![]() Yesterday I invested a small amount and will become a shareholder of Crowdcube Ltd., which runs the British p2p equity marketplace Crowdcube.com (see earlier articles about Crowdcube). Crowdcube is currently using it’s own platform to raise 300,000 GBP (approx. 470K US$) for a stake of 9% in the company.

Yesterday I invested a small amount and will become a shareholder of Crowdcube Ltd., which runs the British p2p equity marketplace Crowdcube.com (see earlier articles about Crowdcube). Crowdcube is currently using it’s own platform to raise 300,000 GBP (approx. 470K US$) for a stake of 9% in the company.

If you decide quick, you can become a shareholder of Crowdcub too (minimum investment is 10 GBP). For UK residents investments of over 500 GBP mean they are eligible for a 30% income tax rebate under the EIS scheme. At the time of this writing the pitch is 54% funded and it looks like it will fully fund within the next days.

Crowdcube provides a slide presentation and a forecast. The forecast is a bit sketchy with some figures being debatable in my view but overall I think Crowdcube is a promising venture for the following reasons:

- The founders achieved quite a lot in the short time since launch

- Good marketing angle. New pitches might allow them to uphold high PR resonance (at least locally and industry sector specific). With luck and craftsmanship they might achieve equal marketing spin in p2p equity as Kickstarter has achieved in crowdfunding

- I expect p2p equity in UK to get a boost by rising tax reliefs (50% !) under new SEIS scheme (see yesterday’s post)

- Crowdcube, if growing fast, might reach a level where (for UK) it profits from network effect. However the pitch is missing competitor analysis and strategies to deal with them.

- Good revenue/cost ratio. With less (technical) complexity than say Zopa or Ratesetter (but much higher risk for investors in pitches)

- Should they succeed in creating a secondary market that is not awkward/clumsy in the future, then that will heighten the attractiveness for investors as it offers liquidity for the investments

I am fairly optimistic that the influx of pitches won’t be a problem. It is hard to gauge how the funding success percentage of these will be as that depends on the quality of pitches. The single biggest threat to Crowdcube’s business model in my view is the prossibility of one of the companies funded at the market place failing big time and leaving very unsatisfied investors.

I plan to post further reviews of the progress (naturally I won’t share any confidential data made available to shareholders).

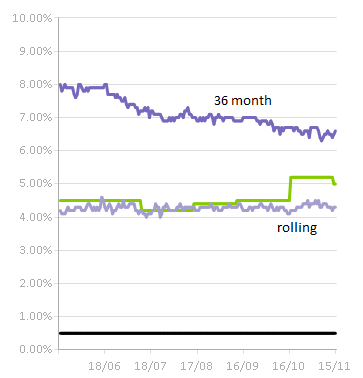

Unlike the postings on other microlending platforms, the loan applications and comments posted on Zidisha’s loan pages are written by the borrowers themselves. This opens the way for dialogue between lenders and borrowers, so that lenders can receive answers to their inquiries about the loan and business directly from the entrepreneur they are funding. At the same time, the direct peer-to-peer connection reduces the administrative cost of loans by automating and outsourcing to borrowers and lenders themselves many of the record-keeping and credit-screening functions traditionally performed manually by local microfinance institutions. As a result, the average Zidisha borrower pays about 8% in annual interest and fees, including interest paid out to lenders. Over the past two years we’ve facilitated over 100,000 US$ in microloans for low-income individuals in four countries. Zidisha borrowers have maintained a repayment rate of 99.5% for ended loans – disproving the notion that the working poor in developing countries cannot be trusted to repay loans without the support of expensive local organizations.

Unlike the postings on other microlending platforms, the loan applications and comments posted on Zidisha’s loan pages are written by the borrowers themselves. This opens the way for dialogue between lenders and borrowers, so that lenders can receive answers to their inquiries about the loan and business directly from the entrepreneur they are funding. At the same time, the direct peer-to-peer connection reduces the administrative cost of loans by automating and outsourcing to borrowers and lenders themselves many of the record-keeping and credit-screening functions traditionally performed manually by local microfinance institutions. As a result, the average Zidisha borrower pays about 8% in annual interest and fees, including interest paid out to lenders. Over the past two years we’ve facilitated over 100,000 US$ in microloans for low-income individuals in four countries. Zidisha borrowers have maintained a repayment rate of 99.5% for ended loans – disproving the notion that the working poor in developing countries cannot be trusted to repay loans without the support of expensive local organizations.

Borrowers needing a small loan can turn to p2p lending marketplace

Borrowers needing a small loan can turn to p2p lending marketplace  Ratesetter has facilitated over 10 million GBP in loans since its inception.

Ratesetter has facilitated over 10 million GBP in loans since its inception.