I started investing at the UK p2p lending marketplace Saving Stream in December 2014. The last Saving Stream review I wrote was 9 months ago, therefore time is right to post an update on how my portfolio is developing.

For those p2p lending newbies that have not heard of Saving Stream so far here are the basics again:

- Bridge loans, secured by commercial properties (first or second charges)

- 12% interest (interest rate is the same on all loans on the platform)

- 0% fees for investors (on primary and secondary market)

- All loans prefunded; investors earn interest from the day they invest money into a loan

- A provision fund shall provide a buffer against default losses

- Open to international investors

To deposit money I used Transferwise and Currencyfair saving me bank fees and allowing me to know the currency exchange rate in advance.

I made 5 deposits over time totalling 5,441 GBP (7,403 EUR).

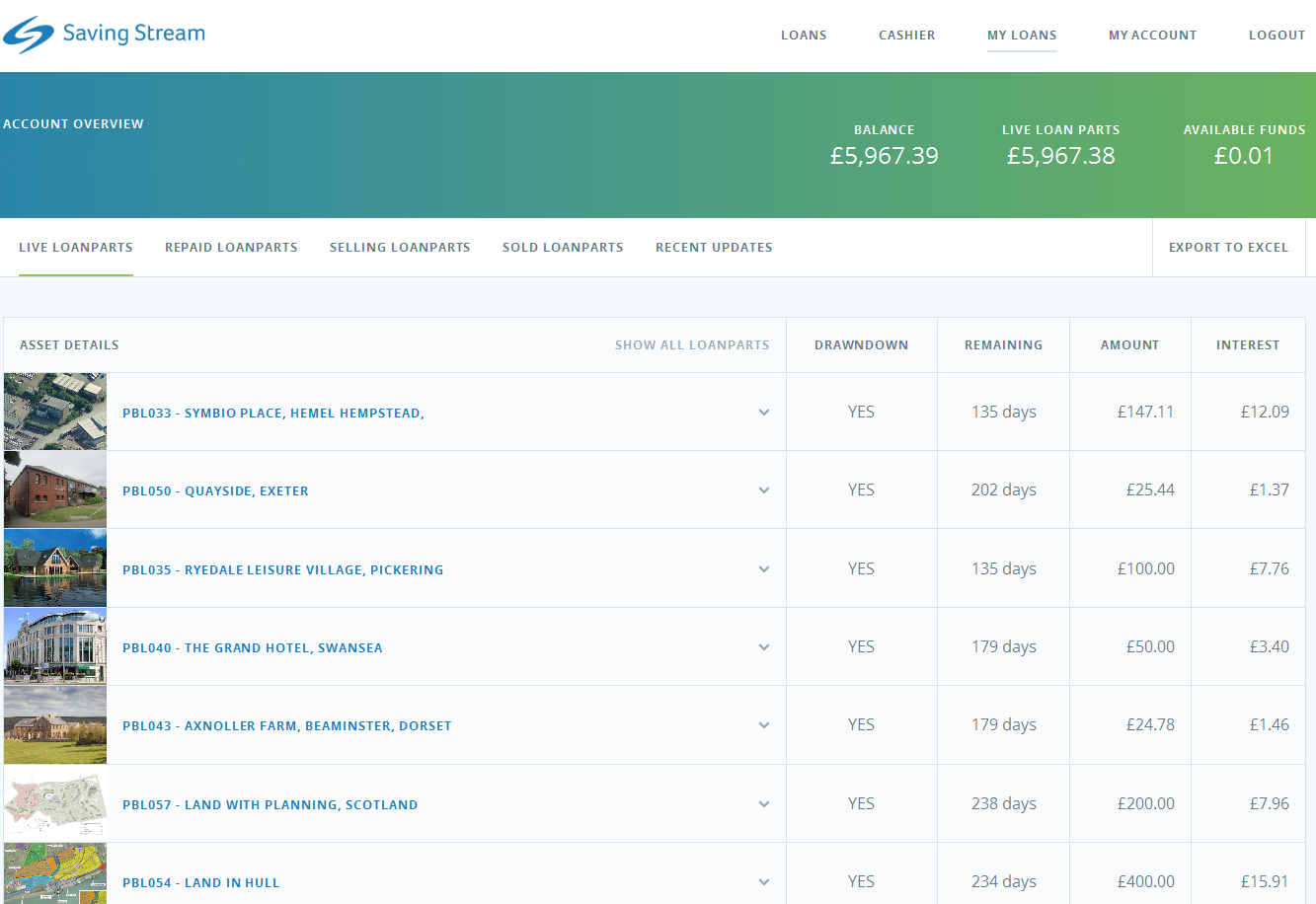

Screenshot: Top of the list of my Savingstream loan portfolio

My portfolio grew nicely and yields a very got ROI

As you can see in the image, my original 5,441 GBP grew to 5,967 GBP current portfolio value. I reinvested all repayments and interest earned. It sure is nice to earn 60 GBP interest per month (1% of live loan parts amount). My ROI is actually a bit over 12% so far as I profited from several cashback offers. I did not experience any defaults on my loans so far.

The new website

Late in 2015 Saving Stream overhauled the website. Major improvement is that this fixes the situation which frequently occured on the old website, where loan parts sold/bought on the secondary market might get stuck when a loan amount left on offer accidently ran into a negative value and needed manual operator intervention to clear. The new website also introduced the two step verification security option. I enabled this security feature for my account.

My strategy

I reinvest all interest and repaid principal into new loans. I try never to hold any loans until maturity. Instead I sell loan parts that approach 90 days remaining loan term on the secondary market, when a new loan becomes available. The Saving Stream secondary market is very, very, very liquid. My last sale took less than 2 seconds after I listed the loan part. Some of the investors use bots to automatically buy up availiable loan parts. This January Saving Stream introduced Captchas presumably to prevent/control the usage of bots.

Prefunding

Prefunding allows investors to pledge amounts they want to invest into future loans. There is one general setting applied to all future loans and I can also select individual amounts for each pipeline loan. Using the prefunding setting is pretty much mandatory nowadays for investors building a portfolio at Saving Stream. Not an unusual situation for a marketplace where demand seems to severly outpace loan supply (see also ‘Queue up for p2p lending‘). Saving Stream experimented quite a bit with the prefunding algorithm last year. The current system is that for loans up to 500K 1M each successful investor gets allocated the same amount (unless he wanted less than this possible amount), whereas for larger loans the old system allocating the same percentage of desired prefunding amount is continued to be used. The current system suits me just fine.

My conclusions so far

Saving Stream offers me an attractive yield for the risk involved. I like the platform, which is pretty straightforward to use. I can let it run pretty much on autopilot, unlike other platforms it does not require much monitoring. I don’t encounter any accounting pecularities that puzzle me and require me to contact support (again unlike other marketplaces).

I consider to top-up my invested amount further.