In January 2010 I wrote down my predictions for p2p lending trends in 2010. Now let’s see how good my crystal ball was. The black text is my original prediction, with the review added in green and yellow.

More competition and entering more national markets (probability 100%)

This is a fairly easy bet. There are many, especially European markets, where no p2p lending service is operating yet. Even accounting for the fact that laws and regulation in some national markets make it hard or impossible to establish a service, there is still plenty of room. Looking at an individual country, it is much harder to tell. I still wonder that there are no competitors to Zopa in the British market (yet).

As expected this was an easy bet to win. Plenty of new p2p lending companies launched. Zopa got 4 new competitors in the UK (Ratesetter, Fundingcircle, Quakle and Yes-Secure). 3 companies launched in Finland. FairPlace started in Brazil.

More products (probability 100%)

Currently nearly all p2p lending platforms only offer one product: unsecured, fixed term loans. The differences are more in the details of loan funding (bidding, no bidding, markets, listings) but not in the offered product. In 2010 we will see additional products (e.g. secured loans).

Ratesetter introduced rolling monthly loans with variable interest rates. (Note: variable interest rates were one of my predictions for 2008 – I was a bit early on that one). Money360 tries p2p mortgages. CommunityLend might be up to something really interesting with FinanceIt. Some smaller enhancements to the existing product were developed too (e.g. cars as collateral).

A bank will acquire an existing p2p lending service (probability <25%)

While last year’s prediction was that there is the first bank experimenting with p2p lending (and there was), 2010 might see a bank (or other financial institution) buying a running p2p lending service.Buying will be much faster, cheaper and risk-less than if the bank tries to build a new service.

Did not happen. An interesting development was the decision of a Korean Savings Bank to act as a lender on MoneyAuction. Continue reading

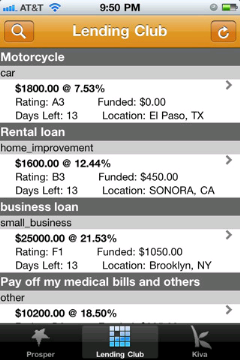

I just saw the first iPhone

I just saw the first iPhone  Canadian P2P Lending company

Canadian P2P Lending company  P2P Lending site

P2P Lending site