A look back on the past 11 years, that saw the rise of numerous UK fintech players. How the financial crisis provided a hotbed for startups to foster and grow rapidly. The video by 11FS is an hour long and delivers and interesting recap. There is also a report.

October Stops Catering to German Retail Investors

Marketplace October* has just announced that due to regulatory requierements it won’t enable retail investors from Germany to invest into any new projects starting next week

In July 2019 we announced that we were going to launch October in Germany by the end of the year after the arrival of our local CEO, Thorsten Seeger. This is now coming fast with our first recruitments and operations in Munich.

For regulatory reasons we cannot open German projects to individuals. This is because the BaFin (German Federal Financial Supervisory Authority) requires the use of a fronting bank to allow retail investment in loans. We have studied this possibility, which has been chosen by other platforms, but the additional constraints and costs make this an unacceptable alternative under our business model.

German projects will only be funded by our institutional lenders (nor Spanish, Italian, French or Dutch retail lenders will be able to German projects). Additionally, lenders who are tax-resident in Germany will not be able to lend to any projects on the platform. Now that we operate locally, we have to apply local restrictions.

This means that you will not be able to lend on October as of next week. You will still be able to:

- Receive repayments on your current projects,

- Debit your October Account at any time.

We will provide you with your annual tax-summary (and this as long as you will be receiving repayments on your October Account).

We are really sorry to announce this news but have to comply with the German regulation. We have at heart to treat all our lenders, borrowers and partners equally wherever we operate. We will continue to work hard, with our peers in the European Crowdfunding Network, to allow German lenders on the platform in the future. How? We are confident that regulation, particularly at European level, will evolve to enable you to support the growth of European companies.

We are at your disposal should you have any questions.

International P2P Lending Volumes September 2019

The table lists the loan originations of p2p lending marketplaces for last month. Mintos* leads ahead of Zopa and Ratesetter*. The total volume for the reported marketplaces in the table adds up to 639 million Euro. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file, I can publish statistics on the monthly loan originations for selected p2p lending platforms.

Milestones in culumulative volume lent crossed this month:

Investors living in national markets with no or limited selection of local p2p lending services can check this list of international investing on p2p lending services. Investors can also explore how to make use of current p2p lending cashback offers available. UK investors can compare IFISA rates.

Table: P2P Lending Volumes in September 2019. Source: own research

Note that volumes have been converted from local currency to Euro for the purpose of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed: Continue reading

Estateguru Secondary Market Launch

After several month of waiting since the first announcement, the Estateguru* secondary market will now launch. In the past weeks could participate in a closed beta test prior to the coming public launch of the market. Estateguru used this to get some feedback and to fine tune the wording (e.g. in the FAQ).

After several month of waiting since the first announcement, the Estateguru* secondary market will now launch. In the past weeks could participate in a closed beta test prior to the coming public launch of the market. Estateguru used this to get some feedback and to fine tune the wording (e.g. in the FAQ).

Overview of important facts about the Estateguru secondary market:

- seller pays a 2% transaction fee

- loans in all status can be offered, including late and in default

- only the total loan part can be offered, it is not possible to split it and sell parts of it

