Prosper Marketplace announced yesterday that it has raised 25 million US$ in additional funding to accelerate the company’s growth . The round, which was led by existing partner Sequoia Capital, also includes a new investment by Blackrock, the world’s largest asset manager, as well as a broad representation of existing investors.

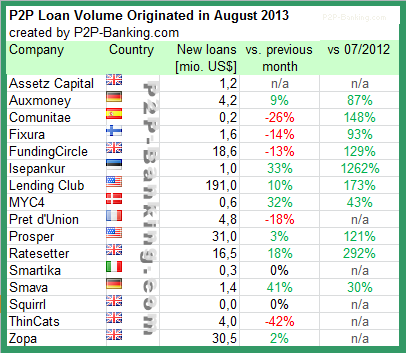

Since bringing on a new management team in January 2013, the Prosper platform has achieved growth in its monthly loan originations, rising from $9 million in January to $32 million in August.

This round came pretty quick after the last 20 million US$ round in January.

Source: Prosper press release