![]() To achieve further diversification of my p2p lending investments I opened an account at the UK p2p lending marketplace MoneyThing. All loans on the platform are secured by assets, which consist of a mix of property and other items like cars. MoneyThing launched one year ago and has since originated 10 million GBP in secured loans. It is operated by Capital Mortgages Direct Ltd. in London. So far none of these loans had any troubles.

To achieve further diversification of my p2p lending investments I opened an account at the UK p2p lending marketplace MoneyThing. All loans on the platform are secured by assets, which consist of a mix of property and other items like cars. MoneyThing launched one year ago and has since originated 10 million GBP in secured loans. It is operated by Capital Mortgages Direct Ltd. in London. So far none of these loans had any troubles.

The key aspects for investors:

- 12% interest rate p.a.

- interest paid from the day the bid is made into a loan

- no fees for investors

- all loans secured by assets

- bridge loans with a term of 3 to 24 months

- there is a secondary market

- minimum deposit is 100 GBP, minimum bid is 1 GBP

Steps to start lending

1. Registering

First I filled in the online form. MoneyThing is open to international investors, but the form had no country field, so I did enter town and country in the ‘town’ field. Later the same day I got an email from support asking me for ID and a further document to be uploaded as non-UK residents can not be automatically verified by their systems. I did that and within 5 minutes received the message that my account is now verified

2. Depositing

I used Transferwise to make my first deposit into the account to reduce transfer and currency exchange costs. A Transferwise alternative is Currencyfair. This time Transferwise took 3 days – a little longer than my usual experience for transfering to the UK with them.

