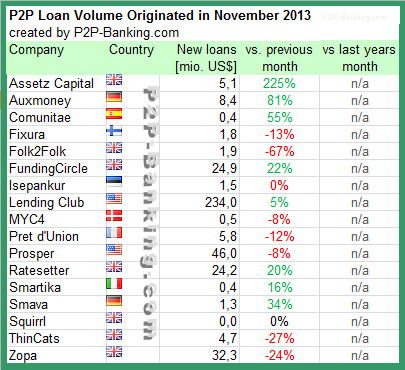

P2P lending volumes grew further in November. Prosper points out that the slight decline was to be expected due to less origination days in this month. Looks like Funding Circle and Ratesetter are catching up on Zopa in Britain. I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services. Next month I expect to add figures for two more services to the table.

Table: P2P Lending Volumes in November 2013. Source: own research

Note that volumes have been converted from local currency to US$ for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.

It is interesting to see that RateSetter is lending about 2/3 of the amount of Zopa, but some of RateSetter’s loans will be for shorter terms. In the UK Zopa is still the #1 by some margin.