![]() Today British p2p lending service Saving Stream introduced a new pre-funding option. This is essentially an autobid, which allows investors to bid on every new loan.

Today British p2p lending service Saving Stream introduced a new pre-funding option. This is essentially an autobid, which allows investors to bid on every new loan.

Investors have long complained that (smaller) loans were filling within minutes, were not (always) announced in advance and lately the demand caused the server to fail frequently when new loans were announced.

Here is what Saving Stream says about the new pre-funding model:

Rationale

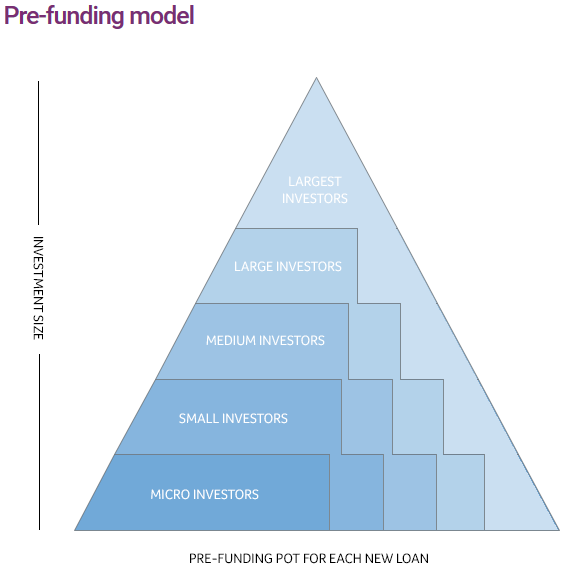

We want to give as many people the chance to invest as possible so we will provide an option to buy in before the loan goes live up to a self-determined limit. We want the smaller investors to be guaranteed a position in every loan, and the deeper pocketed investors will also participate at the same amount as everyone else. If there is spare capacity, the larger investors will pick this up subject to their pre-set investment levels.

This will also help us know how much is potentially available to lend out. This has been a continual problem that we just don’t know the exact appetite for our loan products and thus limits the number of loans that we can make.

How pre-funding will work?

Set your limit to invest in each new loan.

When a new loan becomes available, you will be guaranteed at least a portion of your investment amount if not all, depending on the loan size.

You will be notified of your participation and are expected to follow up with a bank transfer, much in the same way as normal.

You can sell your loan if you want.Potentially complicated numbers stuff coming up…

For example  – you set your limit to £1k. There are 400 people who have the same limit and 40 with a limit of £10k. A loan of £1m is launched. All 440 people will get £1k (£400k total) and the 40 people with higher limits will get an additional £9k each in the surplus thus they get £10k in total. The remaining availability will go to the market and can be bought by whoever wants it.

It will become complicated when the loan is less than the amount in the Pre-Fund pot i.e £500k loan, 400 people with £1k, and 40 with £10k. Again, all 440 people will get £1k leaving £60k to divide by the 40 which is an additional £1.5k each, giving a total investment of £2.5k for those investors who set their limit higher.

Those investors with higher limits might be disappointed that they didn’t get their full allocation, but they should be happy that they have participated in an equitable distribution model which should assist with the growth and opportunities available. The next loan might be able to take all of their demand plus more.

You won’t be able to review the loan parts or valuation beforehand (yet) but the secondary market is incredibly liquid and we are confident of the ability to sell your position if required.

I expect that Saving Stream customers will widely use this new option. While it seems strange that this option excludes the possibility to review loan details before bidding, this has been essentially happening before already with loans gone in minutes. And the Saving Stream secondary market is very liquid, therefore it is usually not a problem to sell (unwanted) loan parts fast.

BTW, if you haven’t found it, the new pre-funding option is located as second selection under the ‘Account’ tab, when logged in. I confirmed with Saving Stream that international investors can use it too in connection with Transferwise.