The Chinese p2p lending service Ppdai.com announced that over 2.5 million RMB (approx. 365,000 US$) in loans were facilitated since it’s launch.

The Chinese p2p lending service Ppdai.com announced that over 2.5 million RMB (approx. 365,000 US$) in loans were facilitated since it’s launch.

“We witnessed strong growth in 2008 and incredible growth in the first quarter of 2009. In less than one year we have achieved over 2 million RMB in loans with roughly half a million RMB in March 2009 alone. … . What we realized was that we were able to provide a solution that has gained popularity as the global credit crisis worsened and left many borrowers with little alternative for funding.” Said Jack Gu, PPDai’s CEO and Founder.

Being that China does not have a robust credit rating system for consumers, the company developed its own proprietary credit system to filter potentially good borrowers from bad borrowers. This system creates a unique profile for each borrower and leverages other Chinese platforms such as TaoBao to accurately project whether a borrower has the financial ability to pay back a loan. PPDai’s credit rating system has helped achieve loan default rates of less than 2% for 2008.

“PPDai’s core value is to create a well customized credit scoring system for Chinese borrowers,” said Tony Li, PPDai’s Director, “We believe that this is the main reason why investors have been willing to lend money to borrowers on the PPDai network.”

PPDai closed an initial round of financing from Essentia Equity in March 2008 and is about to raise an additional round in the third quarter of 2009.

“We were attracted to PPDai because it offers a unique opportunity to benefit from the extraordinary growth being witnessed in China,” said Roy Sebag, Managing Partner at Essentia Equity, “There are currently 298 million internet users in China and an offline non-banking lending market that is said to be in the range of over 1 Trillion RMB per annum.”

(Source: press release)

In the Netherlands p2p lending service

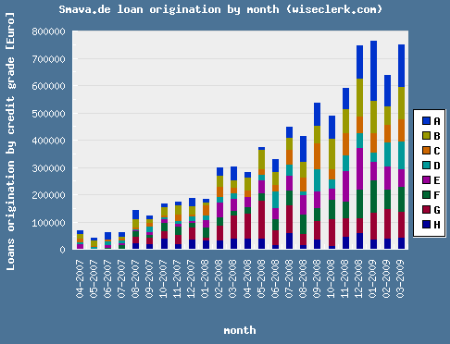

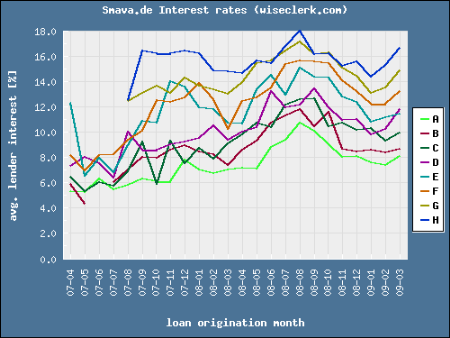

In the Netherlands p2p lending service  German p2p lending service

German p2p lending service