In a recent presentation Kiva.org states it expects to reach $130 million in loans through microlending with over 550,000 lenders contributing.

Lendingclub with new homepage

Lendingclub has a new homepage. At least I think it is new, but maybe I have overlooked it for quite some time since Lendingclub used to point the homepage to the Lendingclub blog and I usually went directly to the blog URL.

The homepage is mainly an information showcase for new borrowers or lenders. Unlike Prosper it has few real functions. While most data remains restricted to logged in users, it does show a few rankings and statistics.

Today Lendingclub announced that it passed the US$ 1 million loan mark. With 683 verified lenders Lendingclub is still small compared to Prosper numbers, but growing steadily.

Prosper announces monthly figures

Prosper.com published a "People to People Lending Market Survey" for August. The Survey covers Prosper data and gives a commentary by Chris Larsen, CEO of Prosper.

Excerpt:

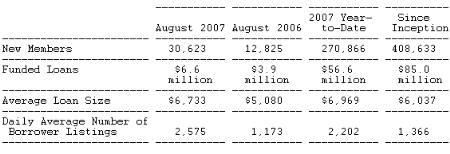

Membership and Loan Volume Statistics

In the commentary the main point is the focus of lenders on higher credit categories: "…At the same time, lenders on Prosper are exhibiting rational behavior by steering their bids toward borrowers in the higher credit categories and being far more cautious about chasing higher rates offered by subprime borrowers. Evidence of this flight to safety is seen in Prosper's mix of funded borrowers. For example, the subprime category accounted for only 9 percent of loans funded in August 2007, a marked decrease from August 2006 and the 2007 year-to-date average of 25 percent and 14 percent, respectively. What remains to be seen is whether lenders on Prosper will start placing less weight on homeownership as a factor in their bidding strategies…"

When studying the figures careful attention should be given to the definitions. HR loans are completely excluded from the Estimated Annual Return on Prosper Select Index and the Average Borrower Rates on Prosper Select Loans table. Furthermore loans that did not fit criteria on delinquincies, credit inquiries and DTI are also not included in these tables.

Prosper revenue in August $118K

As Mike has calculated, the revenue Prosper.com earned in August was $118,000. No figures on the cost structure of Prosper's operations are available.

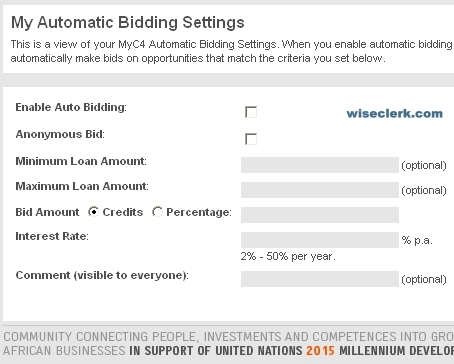

MyC4 introduces automatic bidding

MyC4 introduced "automatic bidding", an automatic bidding assistant that will bid on any new loan listings that match parameters set by the lender. Similar to the Standing Orders feature of Prosper.com, but not with as many selection criteria.

Mads Kjaer, CEO of MyC4, said:

The Auto Bid request came from several of the businesses we have talked with and also several Builders who asked for a quick way of get going.

You could say that this feature is also the preparation for e.g. philantrophy funds or bi-lateral organisations who want to use My4 to reach micro entrepeneurs in Africa at NO COST = 100.000 credits is 100.000 credits invested …

MyC4 now also enables the use of Paypal to transfer money into the MyC4 account.

Kiva sold out!

After a great traffic surge due to media coverage in The Today Show and The Oprah Winfrey Show new lenders funded loans faster then Kiva.org could list new ones. When Kiva reached nearly 1 million page views per day it was completly sold out temporarily. Right now there some loan listings, but Kiva limited bidding to $25 per lender.

My 20 Kiva loans are all paying on time so far.

(Spotted via Remo.fm)