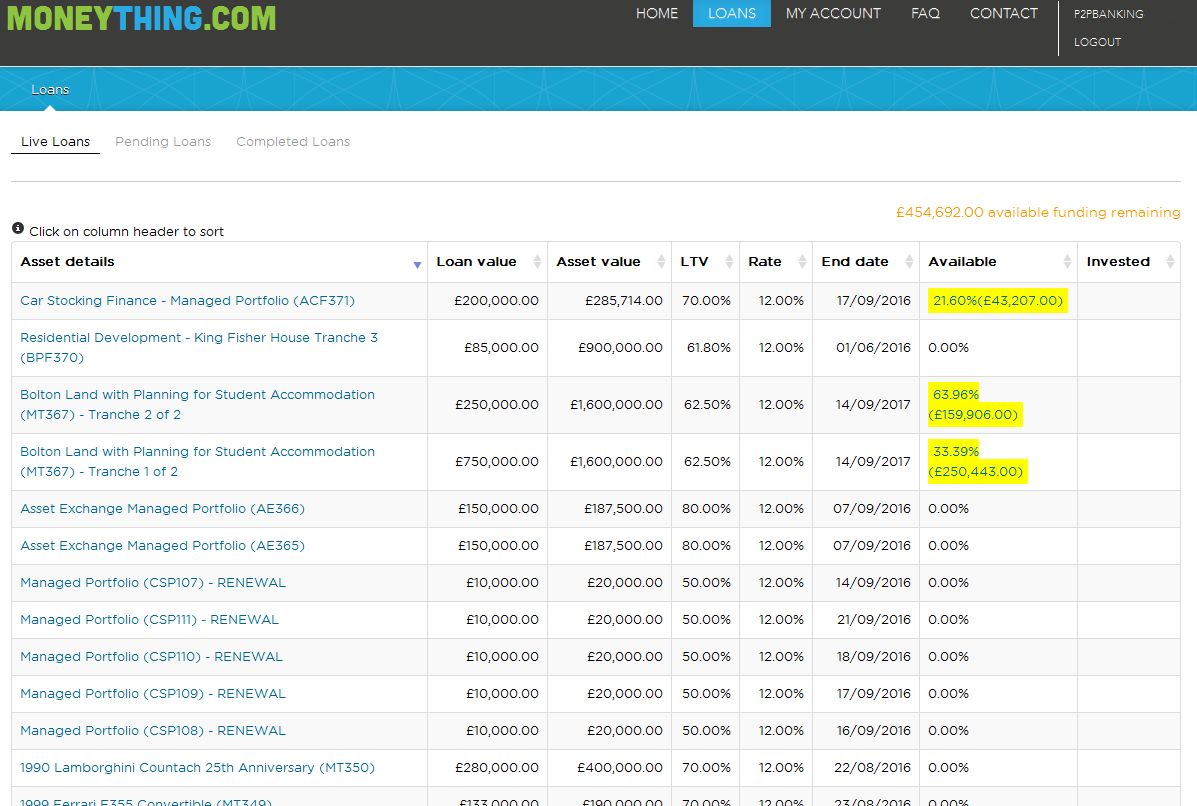

3. Selecting the loans on the market

MoneyThing lists all loans in a single market view – there is no separate secondary market view. All available loan parts are highlighted in yellow. Since loans are sorted chronologically to find parts of older loans on sale the easiest way is to resort by the ‘Available’ column. Otherwise just scroll down.

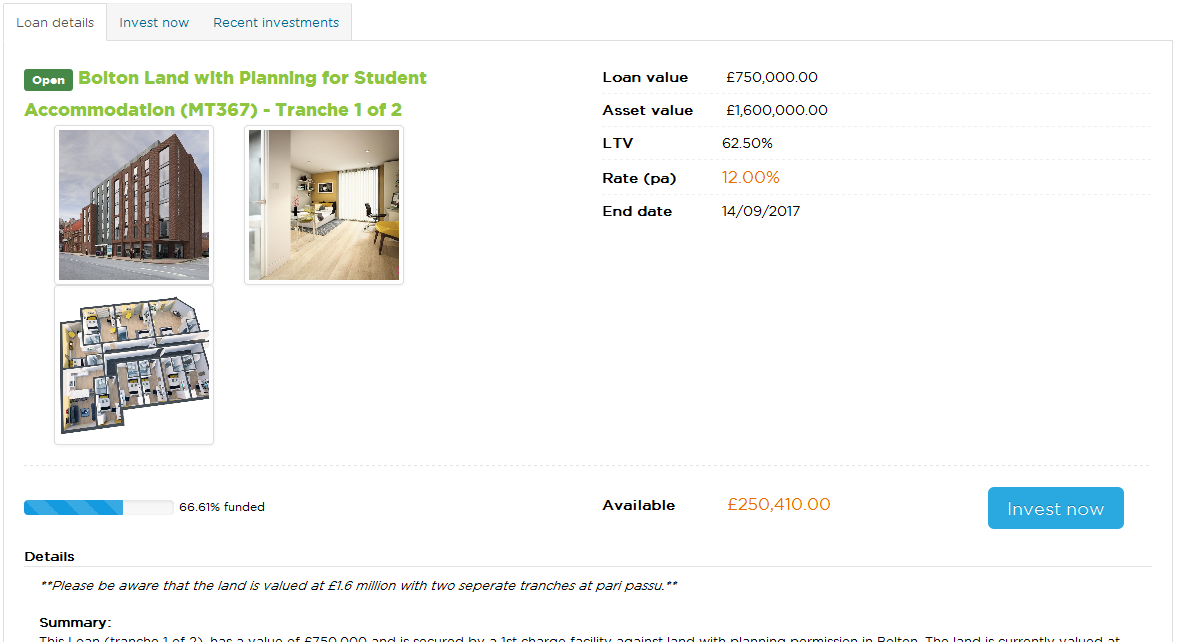

Clicking on a loan reveals detail information about a loan and supporting documents (e.g. a valuation report).

I invested the deposited funds into loans (save for 100 GBP which I will invest in the AE372 loan, which will go live on Saturday) and will keep you updated on my experiences with Moneything.

Some hints:

- for new loans I understand there are bidding limits for the first 24h. Each investor is limited during that period to a maximum bid of 0.5% of the loan amount. MoneyThing does this to let many investors participate, instead of the larger ones filling the loans fast

- renewals go live at 4pm GMT and if the amount available for renewal (that means not taken by existing investors) is small, then they might fill within seconds. Upcoming renewals are announced under ‘Loans > Pending Loans’

Hi there,

I was considering starting with some p2p in UK in order to diversify my portfolio. As you mentioned before you use Transferwise to deposit money but what about withdrawals? I don’t have UK accout and it seems there is no free option anymore. I would hate to loose all earned interests due to transfer fees from UK to EU bank account. Do you have any experience with getting money back to your bank account and how much money one loses during the transfer? There is an exchange rate risk £/€ akready so I am just wondering if this investing in UK makes sense at all for EU based guys. Thanks for your reply.