- seller can set the price at par or at premium. Discounts are not possible

- buyer gets all repayments and interest after the sales transaction date

- bought loans can not be resold for the next 30 days

- each listing runs for 7 days. Unsold parts will be removed automatically

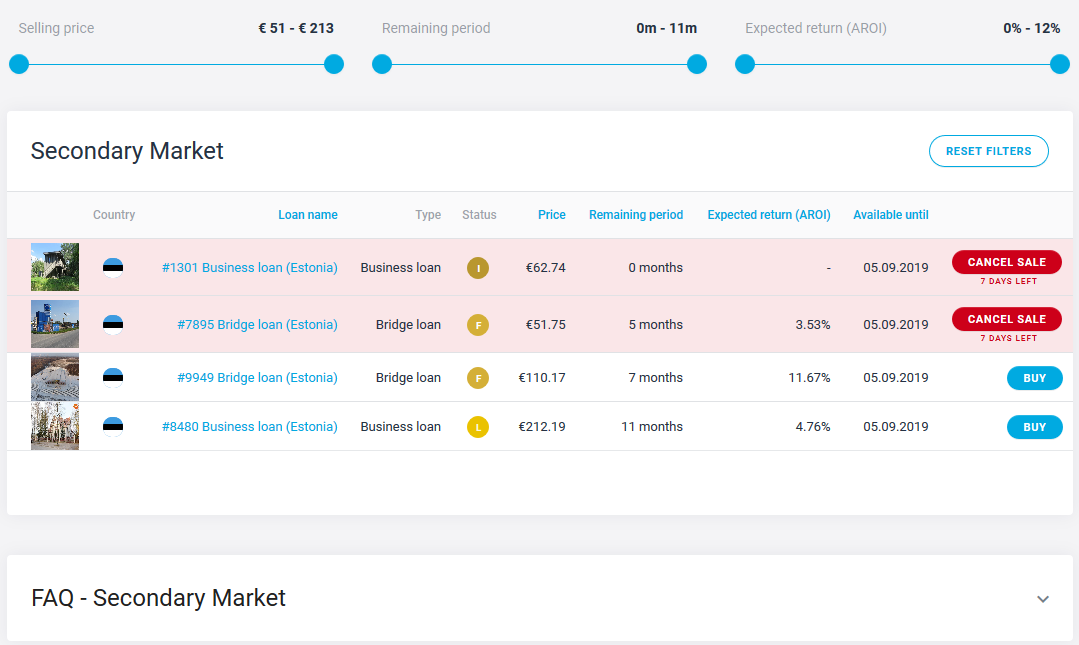

And now, without further ado, this is how the secondary market looks:

Fig. 1: Estateguru secondary market

On top of fig. 1 you can see the available filters. Also most columns can be used for sorting. The red highlighted loans are parts I listed for sale. I’ll now show you the steps necessary to sell a loan.

First I consented to this notice for activating the secondary market.

Fig. 2: Activating the secondary market

Then I went to my portfolio, selected the loan, I wanted to sell and clicked the “Sell” button on the right. Now I got to this screen:

Fig. 3: Setting the sales price

There is a slider on the upper right for the sales price. It is preset to 2% premium, to recover the sales fee. I set a higher premium here. Below the price the AROI for me (the seller) and the AROI for the buyer is shown. As the AROI is prominently featured in the market overview (see fig. 1) it is an important criteria for the buyer. And 3.56% is probably to low to achieve a sale. In fact this part did not sell in the 7 days (the other listed part #1301 did sell, see Fig 5.).

Here is the Estateguru AROI definition: ‘AROI (annualised return on investment) is an estimated annual return based on the total return on investment’.

After I clicked “Sell my claim” there is a screen for entering the password.And after that a display where Estateguru confirms that the loan is listed for sale

Fig 4.: Email I received notifying me of a successful sale of a loan

I like the overview table of the secondary market. As improvements I suggest to display the premium percentage and to allow filtering by status. Maybe that will be added in the next release. I also asked if they could add the ability to trade at discounts. The reply was that they wanted to offer an easy opportunity to sell loans and not overcomplicate the tool.

My first impression

The secondary market delivers what it aims to do: allow an early exit by selling loans. The 2% fee is relatively high, I expect that will keep the traded volume low. Sellers of late and defaulted loans will have to carefully consider the price set, as I think that with any positive news updates on the recovery status of the loan, the loan part will be bought, before the seller has a chance to read and react to the update.

International P2P Lending Volumes August 2019

The table lists the loan originations of p2p lending marketplaces for last month. Mintos* leads ahead of Zopa and Ratesetter*. The total volume for the reported marketplaces in the table adds up to 634 million Euro. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file, I can publish statistics on the monthly loan originations for selected p2p lending platforms.

Milestones in culumulative volume lent crossed this month:

Investors living in national markets with no or limited selection of local p2p lending services can check this list of international investing on p2p lending services. Investors can also explore how to make use of current p2p lending cashback offers available. UK investors can compare IFISA rates.

Table: P2P Lending Volumes in August 2019. Source: own research

*The Mintos figure is a bit too low this month, as it misses the originations from the last two days.

