A Bloomberg article reports that Prosper seeks to be regulated like a bank in order to avoid the jurisdiction of the SEC.

P2P Lending With Cars as Collateral

German p2p lending service Auxmoney.com has introduced a new feature this week. Borrowers can now offer a car as collateral for a p2p loan.

German p2p lending service Auxmoney.com has introduced a new feature this week. Borrowers can now offer a car as collateral for a p2p loan.

The user pays a fee of 9.95 Euro to document this in his loan listing. Pictures of the car, the model and the mileage and the estimated price a car dealer would pay for car are displayed in the listing. In this example listing, the borrower puts up his BMW as collateral. The estimated value covers 101% of the loan amount requested. In general the car can cover any percentage of the loan amount – it does not need to cover the full amount. Furthermore there is information on the type of insurance coverage.

If the loan is funded, then a contract defines the terms of the assignment as security. The borrower continues to drive the car (obviously he is not allowed to sell it without the consent of Auxmoney), but needs to deposit the certificate of ownership (motor vehicle registration certificate) at Auxmoney. This arrangement costs the borrower 2 Euro per month.

Should the borrower fail to repay the loan, then Auxmoney has the right to sell the car.

While a car as collateral does in not provide fail-safe security (many things can happen), it will be probably perceived by lenders as one feature for higher security against defaults.

The Wiseclerk Auxmoney stats page will in future track the performance of p2p loans secured by cars.

This is a first for p2p lending – but soon another p2p lending service will follow. Pärtel Tomberg, CEO of Estonian p2p lending service Isepankur told P2P-Banking.com earlier this month, that Isepankur will introduce cars and real estate as collateral for p2p loans in the second half of 2010.

(Photo by pedrosimoes7)

(Photo by pedrosimoes7)

Lending Club Introduces 5 Year Loans

P2P lending service Lending Club did up to now only offer 3 year loans. Today Lending Club adds 5 year loans.

Can P2P Lending Cross the Chasm?

This is a guest post by Tuomas Talola, CEO of coming Finnish P2P lending site Lainaaja and blogger at Cloudfunder.

Peer-to-peer lending has been growing rapidly since the inception in 2005. Lending amounts are small compared to traditional banks, but potential is immense. What would it take to really break into mainstream and become a potential option to large customer masses?

What Is the Chasm and Target Customers?

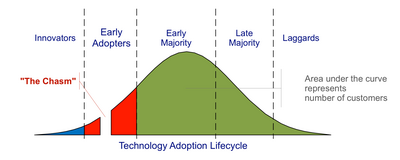

Geoffrey A. Moore wrote a highly appraised book called Crossing the Chasm in 1991. The book was about high-tech products marketing during the early stages and the difficulties of reaching majority of customers. In this post I’ll take a look what can be learned from the insights of the book and how to apply it to P2P lending.

Crossing the Chasm - Source:Wikpedia

According to Moore, there is a chasm between early adopters (technology enthusiasts and visionaries) and the early majority (pragmatists). Visionaries and pragmatists have very different expectations and this might be the reason why many technology products fail. Selling to the Early Adopters is easier, they are people who are always looking the new revolutionary technologies. As a group, they are easy to sell but very hard to please. Continue reading

Trust, Reputation and Community Aspects of P2P Lending

One of the biggest challenges for a new internet startup to offer an innovative financial service is to gain the trust of its potential customers. Consumers approach new concepts with legitimate caution.

One of the biggest challenges for a new internet startup to offer an innovative financial service is to gain the trust of its potential customers. Consumers approach new concepts with legitimate caution.

The book ‘P2P Kredite – Marktplätze für Privatkredite im Internet‘ examines how p2p lending services can address the uncertainties and what measures can be used to build trust. After a short introduction of how p2p lending works and a look at Cashare, Smava, Zopa and Prosper the author covers the aspects credibility, safety, reputation, guarantee, sanctions, information and communication. Fabian Blaesi also describes how community features can help.

In an empirical study the importance of several factors for the perception and acceptance of p2p lending services by lenders is quantified.

The book is available at Amazon.com, Amazon.co.uk, Amazon.de and Amazon.co.jp.

MYC4 Plans to Target New Partners, Mitigate Risk

In a telephone call MYC4 executive Jes Colding yesterday gave P2P-Banking.com a preview of the future positioning of MYC4. The two main goals are risk mitigation and new provider structure.

In a telephone call MYC4 executive Jes Colding yesterday gave P2P-Banking.com a preview of the future positioning of MYC4. The two main goals are risk mitigation and new provider structure.

All new providers will have to take a direct stake in the loans they provide. They will have to guarantee 20% of the outstanding portfolio. The guarantee can either be provided by a bank deposit or by a bank guarantee. Loans from an already active partner on the MYC4 market place, Fusion Capital, are already covered by a 15% guarantee.

The agreements with new partners will also adapt a new fee structure. While in the past as much as 2/3 of the provider fees were deducted from the loan upon disbursement, in the future a minimum of 75% of the fee will be payable as the loan repays. Limiting fees payable on disbursement to a maximum of 25% of the total fees will align the interest of the providers with the interest of the investors, says Colding.

MYC4 will also shift towards a new kind of partners. The reasoning is that microfinance partners, which MYC4 solely worked with in the past, sometimes have cheaper access to capital already and cannot reach the 3 loan segments MYC4 wants to target in the future: SME, rural and youth.

SME (small and medium size enterprises)

To fund SME loans MYC4 aims to partner with consulting and private equity companies that already work with these clients. Colding cited Fusion Capital as an example.

Rural

Here MYC4 will have supply chain partners and outgrower schemes. Colding gave two interesting examples for the supply chain model. A large Danish supermarket chain wants to increase the amount of African produce on offer. The loans will be used to enable the farmers to upscale their production. And most interesting: Colding says MYC4 will be advertised on the products (e.g. bags of frozen peas) as well as in the supermarket. A solar system company wants to sell more solar power systems in Kenya. Here MYC4 loans will allow groups of people to buy a system, the manufacturer is paid upon delivery and the group repays MYC4 investors over the loan term. While these are not business but consumption loans, Colding says MYC4 will allow them because of their social and environmental impacts. A third example, which is already available to invest in on the MYC4 market place is loans to Armajaro farm shops in Ghana, which have been fully underwritten by Armajaro, one of the world’s largest cocoa bean wholesaler.

Youth

65% of the population in Sub-Saharan Africa are under the age of 25. Many are well educated but have slim employment chances, leaving starting a business as only option. High risk normally makes funding unavailable to them. Funding via MYC4 investors would not be sustainable for the same reason. Therefore MYC4 partners with the International Labour Organisation (ILO), Geneva. The ILO and the provider partners will underwrite up to 90 percent of the risk.