The quarterly earnings announcement of Lending Club was completely dominated by the circumstances of the resignation of CEO Renaud Laplanche. I add the results for the 1th quarter of 2016 below:

(Source: Lending Club)

The quarterly earnings announcement of Lending Club was completely dominated by the circumstances of the resignation of CEO Renaud Laplanche. I add the results for the 1th quarter of 2016 below:

(Source: Lending Club)

![]() Today’s news that Renaud Laplanche, founder of Lending Club, resigns came as a surprise for me and I think pretty much everybody else in the industry. Renaud Laplanche steered Lending Club from launch to the position it as the largest marketplace lending service for consumer loans in the US.

Today’s news that Renaud Laplanche, founder of Lending Club, resigns came as a surprise for me and I think pretty much everybody else in the industry. Renaud Laplanche steered Lending Club from launch to the position it as the largest marketplace lending service for consumer loans in the US.

The board has reportedly asked for his resination after an investigation into a sale of 22 million US$ in loans to an institutional investor that mismatched the investor’s criteria. The loans were subsequently repurchased by Lending Club.

Today’s press release states:

Lending Club conducted a review, under the supervision of a sub-committee of the board of directors and with the assistance of independent outside counsel and other advisors, regarding non-conforming sales to a single, accredited institutional investor of $22Â million of near-prime loans ($15Â million in March and $7Â million in April). The loans in question failed to conform to the investor’s express instructions as to a non-credit and non-pricing element. Certain personnel apparently were aware that the sale did not meet the investor’s criteria.

In early April 2016, Lending Club repurchased these loans at par and subsequently resold them at par to another investor. As a result of the repurchase, as of March 31, 2016, these loans were recorded as secured borrowings on the Company’s balance sheet and were also recorded at fair value. The financial impact of this reporting is that the Company was unable to recognize approximately $150,000 in revenue as of March 31, 2016, related to gains on sales of these loans.

The review began with discovery of a change in the application dates for $3.0Â million of the loans described above, which was promptly remediated. The board also hired an outside expert firm to review all other loans facilitated in the first quarter of 2016 and the firm did not find changes to data in these or other Q1 loans.

The review further discovered another matter unrelated to the sale of the loans, involving a failure to inform the board’s Risk Committee of personal interests held in a third party fund while the Company was contemplating an investment in the same fund. This lack of disclosure had no impact on financial results for the first quarter.

Given the events above, the Company took, and will continue to take, remediation steps to resolve the material weaknesses in internal control over financial reporting identified in the first quarter of 2016 — one related to the sales of non-conforming loans and the other to the failure to disclose the personal investment interests — and to restore the effectiveness of its disclosure controls and procedures. These remediation steps included the termination or resignation of three senior managers involved in the sales of the $22Â million of near-prime loans.

Scott Sanborn will continue in his role of President and will become acting CEO.

The LC stock is currently trading 25% down following the news.

With everybody focussing on the larger p2p lending merketplaces, I think another current development in the space in the UK is happening without much attention. Looking at the numbers each months while the larger players go from strength to strength, some of the smaller marketplaces are in stagnation or even in decline in terms of volume.

Even with numbers fluctating monthly, it can’t be healthly to originate a few 100K each month over years whereas the total sector is doubling each year. Marketplaces have to pay employees, infrastructure and maintain and improve their technology. Add hefty marketing costs on top of that.

The struggeling ones are failing to attract enough new borrowers.

From an investor’s viewpoint there is little incentive to add funds on platforms that are not delivering much dealflow. Selection is superior on other marketplaces and even considering the advantages of diversification across platforms there are now so many choices that investors dedicate their largest amounts on probably not more than 3 to 6 different marketplaces. So every platform needs to compete to at least stay in the top 10 of attractiveness in its sub-category (e.g. consumer, property, SME, …).

