In August I discovered Appbackr. Appbackr is a marketplace where everyone can invest in IPhone apps and Android apps. Crowdfunding for app development? That sounded very interesting and innovative. I read the information supplied and the way it works is that investors prefund future sales of apps. The investor buys the copies at a lower wholesale prices and makes a profit later, when the copies actually sell in the app store. Clearly the risk is the uncertainty as to when the prepurchased copies will sell or if the sales volume will not be high enough at all and the copy will not get sold, which will result in a total loss of that investment.

Funding is done during an open bidding period. The developer lists his app on the marketplace and provides a description and information what the funding will be used for. Provided a minimum reserve is met, the funding will be successful, even if the maximum amount the developer seeks is not reached during bidding period.

Concept versus Live Apps

Appbackr differentiates between ‘Live Apps’ and ‘Concept Apps’.

A ‘Live App’ is already online in the Apple or Android Store and has started selling. For most Apple Apps Appbackr provides sales stats, which allow an educated guess how good the app is selling. The markup investors earn on Live Apps is 27% (once they are sold).

A ‘Concept App’ is an app that is under development or just an idea with a plan. The developer states a date, when he plans to launch in the store. For ‘Concept Apps’ the markup is 54%. The higher margin reflects the added risk for possible developing problems, which could in a worst case scenario lead to the app never making it into a store with zero copies sold.

A major difference between these two kind of apps is that the payout for ‘Live Apps’ is ‘sequential’ whereas the payout for ‘Concept Apps’ is ‘simultaneus’, meaning that those investors, who invested first during the bidding period ,get paid first for sales of Live Apps (you are informed how many copies need to sell before your copies will sell). For the ‘Concept Apps’, each backr will receive a fraction of each sale. That means you only get full payout for ‘Concept Apps’ after the last funded copy has been sold, too.

I had a good start – everything looked promising

After a lot of reading and browsing I did my first purchases/investments in early September. And it looked like I had a lucky start with good picks.

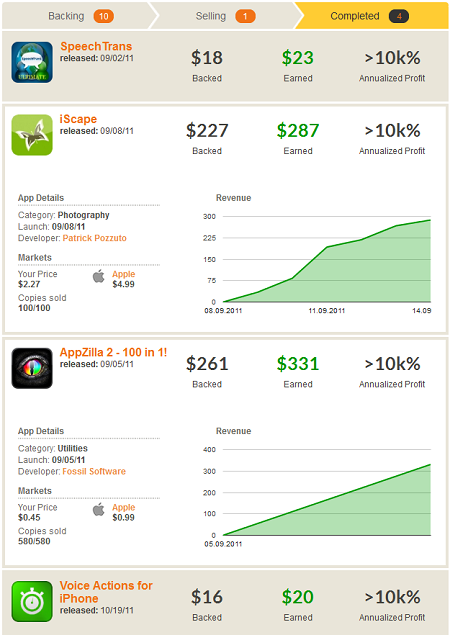

Screenshot of the Appbackr Dashboard for my Apps in status ‘Completed’. I unfolded the details for the AppZilla 2 app and the iScape App. It shows that ‘my’ 100 copies of iScape sold over the course of only 7 days. For the AppZilla 2 app it went even better. It took only 1 day for all ‘my’ 500 copies to sell. Note that Appbackr calculates annualized profit solely on the duration of the sales period. De facto I purchased the copies on Sep., 5th and was paid back $330.60 on Nov., 7th. My money was tied up for roughly two month which translates to a tremendous annualized profit of roughly 160%.

Investing and payout is conducted via Paypal. All Paypal fees are covered by Appbackr. I initially overlooked that Apple releases the money roughly one month after the sales took place, but Appbackr support explained that after I contacted them. Later in a new release of the interface Appbackr added information about upcoming payment dates, an information I previously missed (see screenshot below).

The prelapsarian state of confidence ended abruptly, when Nov. 11th passed after I had only received payout for one of the 3 apps that were due to be paid. The payment schedule notice in my dashboard stayed unchanged. Used that things go wrong in startups and delays are not uncommon, I remained unfazed, but after a week with no notice I contacted Appbackr again and asked for an explantion.

I was told that the developers in question had not payed despite Appbackr’s invoice and that investors would receive more explantion later the same day.

So far I felt that Appbackr had not done anything wrong other than failing to inform investors earlier and I also felt I had not been informed beforehand that there is a real risk that developers would fail to comply to the agreement despite earning the money from the sales.

Later that day I received a formal information by Appbackr with an excuse from Yan Auerbach, Founder and COO of SpeechTrans Inc. which I found rather lame: ‘According to SpeechTrans, they used the wholesale purchase payments and the subsequent retail sales to fund development of an Android app, saying that they had been unclear that payment would be due to buyers after the Apple retail sales occurred.’.

Again, while a major surprise, that was not really Appbackr’s fault. But it went on to state that Appbackr and SpeechTrans agreed to postpone payments by SpeechTrans until January, 13th 2012.

Wait?

They agree to postpone payments of money that is due to me? Without even asking or informing me before? I don’t like it when the rules get changed in the middle of the game. I would have expected them to take steps to enforce the agreement.

And i feel even more weary as there is still no information why iScape has not payed. Will they be allowed to postpone payments too, just by asking?

My conclusion

Appbackr is an interesting concept, that could yield good profits to investors. But it seems that Appbackr is ‘soft’ on developers, either having no means to prohibit violations of the agreement or not willing to do so, as they probably need good relations to developers since influx of new apps might be more vital for their business model then influx of new capital (investors). Another indicator supporting this theory is that none of the concept apps I invested in launched on time. Some have been postponed (more then once) with explanation given, some are overdue without any information. The later is not acceptable in my view.

Relevance and learnings for other financial startups

It is vital that as much information as possible is given (through FAQ or otherwise) beforehand. Most p2p lending startups I follow are good on this, many use forums as addentional information ressource. While Appbackr staff was friendly and supportive at all times, I did feel like I have to pull informations needed again and again.

Maybe I am the more cautious investor, but each financial startup needs to remember that it lives on the trust the investor has to extent to this unknown startup and overcome not only his wearyness of unknown risks but also the thought of falling prey to a scam. Should this trust be endangered, then this could harm the business model seriously.

Summary of positive points:

- Innovative concept

- Can create a win-win-win for developers, investors and appbackr if working out as planned

- Promising apps

- Appbackr team working hard to improve the interface

- Appbackr pays all paypal fees

Summary of negative points:

- Lacked/ still lacks some (updated) information on payout schedule & payout status

- Not strictly enforcing agreement against developers

- Information and reaction to non-payment by developers appears unsatisfying to me

Disclosure: I received an $100 gift certificate by Appbackr for taking part in a 1-hour phone interview to give feedback how I as an investors see the interface and which suggestions and wishes I had for improvement of the interface

UPDATE Dec., 1st: The outstanding payment for the iScape app arrived today.