What is Klear about?

Klear is a Peer to Peer Consumer lending platform. We target Prime Bulgarian Borrowers. We pre-fund the loans, then we list them on the market where investors from EU and EEA can buy parts of them.

Klear has been built by a team of professionals from the consumer credit industry. Almost all of us came from BNP Paribas Personal Finance Bulgaria, the market leader (known as Cetelem in some other countries). For example, Nikolay was the IT development team leader, Lukasz was the CFO then the Chief Risk officer and I myself was the CEO.

Klear is all about building something solid.

What are the three main advantages for investors?

- A good net return. 5.5% expected in average, well above the remuneration of deposits, which is close to zero. Klear does not charge fees.

- A low risk. We are one of the few platforms in Europe serving good profile borrowers. No subprime or payday loans customers. Such portfolio of credits should be much more resilient in case of economic downturn.

- An easy exit option. If an investor sells his loans without premium or discount, all the loans without bad payment history will go on the primary market.

What are the three main advantages for borrowers?

- The best interest rates on the market. Cheaper than the banks’. It’s key to attract excellent borrowers.

- Full online process. Unique in Bulgaria for prime loans. Authentication is performed through a convenient and efficient video-call. Partial or full early repayments can be done online.

- No hidden fees. We have a one-off fee when the loan is disbursed. That’s all.

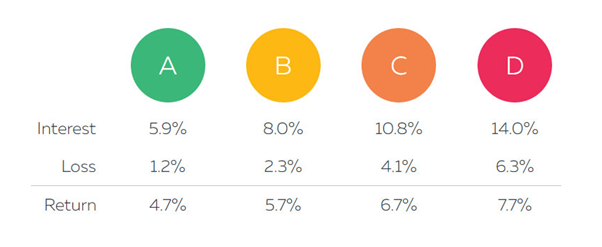

What ROI can investors expect?

5.5% in average. Thanks to our credit scoring algorithm, we attribute a risk segment to each borrower (from A to D) and determine his interest rate based on it.

Our portfolio is mainly constituted of A and B. But investors can select the segments they want to invest in, according to their risk / return appetite.

Is the technical platform self-developed?

Yes. Everything was developed in-house. The team includes 5 software developers and a designer. Our third co-founder is an IT architect with huge experience in handling core banking systems. We invested a lot of energy building the platform: in the front end to offer a great user experience, and in the back end to ensure a solid setup.

How reliable is the credit rating / credit history data available in Bulgaria?

It’s probably one of the countries with the richest set of available data. The credit bureau registers all the credits financed in Bulgaria, by banks and non-banks, with 5 years of history.

Besides we consult the National Health Insurance database, where we can check the salary and the employment history of any credit applicant. We also consult the Police database to check if the ID card is not stolen.

The founders financed the company by committing 1 million Euro from personal savings and collecting from family and friends. That is amazing – how do you feel about this achievement?

That’s great! It shows trust in the team, in our experience, in the project and common goal. We built something to last. We all have been very successful in our careers in the banking industry and now we want to do things differently, for the better and we believe we can. That’s the main drive for all of us.

What was the greatest challenge so far in the course of launching Klearlending?

What was the greatest challenge so far in the course of launching Klearlending?

To explain that we are NOT a new subprime or payday loan company, like the many other non-bank institutions in Bulgaria. To demonstrate that we are providing something better than banks, for both sides, borrowers and investors.

Can you please describe the market environment and regulation in Bulgaria?

The total consumer credit market is around 5 billion Euros. These loans are issued in the domestic currency, Bulgarian Leva (BGN), but it’s important to know that Bulgaria is in a currency board with the Euro since 1999 (at that time it was with the Deutsche Mark) and the parity has not changed since. So, there is almost no currency exchange risk, when investing in Klear loans in Levas.

Although there is no specific regulation for peer to peer lending, we decided to apply for a non-banking financial institution registration in the National Bank. We have this accreditation and it gives us the possibility to consult the National Credit Bureau.

Which marketing channels do you use to attract investors and borrowers?

Since one year, we have been providing online financial education tools (an online budget management application) and a blog where we regularly publish articles regarding personal finance. That’s an efficient inbound acquisition channel.

We are also very active on social media and we perform online advertising.

Is Klear open to international investors?

Yes, to citizens from the European Union and European Economic Area, who have a bank account opened in a bank from these regions.

Where do you see Klear in 3 years?

- Having a visible market share in the consumer credit market in Bulgaria and operations in a few other countries. As we have worked in many before and are familiar with the specificity of their domestic markets.

- Being recognized as a fair, transparent and social impact player, also helping people who cannot get a credit by providing them financial advice and support to solve their debt issues.

P2P-Banking.com thanks Loic Le Pichoux for the interview.