Lendingclub.com has in a new release some new account management features for lenders.

Lendingclub is currently not open for registration of new lenders.

Report on p2p lending in Poland

Accenture in cooperation with Gemius published a report (english, polish page) on the polish p2p lending market. The report looks at the parameters of the polish p2p lending sites Kokos (see our earlier interview with Kokos), Finansowo and Monetto. The report in detail shows the result of a survey of 1075 internet users on questions of various social lending aspects.

Zopa UK plans Young Market to target young borrowers

Zopa UK said it will introduce 'Young Markets' (Young36 and Young60) specifically for borrowers aged 20 to 25. The need for this arises from the fact that currently many applications are turned down – not because the borrowers have any negative marks on their credit history – rather they don't have sufficient history of debt.

Zopa will still check borrowers in this age group (identity, fraud, affordability, adress and employment). As long as they have no history of bad debt they will be approved for borrowing on the Young Market.

The new young market segment will allow Zopa to advertise the service focussed on young borrowers, which are internet savvy and open to the p2p lending concept.

Lending Club files S-1, step towards reopening for individual lenders

On June 20th, Lendingclub.com filed a registration statement with the SEC to issue up to 600 million US$ in Member Payment Dependent Notes. The notes will be backed by loans and sold to lenders. The process for lenders remains pretty much the same as before the quiet period, only the legal setup will change to comply with regulation.

Link to SEC filing of Lending Club

Press release by Lendingclub regarding the SEC filing

Netbanker extracted some interesting data from the 100+ page Lendingclub filing.

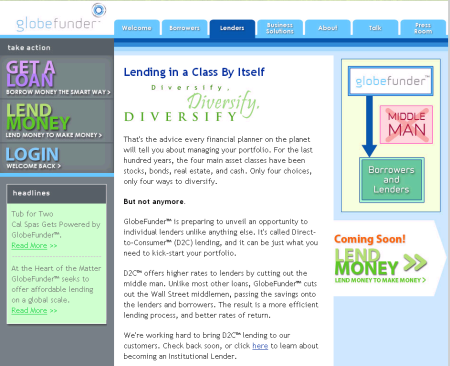

Globefunder with new homepage

Globefunder's site got a new layout. It looks more structured and professional now.

Also it seems that Globefunder will open its d2c lending (d2c="direct to consumer") to individual lenders. Only in May an announcement of Globefunder sounded like under dtc lending the company would on the lender site be open only to institutional investors.

Now there are "Coming soon Lend Money to make money" signs on the new site. But it's not available yet. Clicking on them displays the message

We're sorry, that option isn't available yet at GlobeFunder.com. Please check back again soon, as we continue to make improvements to the site.

MyC4 with accounting troubles

Since the new release, MyC4.com has encoutered repeated accounting problems, sometimes with wrong interest calculations, sometimes requiring correction of user account balances.

Examples of incidents: 1, 2, 3, 4, 5

MyC4's staff has been quick to respond to the problems and usually is fixing them fast.

But I believe the issue here is, that p2p lending through a foreign internet startup requires a great amount of trust. And while lenders are used to bugs in new internet application, they do expect a high standard when it comes to accounting. After all no user of online banking would accept that he has to check the interest calculations made by the bank.

The MyC4 team did a good job developing the platform so far and earned at lot of trust; but if the problems persists this might be an obstacle to further growth.