So what happens to these platforms? Outright announced closures are rare (remember Squirrl?). With a lot of capital, time and effort spent, the management often hopes for a turn to the better, may it come in form of a new investor, opening up of a new sales channel or an exit/trade sale. Furthermore with an existing loanbook running, there isn’t any easy time to close down operations as the platform will usually have to continue to service the loans for the full remaining loan term. Continue reading

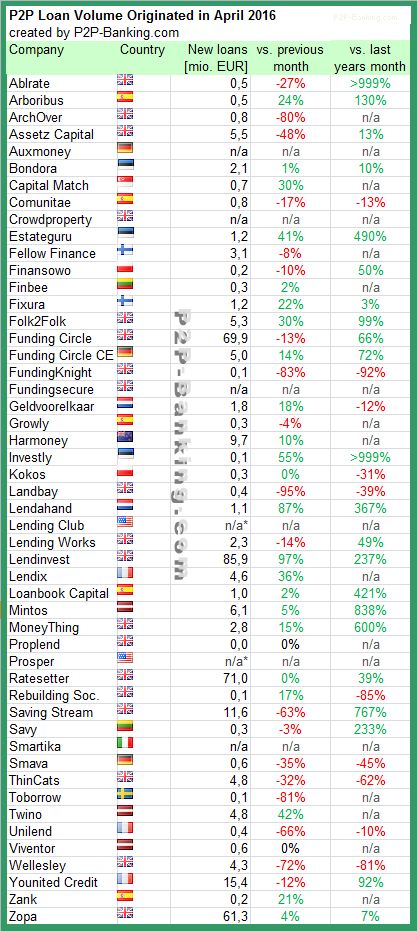

The following table lists the loan originations of p2p lending marketplaces in April. Lendinvest leads ahead of Ratesetter and Funding Circle UK. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending platforms.

Investors living in markets with no or limited choice of local p2p lending services can check this list of marketplaces open to international investors. Investors can also check how to make use of current p2p lending cashback offers available.

Last month Younited Credit (formerly Prêt d’Union) originated first loans in Italy. Geoffroy Guigou told P2P-Banking.com, Younited Credit had a great start, with 416,500 Euro loans originated.

Table: P2P Lending Volumes in April 2016. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

Notice to p2p lending services not listed: Continue reading

In October 2012 I started to invest into p2p lending at Bondora. I periodically blog about my experiences – you can read my update from Dec. 2015 here. Over the total time I did deposit 14,000 Euro and withdrew 13,380 Euro. So as you see I cashed out an amount almost equal to the amounts I deposited. The good news is that I still own 705 loan parts with an outstanding principal of 10,362 Euro at an average interest rate of 23.74%. Of these 6,355 Euro are in current loans, 1,004 Euro in overdue loans and 3,003 Euro in 60+ days overdue loans. The reason that I still have such a large loan book despite cashing out nearly as much as I paid in, is that I reinvested nearly all interest and principal repayments from 2012 till 2015.

Bondora shows a net return of 24.6% for my portfolio. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 17.0% return.

