the opportunity to invest in loans. Interest rates range from 4% to 9% depending on the risk score determined by Geldvoorelkaar.nl. All loans are being repaid in monthly instalments as of the first month. By investing in projects via this platform, it is fairly easy to generate a decent cash flow. Up to now, 3.5% of my investments on the platform have defaulted. As the principal of one of the defaulted projects was almost fully paid back, my average ROI still accounts for about 6.5% per year. The other defaulted project was probably a case of bankruptcy fraud, which I expect to happen more often in the future. The platform opens several dozen new projects every week, which creates sufficient opportunities to diversify your portfolio and reinvest your money. An investor must pay a fee equal to 0.3% * loan duration (in years) * invested amount (which amount will be refunded if the project defaults).

Oneplanetcrowd claims to be Europe’s leading sustainable crowdfunding platform. Since launching in 2012 it raised over € 6 million in funding for more than 100 projects. Oneplanetcrowd operates in Germany and the Netherlands and is planning to open in other European countries soon. It provides investors the option to invest in loans and convertibles (apart from donations and presale options) and offers some of the most interesting investment opportunities, such as Snappcar and Wakawaka Power. Various projects offer the opportunity to co-invest with sophisticated venture capital firms as these firms invest simultaneously with the crowdfunding campaign. In my opinion, this is a huge advantage for investors as VCs tend to do a thorough due diligence before choosing to invest. The platform only allows companies with a sustainable philosophy to start a campaign on the platform. Their goal is to provide high quality investments with a decent return to investors. Although this is a good niche market, the strategy makes diversification opportunities fairly difficult. Investors do not pay a fee on Oneplanetcrowd.

Oneplanetcrowd claims to be Europe’s leading sustainable crowdfunding platform. Since launching in 2012 it raised over € 6 million in funding for more than 100 projects. Oneplanetcrowd operates in Germany and the Netherlands and is planning to open in other European countries soon. It provides investors the option to invest in loans and convertibles (apart from donations and presale options) and offers some of the most interesting investment opportunities, such as Snappcar and Wakawaka Power. Various projects offer the opportunity to co-invest with sophisticated venture capital firms as these firms invest simultaneously with the crowdfunding campaign. In my opinion, this is a huge advantage for investors as VCs tend to do a thorough due diligence before choosing to invest. The platform only allows companies with a sustainable philosophy to start a campaign on the platform. Their goal is to provide high quality investments with a decent return to investors. Although this is a good niche market, the strategy makes diversification opportunities fairly difficult. Investors do not pay a fee on Oneplanetcrowd.

KapitaalOpMaat and Collin Crowdfund are some of the main competitors of Geldvoorelkaar.nl as these platforms focus solely on loans with loan periods ranging from 6 up to 120 months and interest rates of 5.5% up to 9% depending on the calculated risk. Almost 6.5 million Euro and 13 million Euro have been funded via these platforms, respectively. Investors on KapitaalOpMaat pay a one-time transaction fee of 0.9% and a yearly fee of 0.85% on Collin Crowdfunding. Both platforms provide discounts to investors investing more than certain thresholds.

Bondora is a European platform offering the opportunity to invest in loans on a European level. Although this is by far the most sophisticated (international) platform available to Dutch investors, its presence is fairly unknown to most Dutch investors. Already more than 35 million Euro has been financed via Bondora. Investors are allowed to choose their own investments on the primary market, but most loans are filled in advance by a bot. Therefore, it will be necessary to invest automatically via the provided bot in order to obtain sufficient loans. This enables the investor to invest in literally thousands of loans differing in purpose, country and risk. All loans are repaid in monthly instalments on a virtual account. Bondora also offers the option to purchase/sell investments to other investors on its secondary market (with a premium/discount) against a fee of 1.5%. Investors do not pay any fees on the primary market. Although Bondora claims an average ROI of 18.75%, many investors complain about the large number of defaults. As the minimum investment is only 5 Euro, the threshold is low.

