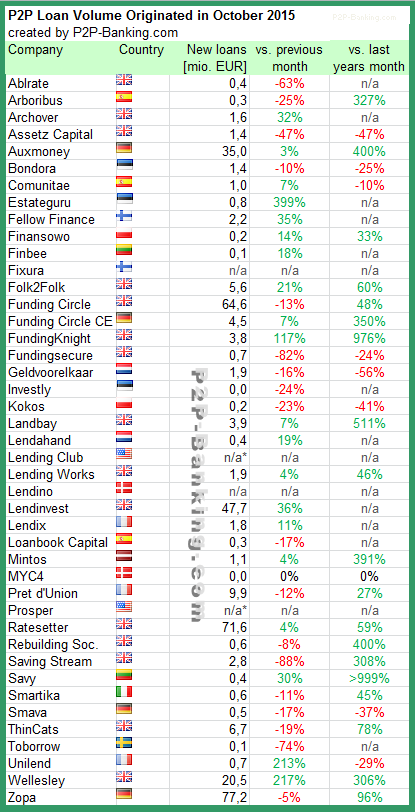

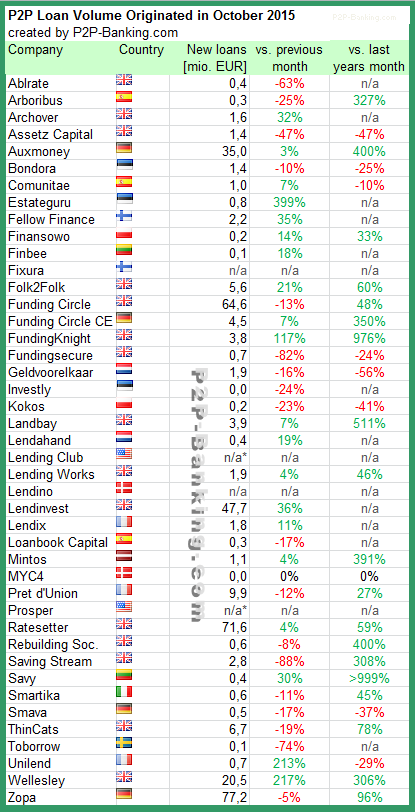

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

![]() Lending Club reported the results for the 3rd quarter today.

Lending Club reported the results for the 3rd quarter today.

Financial Highlights are:

“We had another spectacular quarter, with revenue growth re-accelerating from 98% to 104%, and EBITDA jumping 181% year-over-year to reach 18.4% margin ,” said Lending Club founder and CEO Renaud Laplanche. “With over 1.2 million customers, continuously high customer satisfaction, strong credit performance, increased marketing efficiency and lower customer acquisition costs, we are continuing to observe tremendous network effects and benefits of scale. Our results this quarter combined with our raised Q4 outlook lead us to forecast a near doubling of revenue again this year and look toward 2016 with high confidence.”

Lending Club opened to retail investors in nine new states, bringing investor base, which is very sticky, to over 100,000.

Small business loans grew in line with expectations.

Traditional banks do not benefit from network effects. Lending Club on the other hand does benefit strongly from network effects. All these dynamics lead to lower acquisition costs and higher margins.

From the Q&A of the earning call:

Source: Lending Club Continue reading

The big news at LendIt conference this week in London was that Funding Circle announced the acquisition of German marketplace Zencap. Zencap launched in March 2014 and facilitated SME loans in Germany, the Netherlands and Spain. Working with local teams, the IT infrastructure is run from the headquarter in Berlin.

Samir Desai announcing the acquisition

Zencap has originated more than 35M EUR loans since launch with a monthly volume of 4-5M in the last months. The vast majority of this volume was generated in German loans.

With the acquisition Zencap will become Funding Circle Central Europe and the founders Matthias Knecht and Christian Grobe will head this division. Knecht confirmed that Funding Circle paid in stock through a stock swap. All existing investors stayed onboard. No details on the valuation were publicly available. Knecht said at Lendit that talks between Funding Circle and Zencap started as early as Lendit 2014.

