Multi-sided platform are platforms that need to attract two or more customer groups in order to create value. They interconnect these groups serving as intermediary setting the rules. The platform need to achieve satisfactory results for both/all sides.

One example are video game console manufactures. The product will only attract enough buyers if enough games are at available. Developers on the other hand will prefer those manufactures, that already sold large numbers of consoles and thereby offer a large potential of customers.

Another example is Google. One customer group are the users. The value proposition here is ‘free search’. With the huge audience Google has and the algorithms for matching, Google can offer targeted ads to advertisers.

So Google gives away search for free, in order to make profit from charging advertisers. In this case there was not much alternative in deciding which customer segment to charge. But sometimes both customer segments are charged and it is hard to decide which side to charge (more).

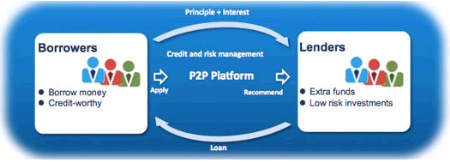

P2P Lending services are obviously multi-sided platforms, too. They need to match borrowers and lenders. Ideally there will be roughly the same level of demand as of supply of capital.

The current situation is that most p2p lending services charge borrowers more fees than lenders.

Possible causes for this are:

- At the inception of p2p lending services, opinion was that it is harder to convenience lenders to trust this unproven model and unknown new company running the service – therefore lenders were charged nothing or little to not build entrance barriers

- Orientation on established models for loans – banks charge borrowers fees too, therefore borrowers will accept these as usual

- Cost-bast pricing: In vetting a borrower the service will incur costs, whereas a new bid by a lender will incur close to zero costs as it can be processed automatically. Even higher than the vetting costs are the customer acquisition (marketing) costs to obtain borrowers.

Now years after launch, most p2p lending service are “short” of (good) borrowers. Their lenders have a surplus of capital that could be lend out, would there be more loan applications on the platform. And typically customer acquisition costs are much higher for winning new borrowers than for winning new lenders. Furthermore borrowers must be acquired over and over again, whereas lenders remain customers for longer periods of time and reinvest capital.

The logical consequence would be for the p2p lending marketplace to change the pricing. By charging borrowers less and charging lenders more, the value proposition to borrowers would be lower APRs, attracting more borrowers.

A counter-argument voiced against this, is that pricing would not change, because lenders would just raise the interest rates they offer to cover the higher fees. This will happen to some degree, but I think how much is dependent on the model the p2p lending marketplace works. In a market place where lenders do set interest rates themselves (e.g. Ratesetter) this will in my opinion be likelier than in a markplace where the operator sets the interest rates (e.g. Lending Club) or where the initial rate is set by the borrower (e.g. Smava) and can possibly be bidden down (e.g. Isepankur). Furthermore even if costs for borrowers overall would not change, the marketing-message could – ‘fee-free loans’ will be more appealing.

This change would need to be a gradual shift as existing lenders are accustomed to current prices and will resent higher fees. For the p2p lending service the effect per loan could be neutral. The amount of fees earned per loan would stay the same, just the proportion of the parts payed by lenders vs. borrowers would change. Continue reading

…

…

German p2p lending

German p2p lending