Symbid is one of the established Dutch crowdfunding platforms and focuses on equity (certificates of shares) and loans. Although Symbid seems to suggest that already more than 300 million Euro has been invested via their crowdfunding platform, the actual amount funded by the crowd is closer to 6 million Euro. One of the advantages of Symbid is that it offers the option to sell your equity to other investors on the platform. Continue reading

What is Groundfloor about?

GROUNDFLOOR is taking private real estate lending public. We’re paving the way to open a new $70 billion lending market to all – and that’s in single family home renovation and construction lending alone. You can read more about how we’re doing that here.

More broadly, we like to think of the company as an exposition on a theory of capital markets. We believe the broadest base of capital wins—because it’s faster, cheaper, more flexible and more efficient.

What are the three main advantages for investors?

What are the three main advantages for borrowers?

What ROI can investors expect?

What ROI can investors expect?

GROUNDFLOOR backs independent builders with secured loans that pay 5-26% annually. During our one-year pilot in Georgia, the average annualized yield for our investors was over 12 percent.

What is the background of Groundfloor? Who are your seed investors?

GROUNDFLOOR was founded in February 2013 and is based in Atlanta. We have raised $2.5 million in seed funding from angel investors including Michael D. Olander Jr, Bruce Boehm, Tibor Nagygyorgy, Mark Easley Sr. and Inception Micro-Angel Fund.

Brian Dally is co-founder and CEO. He has spent his career building disruptive technology startups during stints in Silicon Valley, Boston, London and the North Carolina Triangle region. Previously, he led the launch of Republic Wireless to take on the big four cellphone carriers to international acclaim.

Nick Bhargava is co-founder and EVP of regulatory affairs. An expert in securities law, Nick was heavily involved in the JOBS Act as an early pioneer who advanced the concept of equity crowdfunding. Nick and Brian met through Groundwork Labs in the Triangle-area startup hub the American Underground. His years in finance have included work for the Financial Services Roundtable, SEC, FINRA, TD Waterhouse and RBC Financial Group. Continue reading

![]() Barcelona based company Prestamos Prima launched Viventor, a p2p lending marketplace for real estate loans.

Barcelona based company Prestamos Prima launched Viventor, a p2p lending marketplace for real estate loans.

Viventor will be focused on serving the investor side of money market. “The financing model of high street banks is outdated, and they are too slow to change the course as fast as the market demands. Recent years have shown that alternative finance solutions are reshaping the industry, and a major change on stage is inevitable,” states Andris Rozenbahs, CEO of the Prestamos Prima Group.

Vivntor will serve loans for residential and commercial property. All borrowers will be businesses, with loan terms one year and longer. The average interest rate investors will earn is expected to be around 6 to 7.5%. Prestamos Prima told P2P-Banking.com that there will be a secondary market.

The new platform, Viventor, will launch in fall 2015. Initially, it will be open for EU investors only, and provide the opportunity to invest in loans secured by Spanish mortgages. Real estate crowdfunding opportunities, investment insurance and inclusion of the borrower side are all on the roadmap. The Group CEO stresses: “We are set to make tremendous efforts to ensure security and credibility. Our goal is to provide quality investment opportunities, no junks. All the loans will be secured by mortgages carefully evaluated, and Viventor will keep its stake in all the loans listed.” Continue reading