Allegedly Zencap has been trying to raise a new round since May 2015 but struggeled. A source from the VC scene told me that he thinks, that Rocket Internet – the backer of Zencap – might have concluded, that it is more important to prove that Rocket Internet is able to deliver successful exits rather than close another round which might not meet high expectations of onlookers.

What does the deal mean for Funding Circle?

I feel that Funding Circle essentially invests in the future outlook. The current volumes of Zencap are solid but not spectacular. So essentially the deal enables Funding Circle to jump from serving two markets to five markets (even though NL and ES are very small so far) without starting from scratch. They also get local teams that are familiar with the markets and their circumstances.

For Funding Circle Central Europe it means easy access to a large base of institutional investors that are already familiar with the Funding Circle brand and can now diversify into SME loan markets in continental Europe.

When I look at the platforms in continental Europe, Zencap is the obvious choice as acquisition target. It is the only platform with a SME loan model very similar to Funding Circle that already operated in multiple markets.

Knecht said at Lendit that he is looking at Italy and France as markets that look interesting for a further expansion.

What does the deal mean for retail investors?

Unlike on other marketplaces there will be no cross-border lending for retail investors on Funding Circle. Both Samir and Knecht explain that the mid-term outlook for this is that retail investors will be able to invest into loans in multiple geographies via a coming fund.

The German platform receives some critic from retail investors, which complain that it is less than perfect and reporting and processes need to improve. This got me wondering for a short while whether the British platform would be used to replace the IT for the continental European markets too. However when I asked Knecht at the conference, he said that there are no plans for that, and that Funding Circle would continue to run seperate IT platforms. Continue reading

LendIt Europe conference in London, where I have been the last three days, was a special highlight for me. The expertise and knowledge level of the attendees as well as the quality of the presentations is outstanding. The number of attendees jumped from from about 450 last year to more than 750 this year. And it was a chance for me to chat with representatives of many European p2p lending marketplaces.

Biggest news

Peter Renton opening Lendit Europe conference (Source: Lendit Europe; photo used with permission)

Major trends

There are so many things evolving and it is sometimes hard to see which are the most relevant ones. And it certainly is a question of perspective. But from my view the three biggest developments are

1. Institutional investors will increasingly dominate the investor side

There is quite a consensus among most of the p2p lending marketplaces that institutional capital is very important for growing and scaling the marketplaces. While marketplaces value a mix of capital sources and many of them feel an obligation to retail lenders, which allowed the industry to create itself, the volume will be increasingly dominated by institutional investors. One way some platform see as a route to cater for a broader base of retail investors is to create funds that allow retail investor to buy into this asset class through traditional distribution channels. Still those platforms that are open to both kinds of investors pledge to guarantee equal access and not allow institutional lenders preferential access.

The ‘Up and coming European platforms’ panel I moderated with panelists from Investly, Lendix, Mintos, Zencap and Fellow Finance (Source: Lendit Europe; photo used with permission)

2. Continued expansion in additional geographies

The headline news with the merger of Funding Circle and Zencap fits into the bigger picture as many platforms are moving beyond there national market. Examples include:

On the other hand Aaron Vermut, CEO of Prosper, said at the dinner event ‘Global trends in consumer lending’ (thanks again for the invitation to that -it was very interesting) that Prosper has no plans to expand into other geographies, as that would distract Prosper too much and all activities are focused on the US market which offers a huge potential for further enormous growth.

3. The UK market offers a perfect environment for p2p lending companies

The UK market is a market were all puzzle pieces are falling into place and offer p2p lending marketplaces (and other alternative finance companies) an environment that has no parallels in any other country

Given these preconditions analyst Cormac Leech is predicting that alternative finance companies might take away as much as 20-30% of bank’s consumer lending activity and more than 40% of banks SME lending activity over the next 10 years. Banks are still looking to find out what an appropriate startegy is to respond to that, and according to Matt Hammerstein of Barclay they’ll need to execute the strategy fast, once they defined it.

