Brad Slavin has written a 15 page research paper: "Peer-to-Peer Lending – An Industry Insight". It contains a good summary on p2p lending aspects as well as a comparision between Zopa.com and Prosper.com. The figures given are not up to date, I assume the paper was written last year.

Toogly to apply idea of peer to peer lending to company funding

As P2P-Kredite.com writes, German Toogly plans to apply the idea of p2p lending to funding startups and companies. Anybody can draft a loan request between 1000 and 100000 Euro describing the business objective. Private lenders can bid between 50 and 100000 Euro. Interest rate and term are set by the borrower.

Currently Toogly only has the idea and a domain as placeholder. The application is currently developed and the CEO Carsten Hansen says he hopes to launch in the end of the 3rd quarter.

Hansen even wants to raise the funding Toogly needs via this way rather then using Venture Capital or other means of financing.

The concept differs from site like GoBignetwork, because Toogly will handle all repayments of the loan from the borrower. It is therefor involved in processing just like other p2p lending services.

Ppdai – p2p lending reaches China

Soon p2p lending via the internet will be available in the country with the largest population: China. Shanghai based startup Ppdai.com which is currently in its test period and open by invitation only, plans to launch in July. Two of the founders are former Microsoft employees.

Gu Shaofeng (Jack Gu), CTO of ppdai, told P2P-Banking.com: "Ppdai.com will be targeted at the small P2P loan in China (the root of P2P concept). The unique part is it emphasize the important of 'Friends', the concept of the Social Networking. Ppdai.com encourge users to lend to Friends, or friends'friend to reduce the risks."

As far as I can see the concept is a copy of the Prosper model (possibly without the groups). The minimum bid is only 50 Chinese Yuan – less then 7 US$.

According to the website, laws and regulation in China are not defining terms for p2p lending, but indirectly it can be assumed that p2p lending is not prohibited provided interest rates are not exceeding 4 times the interest rates of bank loans.

While browsing the site I noticed that the design is closely resembling designs of Smava, Prosper and in one occassion Lendingclub.

Smava original logo and homepage:

Ppdai imitation:

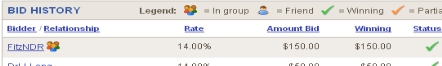

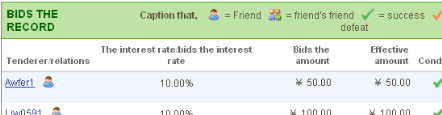

Prosper original bidding icons:

Ppdai copycat (text translated):

Lendingclub grows fast, passes $100000 in loans

P2P lending service Lendingclub, which launched last month has passed 100000 US$ in closed loans. The growth rate, compared to other peer to peer startups launched this year in other markets (see previous articles) is very high. More than $210000 in loans will close in the next 12 days. (Source: Techcrunch)

Prosper raises $20 million venture capital

Prosper.com has raised another 20 million US$ in funding from DAG Ventures, Meritech Capital Partners. Previous investors also participated in this round. (Source: VentureBeat)

It is speculated that Prosper might use the money to further develop its p2p lending model in order to enhance competitiveness with Zopa and others in the US.

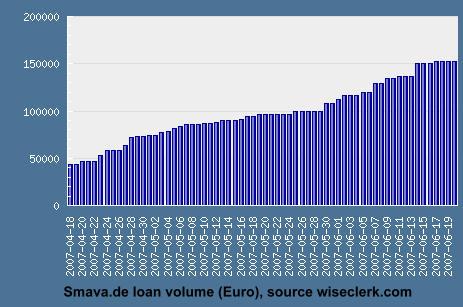

Smava with no lates but slow growth

It's been roughly 3 month since the launch of German p2p lending service Smava.de and I want to do a short résumé on the results so far. One huge achievement is that all borrowers made their first payment on time – no lates so far. While it certainly is to early for conclusions, since only one payment cycle (first repayment in the beginning of June) has taken place, the outlook for Smava concerning low default rates is very good. Looks like Smava will be much nearer to Zopa then to Prosper in this point.

Smava has a very restrictive approach for admitting borrowers and loan applications. Not only does Smava verify identity, credit score and income documentation – it goes one step further and calculates if the borrower's financial situation is well enough to allow repayment of the desired loan sum. Only after completions of all these checks is the borrower allowed to publish is loan listing.

As a result the majority of borrowers (about 70 to 80 percent of all applicants) are declined from using Smava. While this strict validation is good for quality it does slow the growth of Smava.

Since the launch Smava enjoyed large and positive press coverage (newspapers, magazines, TV, internet). Despite the good PR, Smava funded only about 50 loans with a loan volume of about 150000 Euro in the first 3 month. There are enough lenders – Smava lacks borrowers. The low volume contrasts sharply from the figures Boober.nl achieved in the Dutch market (see previous post)

The majority of loan listings that were published did get funded. Smava has two interesting functions that are unique and not used on other p2p lending services:

- Borrowers can close the loan early provided it is more than 50% funded

At Smava, listings usually run 14 days. However a borrower can decide to take the funded amount (provided it is at least 50% of the total amount) and close the listing early. Several borrowers have used this function. A borrower can open another listing (provided he has not reached his personal maximum repayment allowance) instantly for the remainder (he can even choose a different interest rate for subsequent listings) - Borrowers can increase the offered interest rates on their open listing. If this happens the change is applied for all bids on this listing. This is a widely used feature. Many borrowers start with (ridciously) low rates. After a few days they realise their loan will not fund and they increase their interest rate – often in several steps

Smava has yet to find a good concept for groups. While there are groups their purpose is yet to be defined. Consequently the majority of borrowers did not bother to join a group.

I will continue post updates on the development of Smava here on P2P-Banking.com.