P2P lending service Bondora* has announced that in future it will focus completely on its hands-off investing product Go&Grow. From February 27th, the products called Portfolio Pro and Portfolio Manager will be discontinued. These allowed investors to select into which individual loans they wanted to invest. Bondora originally started and grew big with investment into individual loans and only 2018 introduced the simplified Go&Grow product which soon became very popular (read my coverage on the start of the Go&Grow product written 5 years ago). Over the years Go&Grow became more and more important for Bondora as investors seemed to prefer the easy to understand product with a fixed interest rate. Bondora’s marketing was focused on this type of investing and also Bondora made it harder to invest into the Portfolio Pro and Portfolio Manager products in the last years by allocating less available loan amounts for investment to these products. In the last years it was no longer possible to invest relevant amounts via Portfolio Pro as allocated investment pieces were only 1 Euro into each loan.

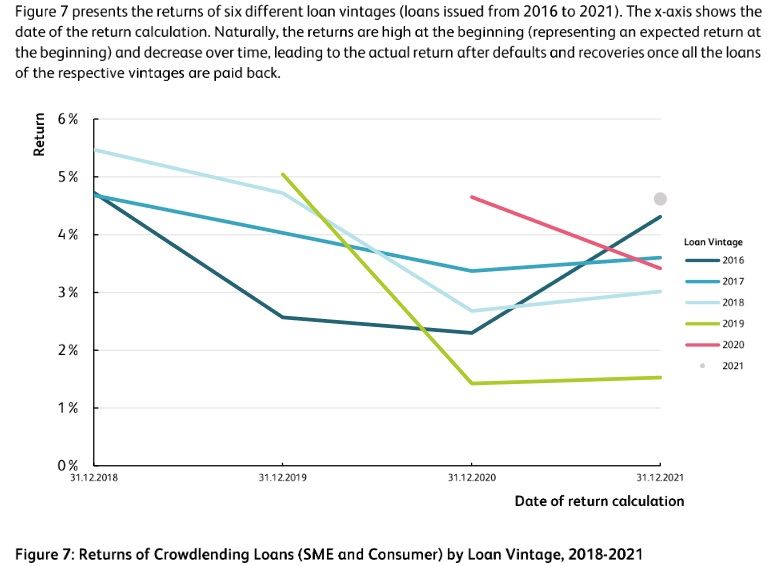

Therefore it comes as no surprise that today’s announcement by Bondora states that currently 96% of all investments are made via Go&Grow. Bondora points out that Go Grow is very easy to use ‘As portfolio diversification is automated, you can just add money, automatically earn returns, and continue living your life. ‘. The Go&Grow product offers up to 6.75% interest (limited for existing customers) or in the Go&Grow unlimited version 4% interest (unlimited, new and existing customers).

Therefore it comes as no surprise that today’s announcement by Bondora states that currently 96% of all investments are made via Go&Grow. Bondora points out that Go Grow is very easy to use ‘As portfolio diversification is automated, you can just add money, automatically earn returns, and continue living your life. ‘. The Go&Grow product offers up to 6.75% interest (limited for existing customers) or in the Go&Grow unlimited version 4% interest (unlimited, new and existing customers).

The secondary market will continue to operate beyond Feb. 27th. It will still be possible to sell and buy individual loans just not to invest into new individual loans.

Bondora* is one of the longest operating p2p lending services in Europe. The platform has more than 215,000 investors according to the website. Investments are into the underlying consumer loans, which Bondora originates via its website to borrowers in Estonia, Finland, Sweden and the Netherlands. There are few comparable p2p lending services that offer one fixed rate to investors without any configuration/selection possibilities.