Note that volumes have been converted from local currency to Euro for the purpose of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed: Continue reading

Two Issues Currently Evolving on P2P Lending Marketplaces

This week some investors on the p2p lending marketplaces Viventor*, Grupeer* and Mintos* are affected by issues that hinder the normal procedures on these marketplaces.

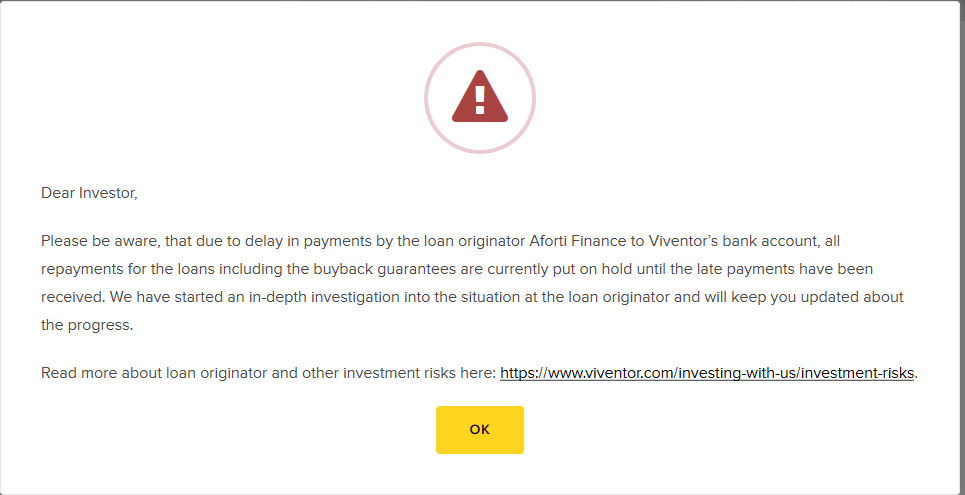

Viventor started to display the following warning message yesterday (visible only if you click on an affected loan)

(Screenshot from Viventor.com)

As a result, multiple Aforti loans were on offer on the secondary market for 5 to 15% discount (at one point in time I saw 35% discount)

Asked for a comment, Viventor CEO Andrius Bolsaitis told P2P-Banking.com:

According to information that we have now, they have some cash management issues, we are in discussions with them and hope to resolve the situation soon. I will be personally meeting with their managers tomorrow in Warsaw and will have more updates then.

Update 14:02: Apparently Mintos has now suspended trading of Aforti loans on the secondary market. I reached out this morning to Mintos’ management for a comment on how they see the situation with Aforti.

Update 14:42: Reply from Mintos CEO:

Hi … ,

Thank you for your email.Aforti is overdue on passing to Mintos payments which Aforti has received from borrowers and payment for buybacks. Thus, we are suspending repayments and buybacks. We are meeting Aforti tomorrow in Warsaw and will update investors accordingly. Below excerpt from communication to all investors:

Mintos has suspended automatic repayments and buybacks for loans originated by Aforti Finance on our marketplace (EUR and PLN).

The decision was made based on Aforti Finance’s overdue transfers of borrower’s payments to the Mintos marketplace.In order to protect the interests of our investors, all loans issued by Aforti Finance have been removed from the primary and secondary markets of the Mintos marketplace. This means you cannot buy or sell Aforti Finance loans, effective immediately until further notice.

Update 16:02: Statement from Aforti Holding:

Dear Sir,

In response to the questions regarding the message released by Viventor, we would like to inform you following.

We are currently at the stage of closing cooperation with the Viventor platform, what has been announced to Viventor. Situation suggested by Viventor is a result of change in Aforti Finance S.A business strategy. Our decision is determined by technical difficulties in cooperation with Viventor platform. Also cause most workload has to be done manually, our operational risk increased significantly. This is what we want to avoid, cause AFORTI business model and operational procedures are going rather in the direction of using API to automatize processes and to minimize human errors.

It’s also worth to add, that we have not been using Viventor platform for new loans for about two last months, as a result of mentioned above decision. Of course Viventor receives daily financial transfers, so we do not see any reason for such a message.

Due to the fact that for tomorrow (Thursday, August the 8th ) we have scheduled a meeting with the Viventor, we believe all misunderstandings will be clarified.

