The Estonian p2p lending service Isepankur recently opened up to international lenders. Anyone with a bank account in the European Union or Switzerland can now start lending at Isepankur. Borrowing is still restricted to residents and businesses in Estonia (due to regulation reasons). I expected cross-border lending to be happening in peer to peer lending as early as 2008 (see my predictions). As it turned out it took 4 more years since my blog post for cross border lending to happen.

The Estonian p2p lending service Isepankur recently opened up to international lenders. Anyone with a bank account in the European Union or Switzerland can now start lending at Isepankur. Borrowing is still restricted to residents and businesses in Estonia (due to regulation reasons). I expected cross-border lending to be happening in peer to peer lending as early as 2008 (see my predictions). As it turned out it took 4 more years since my blog post for cross border lending to happen.

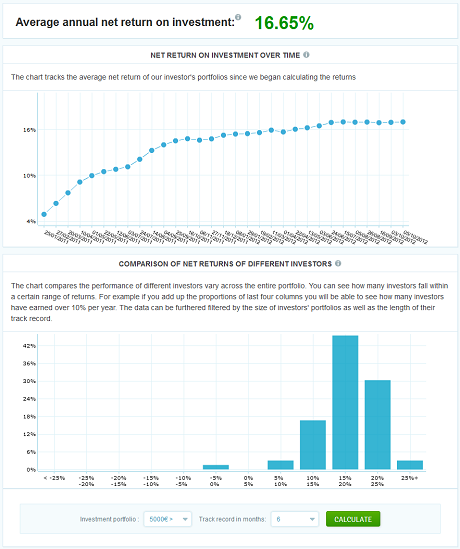

Isepankur is in operation since 2009 and has a good performance track record since.

Screenshot from the statistics section. The realised returns (after bad debt) show that most of those investors, who lent more than 5,000 Euro, fall into the range of 10 to 20% p.a.

Advantages and disadvantages for (international) lenders:

- no lender fees

- higher interest rate level in Estonia (compared to other European markets)

- fast money transfer (SEPA bank transfers usually take only one working day and do not cost more than national transfers) – therefore getting money in and out is fast

- lots of information about the borrowers (employment&income verification, information on other existing debts of borrower)

- low bad debt in relation to interest rates

- low minimum bid allows wide diversification

- stringent debt recovery process

- detailed statistics (>2 years track record) and account performance overview

- high security standards

- not that many loan listings. It takes lenders some time to built a large portfolio

Advantages and disadvantages for borrowers:

- application can be completed totally online (no paperwork, borrowers even submit bank account records digitally)

- moderate fees

- fast funding with short auction duration; money accessible within two hours of auction (successfully) closing

- currently the interest level is very high; this might get better if Isepankur succeeds in getting more lenders

I will publish an in depth review article showing step by step how I tested investing at Isepankur. Look out for this article containing screenshots showing the features and interface in the next days on this blog.

Today

Today

Today

Today