The bank of Italy has authorised Zopa Italy to operate as a payment institute. Zopa now cleared the legal problems it encountered in 2009. Maurizio Sella of Zopa Italy stated that Zopa will resume loan financing after performing some legal steps necessary in connection to being regulated as a payment institute.

VISA P2P Payments Introduced in US

Today VISA introduced p2p personal payments in the US market. VISA partnered with CashEdge and Fiserv which will incorporate the new service to their platforms Popmoney and Zashpay.

The service allows to make payments directly to the recipients VISA account.

The new VISA person-to-person payment service was launched first with selected partners in Europe in February.

VISA seeks to capture market share for online payments from Paypal.

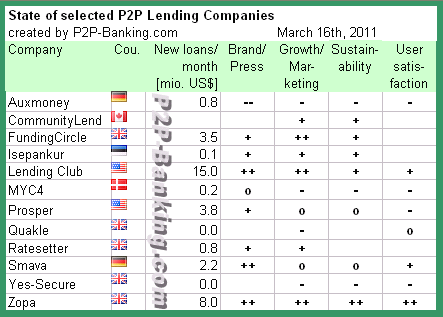

State of Selected P2P Lending Companies

More than 2 years have passed, since P2P-Banking.com published the first overview table of p2p lending companies. At that time the focus was to create a comprehensive list and to get a perspective on the loan volumes.

Today I want to look at a smaller selection of p2p lending companies and do a rating on more factors than just loan volume. While I describe below what factors led to my rating, please note that the rating represents my personal opinion.

The table lists the companies in alphabetical order and gives:

New loan volume per month

This amount is in most cases retrieved from the last month(s) figures from the company websites (if they have statistic sections), and then converted into US$ at today’s currency exchange rates. In other cases it is a rough estimate by me based on volume figures published in media in the recent past. For CommunityLend I failed to find a per month figure (the total figure from launch to mid-February is here).

Brand/Press

Extend and tone of press coverage in the past months. Since a large share of new users is introduced to p2p lending services via media, positive media coverage is extremely important. Continued positive media coverage has helped some companies to associate positive values to their brand.

Growth/Marketing

This column especially rates if the new loan volume is growing continuously month after month. Furthermore it puts the absolute volume into perspective to the size of the market. It is obvious that absolute numbers in a country with a small population (e.g. Canada) will be much lower than those in a country with a large population (e.g. US). Furthermore it takes into account if the (online) marketing measures of the the company succeed in winning new borrowers and lenders (though in most markets lenders do not need to be actively acquired).

Sustainability

Sustainability rates a mix of several factors:

- ROIs for lenders / default rates

Most p2p lending companies that failed in the past, did so as a result of high default rates which led to negative lender ROIs and caused massive lender churn - Ability of company to raise new funding

Most p2p lending companies still have to bridge a considerable time-span at their current growth rate before they become cash flow positive. The ability to raise more funding to finance continued operation is essential for their success - Business model

User satisfaction

This rates the publicly voiced user opinion. Major factor are the comments in forums. To a lesser degree I took the user experience published in blog articles into account. The problem with lender experiences published in blogs often is that the writer is casting a positive image, since he earns commissions for newly referred customers through the affiliate program of the p2p lending site. Also these review are often written at the start of the lending activity at which point the lender’s ROI is naturally unharmed by the experience of defaults.

Empty fields: I had not enough information to rate these. E.g. with some of the new UK p2p lending companies I felt I had too few indicators to reach an opinion on the sustainability.

Availability of information also influenced the selection of companies. Due to language barriers including more services (e.g. the Japanese p2p lending companies) was not feasible for me.

Petition Might Lower Hurdles for P2P Equity and Crowdfunding in the US

A petition (‘Petition for Rulemaking: Exempt securities offerings up to 100,000 with 100 maximum per investor from registration‘) submitted last July by the Sustainable Economies Law Center to the SEC, aims to exempt securities offerings of up to 100,000 US$ with a limit of 100 US$ per investor. If a new rule granting exemption would be issued by the SEC, this could substantially lower the hurdles for peer-to-peer equity platforms in the US.

The petition 4-605Â is online here.

Comments and supporters that joined after the filing are listed here.

CommunityLend Raises 1.5 Million CAN$

CommunityLend has closed a 1.5 million CAN$ private placement from several individual angel investors and an institutional investment fund. The proceeds of this private placement will go to scaling up loan origination, loan adjudication, and loan servicing operations, the company says, continuing:

CommunityLend has closed a 1.5 million CAN$ private placement from several individual angel investors and an institutional investment fund. The proceeds of this private placement will go to scaling up loan origination, loan adjudication, and loan servicing operations, the company says, continuing:

This investment comes on the heels of a successful year since our launch as Canada’s 1st (and only) online consumer loan marketplace by CommunityLend Inc. Monthly loan volume has more than doubled each of the last 3 months and we are projecting this pace of growth to continue throughout 2011.

(Source: Communitylend blog)

Peer-to-Peer Equity: Crowdcube

![]() With the introduction of p2p lending some lenders wrote that the concept enabled everyone to feel as banker.

With the introduction of p2p lending some lenders wrote that the concept enabled everyone to feel as banker.

Now, newly launched Crowdcube.com enables any UK resident to feel as venture capitalist for a financial commitment as low as 10 GBP. Investors can browse pitches which usually include business plans and financial projections and sometimes even video pitches.

In return for the investment, investors get shares of the company. For example entrepreneur Daniel Vinson wants to raise 50,000 GBP. He is offering 49% equity in return, meaning investors roughly get 1% shares in return for 1,000 GBP investment. So far 11 investors have pledged 1,200 GBP.

There are 6 entrepreneurs pitching for funding at the moment. Interested investors can answer questions and for some businesses a lively discussion has started.

Crowdcube, founded by Darren Westlake and Luke Lang, launched 2 weeks ago. Crowdcube’s business model is to offer a platform to match entrepreneurs with peer investors and business angels. Costs for entrepreneurs are a success fee of 5% of the funding amount plus legal fees of 1750 GBP for completion of each company investment. For a limited period they are waiving the 250 GBP listing fee to register as an entrepreneur and add a pitch.

Investors are charged a processing fee by Crowdcube for each transaction equal to the sum of 0.20 GBP plus 4% of the value of the transaction. Continue reading