Flender is a UK startup (with background in Ireland) currently pitching to raise 500K GBP from the crowd.

Interview with Kristjan Koik, CEO of Flender

What is Flender about?

Flender is a peer to peer finance platform which helps businesses and consumers to borrow and lend money through their existing networks.

Businesses can leverage their customer base and strengthen loyalty; while friends become part of each other’s’ success. Flender does this while adding a new element of trust via social network connections.

Flender emphasizes the social relationships between borrowers and lenders. Don’t you think borrowers are hesitant to ask friends and connections for money?

The social lending market among friends, family and connections has never been formalized, which is crazy when you consider that this is a market worth over 3 billion EUR a year in Ireland and the UK based on independent research performed in September 2016.

Asking people that you know for money – and lending to them – is an awkward thing to do and is certainly an unreliable means of finance. Whether it’s to fund further study, grow a business or to fund home improvements, Flender will let you borrow from and lend to people with whom you have a connection much more easily.

For individuals, there is the satisfaction of helping others while earning more interest than a standard savings account while businesses can have access to funds faster and at the interest rate they prefer. Everyone wins.

P2P lending has evolved a lot over the past 10 years. Your model has a back to the roots touch to me. Do you see your model as a reinvention of the true spirit of p2p lending?

I believe p2p lending and the sharing economy is the future of finance.

We have all lent or borrowed money at some stage of our lives and will use some sort of finance in the future – be it mortgage, car leasing, credit card, deposit account or investments. Similarly, we all have people in our social circles and professional networks who have money to lend or are looking for finance. It makes no sense that rather than doing these transactions with people who you know and trust we would do these with complete strangers with whom we know little or nothing.

Flender is not trying to create a new marketplace. We are simply formalising existing massive social lending market and by providing a seamless user experience and having first- mover advantage we feel we can dominate this sector.

The pitch video

Flender positions itself as different to other p2p lending marketplaces. Yet you take these as benchmarks for valuations in an exit. Furthermore your expected margin is much higher than those of other UK p2p lending marketplaces. What is the reasoning behind this?

Yes, we are very different to other p2p platforms, but investors will initially want to benchmark against something with which they are familiar, hence our comparison to existing platforms. Continue reading

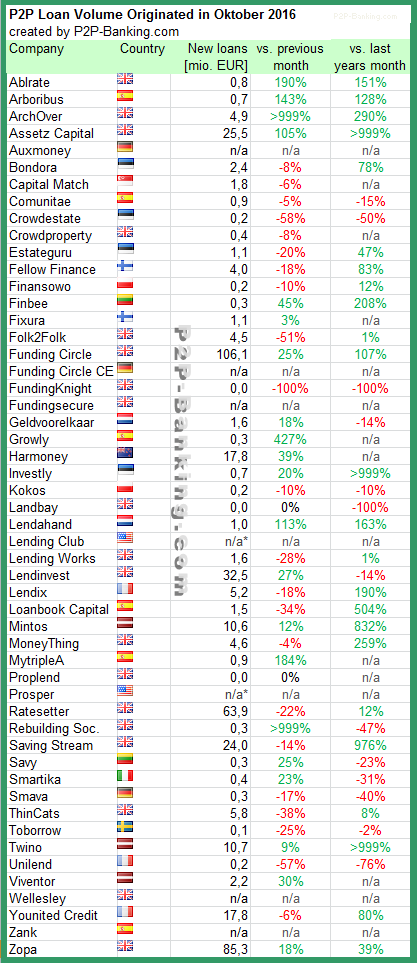

P2P lending marketplace

P2P lending marketplace

The Asian region is seeing an explosion in peer-to-peer activity, particularly, and crowdfunding in general,†says Daniel Daboczy, CEO and co-founder of Fundedbyme. “Fundedbyme is strategically positioned as the bridge between Scandinavia and Asia as we early-on saw the trend of cross-border investments – in the first equity crowdfunding campaign from Malaysia,

The Asian region is seeing an explosion in peer-to-peer activity, particularly, and crowdfunding in general,†says Daniel Daboczy, CEO and co-founder of Fundedbyme. “Fundedbyme is strategically positioned as the bridge between Scandinavia and Asia as we early-on saw the trend of cross-border investments – in the first equity crowdfunding campaign from Malaysia,