Two month ago, when p2p lending service Isepankur opened up to investors from all EU countries, I started lending there. In this post I look at the status of the portfolio I have built so far.

Two month ago, when p2p lending service Isepankur opened up to investors from all EU countries, I started lending there. In this post I look at the status of the portfolio I have built so far.

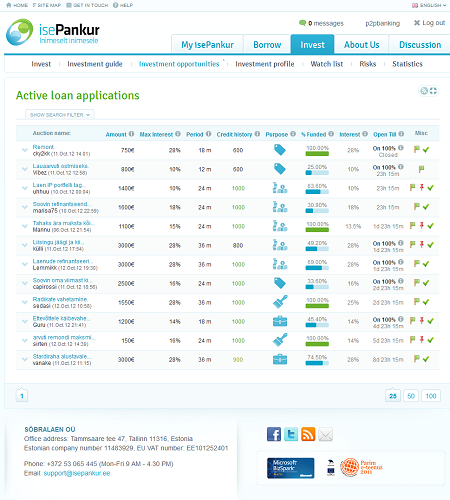

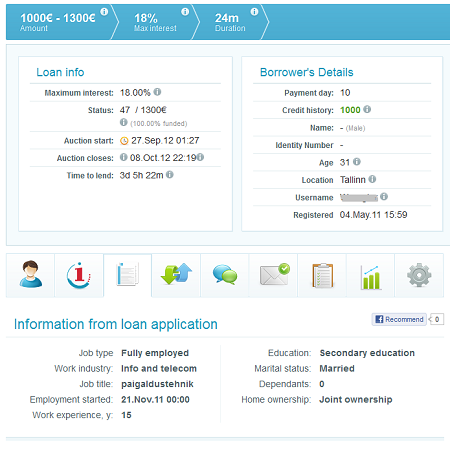

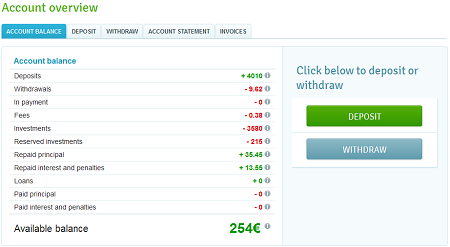

I have deposited 4,000 Euro (approx. 5,200 US$) over the past weeks. The account currently has 254 Euro in cash, 215 Euro waiting in bids on loans to close and the majority of 3,580 Euro is invested in loans. I invested usually between 10 and 35 Euro per loan. The average interest rate of the loans is 25% and loan terms are between 1 and 36 months with most loans running for 24 months or longer. Most of the investments were done using the automatic bidding feature: About two thirds of the loans are fully funded by automatic bids the minute they appear on the marketplace. It is therefore necessary to use the automatic bidding, or these loans will be missed investment opportunities.

Screenshot of Account Overview

Repayments

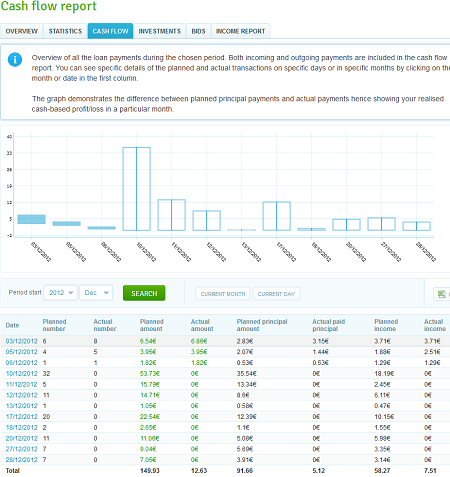

So far nearly all repayments came on time. Of the few who missed a payment date, all but two repaid the next day. Currently only one loan (10 Euro) of my portfolio is a few days overdue. One loan was fully repaid early after only one month. In December I have scheduled repayments of 149 Euro which consist of 91 Euro principal and 58 Euro interest. In January – with more loans reaching first repayment date – repayments will rise to over 250 Euro. Isepankur offers monthly and daily charts forecasting cash flow.

Screenshot of Isepankur cashflow view for my portfolio showing payment dates and amounts in December

Statistics

The portfolio management has a statistics section that daily calculates the return on investment. Continue reading

British p2c lending

British p2c lending  French p2p lending service

French p2p lending service  ‘The Lending Club Story‘ is the new Kindle ebook written by Peter Renton. It covers the interesting development of Lending Club from a p2p lending startup to a company that has issued 1 billion US$ p2p loans. The process is explained for new lenders and borrowers and the story of selected borrowers and lenders is shared.

‘The Lending Club Story‘ is the new Kindle ebook written by Peter Renton. It covers the interesting development of Lending Club from a p2p lending startup to a company that has issued 1 billion US$ p2p loans. The process is explained for new lenders and borrowers and the story of selected borrowers and lenders is shared.