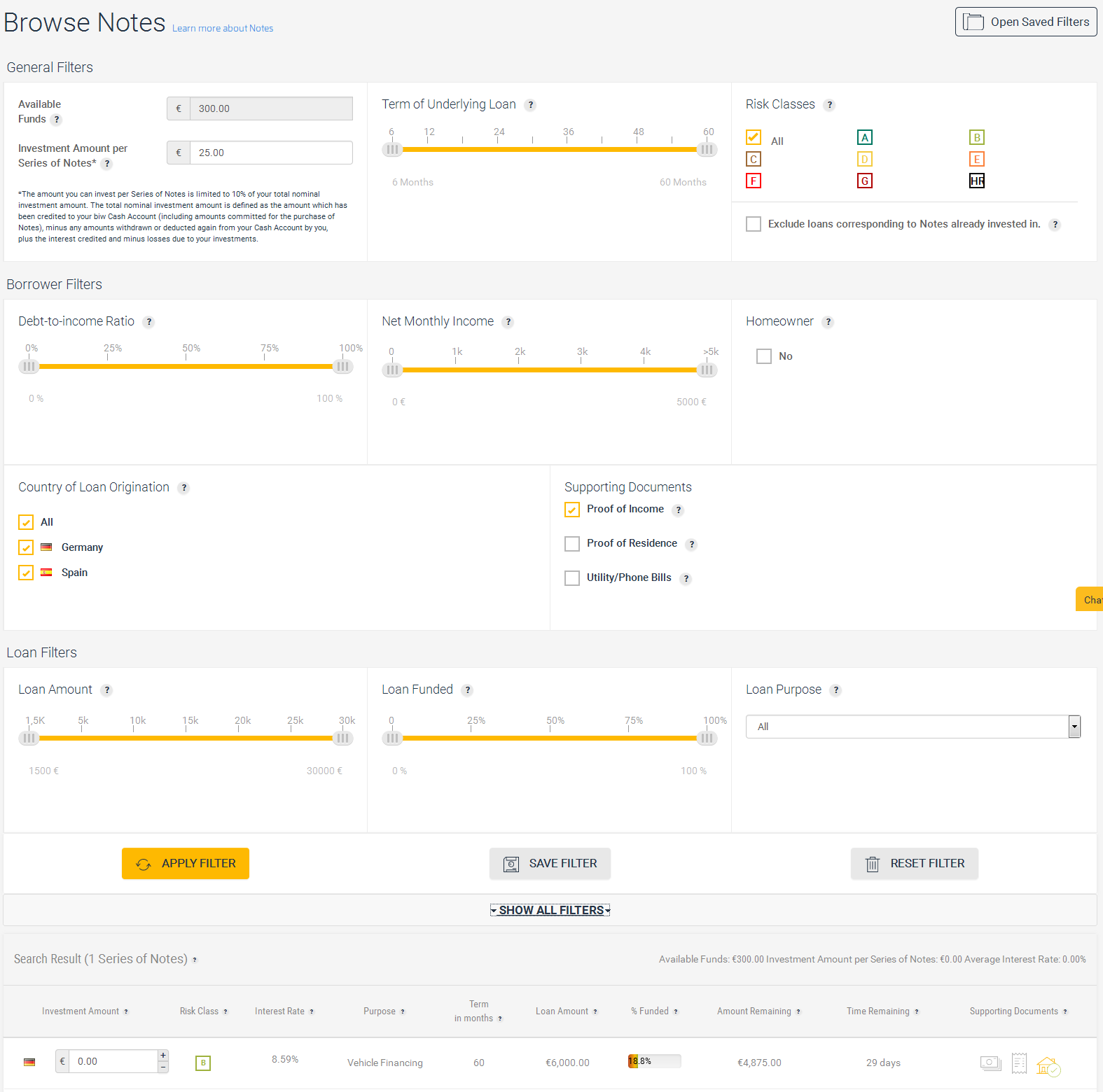

As reported earlier today, new p2p marketplace Crosslend (Spanish site) (German site) offers unsecured p2p loans to consumers. There was a soft launch phase last week, which enabled me to register early and gain first insights into the marketplace interface. After registration I awaited verification of the newly opened lender account at biw Bank and then deposited money there (if you are outside the Eurozone, you may consider using Transferwise or Currencyfair instead of doing a direct transfer).

In the dashboard I selected ‘Browse Notes‘ which led me to an overview of all available note. Since my test was conducted during soft launch, there was only one available not.

Screenshot Browse Notes (click for larger view): at the bottom there is the listed loan (risk grade B) for 6,000 EUR vehicle financing at 8.59% interest

Crosslend Filters

Initially only the general filters (loan term, risk classes) for selecting loans are displayed. By clicking on ‘show all filters’ I expanded further loan selection filters: Borrower filters are DTI, monthly net income, home owner, country and supporting documents (proof of income, proof of residence and utility/phone bills). Loan filters include loan amount, funding percentage and loan purpose. It is possible to save filters to reapply them again in future. Continue reading