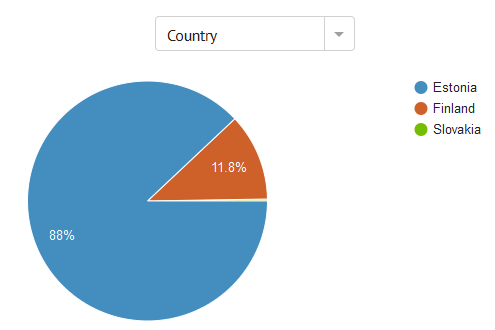

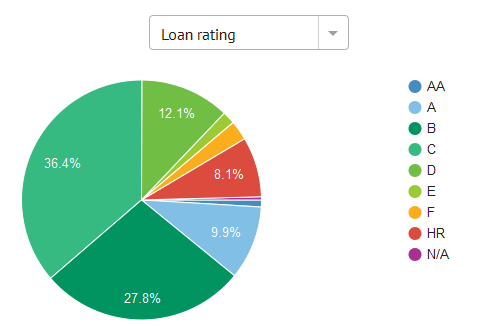

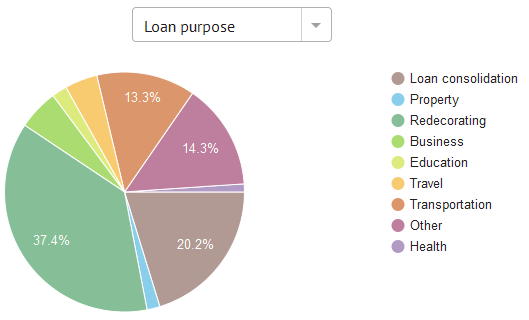

Let’s look how my remaining portfolio is distributed by several criteria

Chart 1: My portfolio by country

Chart 2: My portfolio by rating

Chart 3: My portfolio by loan purpose

Recent developments

A lot has changed in the past four months. With the introduction of new regulation in Estonia, Bondora now prefunds all loans and also keeps a stake in the loans (‘skin in the game‘). Manual bidding on loans is not as straightforward as previously because now investors can make bids, which are not binding until allocation happens. This leads to situations were say 155% of the loan amount has been bid for, but the allocation has not happened yet, because some of the bidding investors have not enough cash in their account to match their bids and those bids that are sufficiently funded don’t add up to 100%. Furthermore Bondora gives bid preference to bids with larger amounts. If at allocation time bids with enough cash add up to more than 100%, then the bids for higher amounts will succeed, while the smaller amount bids will be rejected.

Earlier this week, I was at the FintechNorth event in Leeds, UK. A very well organized, small conference with about 150-200 attendants. After a welcome from Adam Beaumont, founder of aql and a chairman address by Dan Rajkumar, CEO of p2p lending marketplace Rebuildingsociety, who co-organized the event, Chris Sier, director of FiNexus gave a very interesting presentation on the current state of the fintech market and the economic context.

Very interesting event venue in former Salem church. Beneath the glass, that Chris Sier is standing on there is the server farm of Aql’s datacentre.

Chris Sier put forward the provocative thought that we are at a cusp of a new banking crisis [in the UK] because of the rise of peer to peer lending. His argument is that the rising market share of p2p lending marketplaces will take away that much working capital from the banks that it will critically diminish the ability of the banks to create credit.

Applied futurist Tom Cheesewright than gave his assessment of the current state of digital innovation, saying he is still optimistic but not as bullish as he was a few years ago on the prospects of fintech and digital transformation.

Another very interesting presentation was ‘The future of lending’ by Richard Carter, the CEO of Nostrum Group, which provides digital lending technology to banks, finance companies and brands (one of their clients is Lendable). He thinks that the biggest gamechanger could actually be that a company like Paypal, Facebook or Amazon starts to make lending offers to their customer and thereby makes use of the size of their existing customer base, the trust these customers have into the brand and the vast amount of data these companies have collected on their customers which will benefit them in the assessment of the credit risk.

He showed a chart with portfolio balances of unsecured loans in the UK (Lloyds 9.6bn GBP, RBS 8.9bn GBP, HSBC 8.9bn GBP, Santander 5.5bn GBP, Barclays 4.9bn GBP, Zopa 1bn GBP). He expects to see totally different names on that chart in the future.

After the lunch break James Sherwin Smith presented Growth Street, a company that offers overdrafts to SMEs. One aspect he mentioned was that all talks with banks about collaboration opportunities so far led nowhere. The banks are unable/unwilling to understand that they need to regain the trust of their SME customers (‘only 13% of SMEs trust their bank to act in their best interest’).

Markus Simson of Ziraff and Tiit Pekk of Codeborne gave some fascinating examples of the efforts to digitize a whole country: Estonia. I was aware of the great progress before, but I find it striking over and over when I hear tidbits about what it means for everyday life. E.g. 99% of state services are online. Tax declaration takes 3 minutes now, but that is considered too long, therefore the next step is to make it ‘zero click’. 98% of medical prescriptions are handled online, no paperwork. Only marriages and divorces are still conducted offline. Wonder about the latter – too messy?

Tiit claims to be able to setup a new mobile bank (including all regulatory compliance, KYC, AML, card services) within months. Continue reading