Update from Pertuity Direct

That’s the title of an email I’ve just received from PertuityDirect.com, a Virginia based p2p lending service in pre-launch stage. Pertuity Direct announces:

… If you have been keeping tabs on the space, you know that the social lending industry has been pretty interesting over the last two to three months. The guidance that regulators have given with regard to the segment, combined with the fact that consumer loans are still hard to come by, fits perfectly with what we are bringing to market. There is a real need for alternative sources of capital for consumers, as well as new and better investing options. Social lending is a great answer to the problem – and Pertuity Direct is poised to bring it to the mass market.

We are in final preparations to launch immediately after the New Year. All of the pieces are finally in place and we are revving up for Day 1.

We’re excited about 2009 and are looking forward to reaching out to you very shortly as we open for business. …

Since the Loanio delays I am a bit wary of launch dates, but ‘immediately after’ sounds confident – looking forward to the launch in January 2009 then.

Which of my predictions for p2p lending trends 2008 came true?

In January 2008 I made some predictions what might happen in p2p lending this year. Now I’ll check on those (the black colored text is the original text, the green and red texts are the review as of today):

More competition and entering more national markets (probability 100%)

In many markets multiple p2p lending services will compete for the attention of lenders and borrowers, especially in the largest market: In the United States Globefunder.com and Loanio.com will launch. In other markets, where there is no national p2p lending service established yet (e.g. Canada, New Zealand, Spain), p2p lending will be introduced by the launch of a service.

Loanio did launch, but went into quiet period shortly afterwards. As did Prosper. Zopa US closed. Fynanz launched. Competition in the US is in fact lower than at the End of last year. Internationally several p2p lending services launched.

Insurance against defaults (probability 75%)

Not totally new, since Boober.nl and Smava.de already offer some protection of the loan principal. Insurance can be implemented as a classical insurance product (supplied by an insurance company) or as a market mechanism, spreading the risk over multiple loans.

Several p2p lending services offer insurance.

Secondary market (probability 25%)

One of the disadvantages for lenders currently is that on all p2p lending platforms, the invested money i locked in for the duration of the loan term. Prosper.com has already announced that it plans a secondary market, enabling lenders to sell and buy loans any time. Depending on the market there are huge regulatory hurdles to allow trading of loans. For example German executives told P2P-Banking.com that on the German market a secondary market is unlikely for years to come.

Zopa Italy and Lending Club introduced secondary markets.

Cross-market lending (probability <25%)

Aside form the social lending approaches (Kiva, MyC4, Microplace) so far all service are open only for lenders and borrowers that live in the same market. If lenders could lend to borrowers in markets with higher key interest rate than the market the lender lives in, the advantages could outweight the risks. In the European Union due to the Euro zone there would be no currency exchange risk. Again there are steep regulatory hurdles to be taken.

Has not happened.

Variable interest loans (probability ?)

So far all loans are for fixed terms (prepayment allowed) with fixed interest rates. Variable interest loans could add flexibility. The interest rate could rise or decline following an indicator (e.g. market prime rate). Another possibility would be a mechanism where the variable interest rate would rise or fall as a result of the level of defaults of the credit grade. This could protect lenders, if the actual default ratio is higher then the forecasted default ratio.

Fynanz loans have variable rates. But this is the only example so far.

Third party bidding management (probability?)

Just a thought. Lenders could allow a third party to manage their portfolio. Like an investment funds the lender would invest an amount of money, while the funds manager does the actual selection of loans. This could possibly be done by a sophisticated software (would you trust this?) selecting loans by statistical analysis of performance of loans with similiar parameters or by a fonds manager. The later is unlikely because the amount of time needed for each loan is too high to be covered by fees.

Prosper introduced bidding via API in February.

I’ll publish my p2p lending predictions for 2009 in January.

Review of peer to peer lending developments in 2008

As the end of 2008 approaches here is a look back on the highlights of peer to peer lending news in 2008:

- February: Gartner predicts that by 2010 social lending captures 10% market share; p2p lending in Poland takes off; IOUcentral launches in Canada – only to be suspended by regulator a week later

- April: Lendingclub enters quiet period for SEC registration; Cashare launches p2p lending service in Switzerland; Prosper goes national with 36 percent max. interest rate – partnering with WebBank; Zopa UK reshapes markets – concentrates on 36 and 60 months loan terms

- May: MyC4 has new interface and shifts currency risks to lenders

- August: Zopa UK launches young market; Maneo launches p2p lending services in Japan

- September: Kiva repayments are now immediately available for reinvestment; Zopa grows in Italy – has secondary market

- October: Loanio launches in the US; Friendsclear launches in France; Smava raises more venture capital; Zopa US closes; Veecus launces p2p microfinance; Lending club comes out of quiet period and introduces secondary market note trading platform; Prosper enters quiet period for SEC registration; Kiva wins grant; more than 685M US$ p2p lending volume; two funds will invest more than 2M Euro in Africa through MyC4

- November: 50 million US$ Kiva loans reached; Comunitae gets funding; SEC orders Prosper to cease and desist; Loanio suspends operations

- December: Class action lawsuit and other legal troubles challenge Prosper

Noba to offer p2p lending in Hungary

Guest article by Peter Petrovics, co-founder of Noba

First of all, let me thank Wiseclerk for the opportunity to post this guest piece on his blog.

