About a year ago I started lending money to African entrepreneurs via MyC4.com. So far it did meet my expectations. The process of uploading money worked without problems, there were always enough loan applications to select from and the offered interest rates were high enough to allow for good returns despite the risks. The only point, where the usability need to be vastly improved is a better status overview for the payment status of all loans in the portfolio. MyC4 does show the payment status in detail for each loan, but its hard to get an aggregate overview.

About a year ago I started lending money to African entrepreneurs via MyC4.com. So far it did meet my expectations. The process of uploading money worked without problems, there were always enough loan applications to select from and the offered interest rates were high enough to allow for good returns despite the risks. The only point, where the usability need to be vastly improved is a better status overview for the payment status of all loans in the portfolio. MyC4 does show the payment status in detail for each loan, but its hard to get an aggregate overview.

I invested at 13.8% average nominal interest rate. 194 loans are currently running, 29 are repaid in full, 12 are open/pending (not yet disbursed), 1 defaulted and 4 were cancelled.

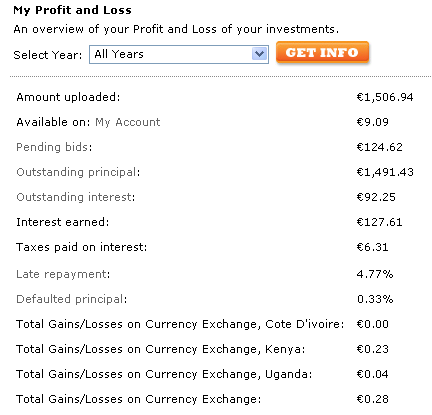

To roughly calculate estimate my ROI I looked at my account display at MyC4

About 12-13 months ago I uploaded 1,506.94 Euro. Now my account value is 1,625.24 Euro (9,09 Euro available + 124,62 Euro pending bids + 1.491,93 Euro Outstanding principal). That results in an ROI of 7.9% so far. Naturally it would drop, if the outstanding principal is not repaid in full due to defaults.

The ROI is much lower then the average interest rate, since it does take weeks before an investment in a loan becomes active – and unlend money does not yield interest. A further point is that several late loans affect the ROI.

Read all MyC4 posts from the past months.