Update Aug. 8th: the meetings are at 12:00/13:00 (Warsaw time)

Update Aug. 8th: Debitum Network* says investors on the Debitum platform are not affected as all Aforti loans were bought back on July 25th

Update Aug 9th: from Mintos*

Update Aug 9th: by Viventor

As previously announced the meeting with Aforti took place in Warsaw. The parties found a solution with regard to the technical issues. We consider the solution satisfactory for both sides and expect all issues to be resolved during next week.

Update Aug. 12th: Mintos now says they had an agreement with Aforti since January 2019, due to which Aforti would not place any new loans on the primary market. Strangely they only communicate that agreement now. Why not in January?

Our team is once again meeting with Aforti Finance in Warsaw, Poland today to continue to work out the details of last week’s initiated solution for Aforti Finance to resume transferring borrower repayments to us for distribution among investors.

We aim to release the next more detailed update tomorrow.

Until then we thank you for your patience, as well as the questions to our Investors Service team and comments on the blog and social media. We are preparing to release answers to them as soon as we handle the current priority of resuming payments.

We also wish to remind that Aforti Finance has not been placing loans on the Mintos primary market since January 2019. It was a mutual agreement with Aforti Finance following a weaker than expected loan performance and IT system related issues. Aforti Finance has continued servicing the loans since then and the total Aforti outstanding loan portfolio on the Mintos marketplace has decreased from EUR 5.7 million on December 31, 2018 to current EUR 2.2 million as of August 12, 2019. In light of adverse changes in the mood on the Polish securitization and bond market as well as our due diligence insights on the company’s internal arrangements changes, we reflected our risk precautions by downgrading Aforti to C+ in March 2019.

At this stage we remain committed to working with Aforti Finance to continue servicing loans and passing borrower repayments to investors on the Mintos marketplace as soon as possible.

Update Aug. 12th: I have analysed the Mintos loan data and came to the result that the last Aforti loan, was listed on January 2nd on the Mintos primary market.

Update Aug. 13th: Several investors report that they received a repayment incl. late fees on this Aforti loan on Viventor today.

Update Aug. 14th: Mintos has announced that Aforti payments have resumed as of today. Aforti loans on the secondary market stay suspended.

Update Nov. 6th: Viventor has issued the following update:

… an update on the situation with the investments into loans issued by Aforti Factor S.A. and Aforti Finance S.A. on ViVentor platform, we want to update you on our actions regarding the repayment of loans, including the buyback guarantees, which were put on hold from the 6th of August 2019.

On August 12th, 2019 ViVentor has negotiated and signed Settlement Agreements with Aforti Factor S.A and Aforti Finance S.A. Each agreement contained a daily payment schedule which was designed to ease up the cash flows of the companies and make it easier for them to repay their outstanding debt at that time. Both agreements expired on September 13th, 2019. By then Aforti Factor S.A has managed to pay all of their outstanding debt and the debt of Aforti Finance S.A. has settled their debt from the schedule on November 5th, 2019.

However, new debt has been growing for both companies ever since and now we are taking all necessary actions, including legal ones to have the full amount paid of current and late dues and to protect the interests of our investors.

…

What is next?

Our team is planning once again to meet with the management of Aforti Finance S.A. and Aforti Factor S.A. to continue to work out the details and find solutions to resume transferring borrower repayments to us for distribution among investors. The meeting date and place are being settled right now. We aim to release the next, more detailed update on our cooperation and ongoing payments executions within a few days (after the meeting has taken place). We would like to assure you that your concerns are of the utmost importance to us.

Earlier this week on Monday, it became evident that the Lithuanian central bank had suspended the operations of Satchelpay (source), which Grupeer* used as one of two ways for deposits by investors. From Tuesday onwards Grupeer asked investors to use the alternate deposit method via Baltic international bank only and said that they will add new payment providers this week.

Asked by P2P-Banking what the status of investor payments is, that were made shortly before or on the day of suspension to Satchelpay, a Grupeer contact told P2P-Banking:

At the moment we are in contact with the bank and have received the information that all transferred funds will be returned to the account of the sender. However, we cannot provide you with the exact terms.

More detailed information will follow.

Hopefully both incidents will be resolved satisfactorily for investors. On both issues I see room for improvement on communications with investors.