I am excited to announce the January launch of the first Hungarian p2p lending service:

Also, as a regular reader of Wiseclerk’s posts, I am hoping to be able to draw on the wisdom of his readership in a particular legal problem we have run into while setting up our initiative.

My name is Peter Petrovics, and I have some modest experience working with online communities, while Charlie Szabo, my partner in Noba, is an accomplished former banker. We both have been deeply interested in the entire concept of p2p lending since we first heard of it. We started our project in our native Hungary last summer .

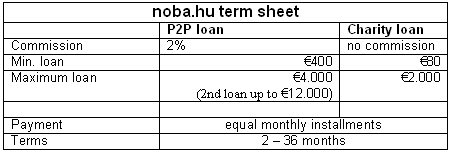

We opted on a dual system: one is dedicated to the P2P lending model, where we hope to see micro projects raising money through friends, family, social network and eventually anyone interested enough in the given venture.

The other section is dedicated to channel loans to the high number of people living in deep and prolonged poverty around the country. We call these “charity†loans, and this part of noba.hu is similar to Kiva.org with the difference that it is limited to Hungary. Applicants for these loans are assisted by a mentor, who is typically an NGO or social worker, in managing their loan applications and projects.

We hope, that noba.hu will not only allow a flow of funds, but will eventually create synergies between lenders and borrowers in terms of know-how, contacts, partnerships.

Both types of loans are intended to allow lenders to make real profit, hoping on the long run to attract a larger community of private and institutional lenders.

This is however the part where we run into a very tenacious obstacle: under Hungarian law, lending (on interest) is a privilege strictly reserved to banks – private individuals are allowed to give a single loan per year, the second loan would be considered as providing commercial banking services without legal authorization. This means that the people who are willing to participate in a P2P loan project as lenders are only allowed to lend the money with a 0% interest, unless these natural persons are founding registered financial institutions.

I would be grateful for any input regarding this problem. We have made some research, and found that similar regulatory restrictions have been overcome by other initiatives in the UK, the Netherlands and Germany, but I would be interested to hear any new ideas from you.

Does anybody have any idea if the whole issue could not be approached from an EU regulatory side? Could prove to be an easier path, than pursuing separate battles against the local legal systems.

Thank you for your attention, and looking forward to your comments.

Peter

Babyloan microfinance

Launched in summer French Babyloan.org has about 1750 lenders financing peer to peer micro-loans to entrepreneurs in developing countries. I signed up yesterday when I found the service (thanks to Jean Christophe Capelli for the pointer) and helped to fund 5 loans to borrowers in Benin, Cambodia and Tajikistan. One of them is Kheav Sitha who runs a small restaurant stand at her house in Phnom Penh, Cambodia. She wants to borrow 140 Euro for 6 months.

Launched in summer French Babyloan.org has about 1750 lenders financing peer to peer micro-loans to entrepreneurs in developing countries. I signed up yesterday when I found the service (thanks to Jean Christophe Capelli for the pointer) and helped to fund 5 loans to borrowers in Benin, Cambodia and Tajikistan. One of them is Kheav Sitha who runs a small restaurant stand at her house in Phnom Penh, Cambodia. She wants to borrow 140 Euro for 6 months.

Signing up went smoothly. I liked the user interface for selecting the loans. It features summaries of the loan detail that are shown with AJAX on the right side of the screen while moving the mouse over photos of the borrowers seeking loans on the left side. The website is in French and English, but on some points the English translation seemed to be missing. Funds are transferred in via credit card payment – I have not yet found out how they can be transferred out after the loan term ends if they are not re-lend.

Like other platforms Babyloan partners with local microfinance institutions (MFIs). The MFIs screen the borrowers and handle the payout to the borrowers – in the case of Babyloan the payout has actually taken place BEFORE the loan is placed on the platform – and the MFI takes the sum to refinance the loan.

Unlike at MyC4 lenders do not receive interest. While Kiva asks for voluntary donations to fund its operations, at Babyloan a fee of 1 Euro per 100 Euro funded is compulsory . (Minimum a lender can lend is 20 Euro).

Babyloan is backed by Acted (a NGO), Bred (a regional bank in France) and Credit Cooperatif.

The following presentation explains what Babyloan does for MFIs: