British p2p property platform Kuflink* has been in operation since 2016. Previously accepting only UK residents as investors, the platform announced that they have enhanced their KYC/AML procedures and are now open to investors from anywhere in Europe. Interested investors can use a free UK bank account from Transferwise* Borderless or Revolut* (Smartphone required). And in exchanging money to GBP new TransferGo clients* can get a 10 GBP bonus when exchanging/sending at least 150 GBP.

Kuflink* offers short term property loans (usually 3 to 12 month), secured by a legal charge. They run a very generous 100 GBP cashback offer available by signing up through this this link*. Note that the landing page says 50 GBP, but I have negotiated with Kuflink that clients referred by P2P-Banking get 100 GBP (doubling normal cashback). VERY IMPORTANT: Read T&C and strictly follow them. E.g. the minimum investment of 500 GBP must be reached within 24 hours of first investment. While it is possible to spread your investment over several loans, be sure that you are in line with the T&C terms.

You can find more cashback deals on this page.

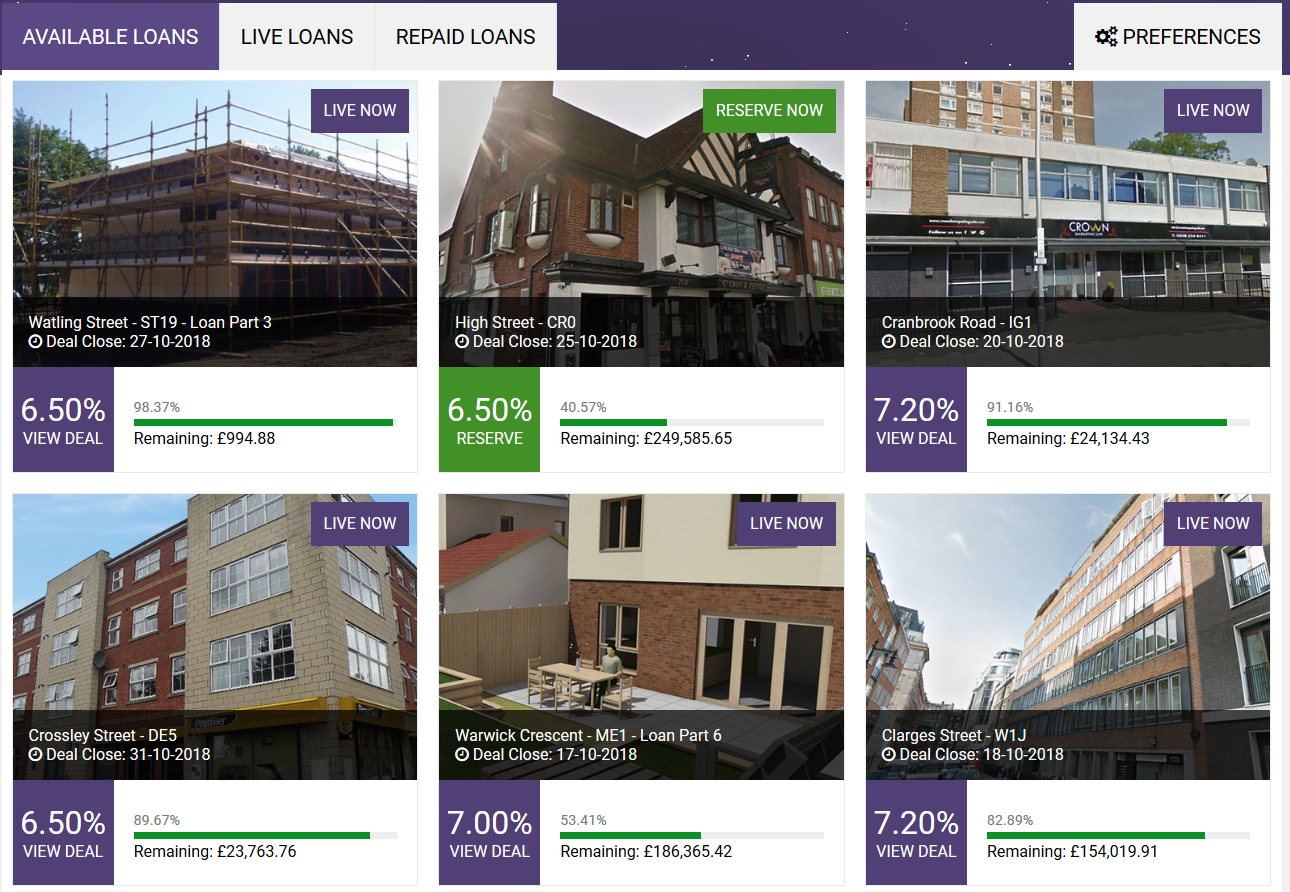

Screenshot: Available Kuflink loans (selection).

Every loan offer comes with detailed information, including a valuation report. Since the start in 2016, Kuflink has originated more than 20 million GBP in loan volume.

Kuflink* does not charge investors any fees. Interest is paid on the first day of each month (for manual investing). There is an autoinvest option, but conditions are less interesting than on manual investing. Two features Kuflink lacks are a secondary market and a detailed statistic page (there is some information in the FAQ).

In April I published an interview with the Kuflink CEO.