The new p2p lending service PertuityDirect.com is now online. The concept Pertuity Direct uses is new. Lenders pay into the “National Retail Fund” which is a “social lending mutual fund”.

If I understand the concept correctly, you do not choose individual borrowers you want to lend to, but rather a group of borrowers with similar parameters by buying share of a fund – but if you want to, there is the option for individual selection (similar to Lending Club). Have not grasped yet how the individual selection is supposed to work when you by shares of the fund?

The initial minimum investment amount is 1,000 US$ per lender.

A so far unheard feature is that it Pertuity Direct allows early withdrawel of funds by lenders (2% withdrawal fee for withdrawals in first year of investment). Another new feature I found while reading the multiple page fund prospectus, is that lenders can set up an automatic investment plan, making monthly or quarterly investments.

Interest rates of the loans are set in the range from 8.9% to 17.9%. Pertuity Direct accepts only borrowers with a FICO credit score of 660 or higher. Update: In fact the prospectus of the National Retail Fund II states that Pertuity will invest over 80% of the money in loans whose borrower’s have a credit score of at least 720.

One advantage for borrowers is that – if approved – they get the loan faster than on other p2p lending sites, since there is no bidding or auction just the evaluation and approval process. Pertuity claims that typically borrowers will receive the money within 2 – 3 business days.

Borrower Fees

1-2% closing fee (depending on credit score)

$15 failed payment fee

$15 late payment fee (on average, may be slightly lower/higher in some states)

1% Electronic Funds Transfer discount

Lender Fees

Currently, the first year expense estimate is 3.17%, or $32 a year for every $1,000 invested. Fees are estimated based on the aggregate size of the fund.

This estimate assumes a monthly average fund size of $12 million during the first year.

While I browse the site for more information, in the meantime check out CEO Kim Muhato’s post on the blog. Excerpt:

Pertuity Direct’s Social Lending Network is different from anything else in the market. The social lending networks we are building will expand to specific affinity groups borrowing from and lending to each other; for example, professional associations like doctors and firefighters, small business owners in specific geographic regions, and university alumni groups etc. We call it Mutually Responsible Banking. Learn more about Pertuity Direct’s Social Lending Network here.

Our team is comprised of executives that have collectively worked in the U.S. financial services arena for a few decades with companies like Capital One, E*TRADE and PNC. We have executives who have experience building innovative and scalable web-based financial products, executives who have managed consumer credit and multi-million dollar loan portfolios, as well as brilliant engineers and systems architects. Our team is dedicated to changing the consumer finance landscape and loves to be on the cutting edge of financial innovation.

Boom of social lending services/p2p microfinance (probability 100%)

Boom of social lending services/p2p microfinance (probability 100%)

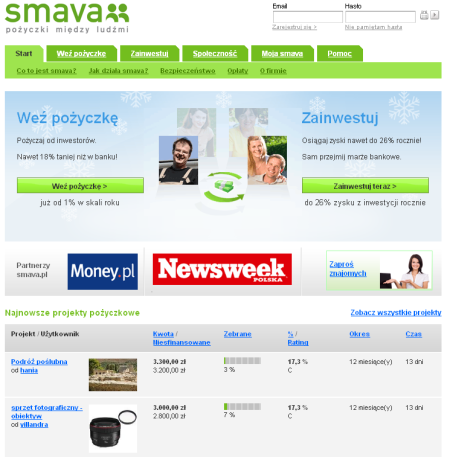

Smava: Compared to the active services smava is much more secure. Like in Germany it is a central product feature, that the risk for the lenders is transparently evaluated and can be factored into the calculation . To achieve this we cooperate with the polish credit rating agency (BIK).

Smava: Compared to the active services smava is much more secure. Like in Germany it is a central product feature, that the risk for the lenders is transparently evaluated and can be factored into the calculation . To achieve this we cooperate with the polish credit rating agency (BIK).