The debate on how this asset class will fare in the next recession is still ongoing. Continue reading

![]() On October 1st Jevgenijs Kazanins became new CEO of Latvian p2p lending marketplace Twino. He previously worked as CMO at Estonian p2p lending marketplace Bondora. Twino was launched in June and is part of the Finabay group which operates since 2009. So far all loans offered on the p2p lending marketplace are from Latvia, whereas the Finabay group is active in a broader set of markets. Twino is open to international investors – German retail investors are the largest foreign investor base.

On October 1st Jevgenijs Kazanins became new CEO of Latvian p2p lending marketplace Twino. He previously worked as CMO at Estonian p2p lending marketplace Bondora. Twino was launched in June and is part of the Finabay group which operates since 2009. So far all loans offered on the p2p lending marketplace are from Latvia, whereas the Finabay group is active in a broader set of markets. Twino is open to international investors – German retail investors are the largest foreign investor base.

In a call with P2P-Banking.com the new CEO outlined the expansion plans. Twino will add loans from new markets, starting with polish loans shortly and possibly adding loans from countries like Russia, Denmark or Georgia at a later stage. There will be no currency risk for investors as it will be covered by Twino. Twino will apply its buyback guarantee to all loans – by which Twino covers overdue principal and interest for investors once a loan is 60 days overdue (though due to extensions this might take 8 month). The interest rate offered to investors for p2p loans in the new markets will be in line with the current offering: up to 14.9%. The loan terms will likely longer and Twino will move away from the current very short term loans many of which I deem essentially payday loans. He said: ‘… we are working on introduction of the loans from other markets, where Finabay has lending operations, such as Poland, Russia, Georgia and Denmark. The reason for the inclusion of other countries is that the demand from investors has already surpassed the volumes we can originate in Latvia. We aim to offer similar rates to the Latvia-originated loans and all loans will also come with the buyback guarantee‘

Since the mother company Finabay is already originating these loans, it will not be a challenge to build loan volume. Kazanins aims to originate 5 million Euro loan volume per month. As the loans already exist and the new aspect consists only of refinancing through p2p investors, Kazanins is convinced of the good quality of the loans: ‘We estimate that 15-20% of [polish] loan volume will be bought back through the BuyBack Guarantee program (defaulted loans and loans with more than 6 extensions‘.

Since the mother company Finabay is already originating these loans, it will not be a challenge to build loan volume. Kazanins aims to originate 5 million Euro loan volume per month. As the loans already exist and the new aspect consists only of refinancing through p2p investors, Kazanins is convinced of the good quality of the loans: ‘We estimate that 15-20% of [polish] loan volume will be bought back through the BuyBack Guarantee program (defaulted loans and loans with more than 6 extensions‘.

Twino also works to add statistics to the site. He stated: ‘ … Disclosing information about financial health of Finabay is highly important given the fact that all loans offered on the platform come with the buyback guarantee …‘

Loan extensions on Twino frequently prompt questions by investors. Kazanins has described in detail how loan extensions on Twino work here. Continue reading

![]() ING Bank partners with equity crowdfunding service Seedrs and reward based crowdfunding platform Kisskissbankbank to tackle the markets in Belgium and Luxembourg. Through this partnership, ambitious businesses will have a fast-track service for equity crowdfunding on Seedrs. The partnership will also raise the awareness of equity crowdfunding in the wider business community.

ING Bank partners with equity crowdfunding service Seedrs and reward based crowdfunding platform Kisskissbankbank to tackle the markets in Belgium and Luxembourg. Through this partnership, ambitious businesses will have a fast-track service for equity crowdfunding on Seedrs. The partnership will also raise the awareness of equity crowdfunding in the wider business community.

During consultations with businesses, ING Belgium representatives will assess which platform may be suitable and discuss how it works. Using the ING fast track procedure it only takes the entrepreneur a couple of clicks to submit an initial campaign enquiry for review. When Seedrs receives a project through this new route, it will be assessed within two days to determine if it’d be a good fit for Seedrs and equity crowdfunding. Continue reading