An Australian perspective on peer to peer lending by Rachel Botsman

My P2P Lending Loan Portfolio at Isepankur after 8 Months

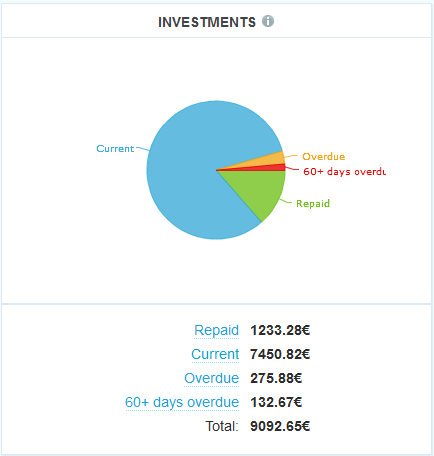

When p2p lending service Isepankur opened up to investors from all EU countries five month ago, I started lending there. In this post I continue the series of posts reviewing the development of my loan portfolio. I have deposited 7,500 Euro (approx. 9,700 US$) since starting. My investment is spread out over more than 400 loan parts. Together the loans add up to 7,859 Euro outstanding principal. Loans in the value of 276 Euro are late, meaning they (partly) missed one or two repayments. 133 Euro are in loans that are more than 60 days late. I already received 1,233 Euro in repaid principal back.

When p2p lending service Isepankur opened up to investors from all EU countries five month ago, I started lending there. In this post I continue the series of posts reviewing the development of my loan portfolio. I have deposited 7,500 Euro (approx. 9,700 US$) since starting. My investment is spread out over more than 400 loan parts. Together the loans add up to 7,859 Euro outstanding principal. Loans in the value of 276 Euro are late, meaning they (partly) missed one or two repayments. 133 Euro are in loans that are more than 60 days late. I already received 1,233 Euro in repaid principal back.

Chart 1: Screenshot of loan status

Most of the money in my account is working to earn interest. Only 98 Euro are currently held in cash. 245 Euro are tied in bids on current loan listings and will originate in the next few days.

Chart 2: Screenshot of account balance

How I used the secondary market

Looking at my account balance (see chart 2) you will notice the relative large amount (2,032 Euro) of sold loans. This is due to 2 developments.

Continue reading

Funding Community Launches P2C Lending in the US

![]() Last week the p2c (peer-to-company) lending service Funding Community launched. P2P loans in the US so far were done nearly entirely to individuals. Funding Community wants to change that and enable loans to local businesses. Funding Community is open to lenders from most states (and not restricted to accredited investors). All loans are 9 months loans. In addition to interest payments lenders may get rewards from the company (e.g. discounts). One example is a fitness company that offers 9,7% interest plus 2 personal traing sessions as reward.

Last week the p2c (peer-to-company) lending service Funding Community launched. P2P loans in the US so far were done nearly entirely to individuals. Funding Community wants to change that and enable loans to local businesses. Funding Community is open to lenders from most states (and not restricted to accredited investors). All loans are 9 months loans. In addition to interest payments lenders may get rewards from the company (e.g. discounts). One example is a fitness company that offers 9,7% interest plus 2 personal traing sessions as reward.

Note that technically lenders at Funding Community do not lend directly to the company that seeks the loan. Instead, lenders lend to Funding Community, which, in turn, lends money to small companies, including the particular ones the lender selected.

Secured loans

Funding Community states that all loans are secured

The interest rates we provide, as well as a security interest in our assets are designed to decrease the risk to lenders. In addition, we take a security interest in small businesses to whom we make a loan and also generally require a personal guarantor to support repayment. We also set aside a small pool of capital to cover a portion of loans that default. It bears repeating, however, that you may not lend to us or use Funding Community expecting a return or profit. You may only use Funding Community if your primary purpose in making the loan is to help us overcome short-term cash-flow considerations in supporting small business growth in the United States.

For now, Funding Circle started with making loans to businesses located in New York and plans to expand into other areas later.

Fees

Funding Community charges companies a 2.5% loan origination fee and lenders a 0.5% service fee.

Disruption & Banking

New Investment Fund Focussing on Investing in Global P2P Lending

‘P2P Income Partners‘ is a new investment fund by Symfonie Capital that will invest capital in p2p loans. The founder, Michael Sonenshine, an ex-investment banker, told P2P-Banking.com that he plans the first tranche to be 25 million Euro. He says: “Initially we will invest in loans issued by sites such as Prosper, Lending club, Funding Circle, Zopa, Isepankur and we will add fonds to the mix as we see fit. The P2P market is not only web-based. Â There are opportunities to make direct loan across Europe. Â The key to success is spreading the risk and doing careful due diligence.”. The fund is open to qualified investors. Minimum investment is stated as 100,000 US$.

Isepankur Launches Secondary Market – P2P Loans Now Tradeable

Today Isepankur launched the possibility for lenders to sell and buy loan (parts) on a secondary marketplace. Lenders can list the loans they want to sell at the secondary marketplace and set a price which either is equal to the outstanding principal or apply a premium (up to 5%) or a discount to that. The fee Isepankur charges if a transaction closes is 1.5% (each) from seller and buyer.

Today Isepankur launched the possibility for lenders to sell and buy loan (parts) on a secondary marketplace. Lenders can list the loans they want to sell at the secondary marketplace and set a price which either is equal to the outstanding principal or apply a premium (up to 5%) or a discount to that. The fee Isepankur charges if a transaction closes is 1.5% (each) from seller and buyer.

I talked about the advantages a secondary market offers in p2p lending before. Most major marketplace have added the possibility to sell or buy loans. The latest to introduce this feature was Ratesetter.

In the past weeks Isepankur also introduced borrower groups (A, B and C), which group loan applications by discretionary income. Combined with the credit history classification already used (600-1000) loan applications are now classified by a combination of both (e.g. A800).