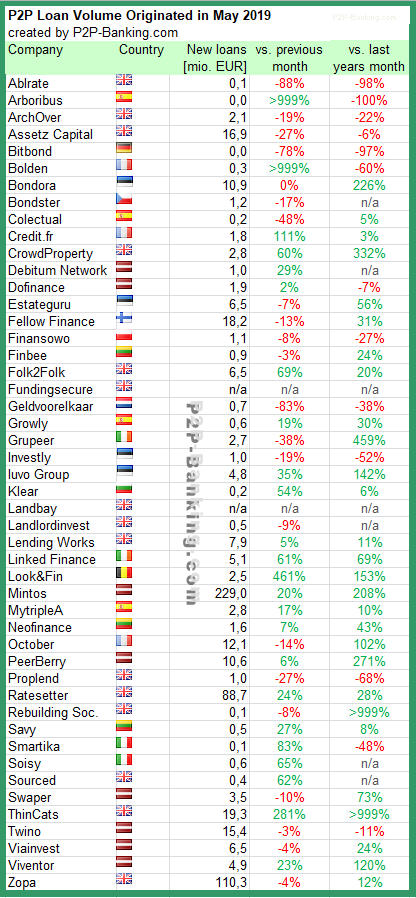

The table lists the loan originations of p2p lending marketplaces for last month. Mintos* leads ahead of Zopa and Ratesetter*. The total volume for the reported marketplaces in the table adds up to 607 million Euro. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file, I can publish statistics on the monthly loan originations for selected p2p lending platforms. This month I added Sourced.

Milestones achieved this month (total volume since launch):

- Twino* crossed 500M EUR

- Linked Finance* reached 100M EUR

Investors living in national markets with no or limited selection of local p2p lending services can check this list of international investing on p2p lending services. Investors can also explore how to make use of current p2p lending cashback offers available. UK investors can compare IFISA rates.

Table: P2P Lending Volumes in May 2019. Source: own research

Note that volumes have been converted from local currency to Euro for the purpose of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

For new companies a small listing fee applies. If you want to be included in this chart in future, please contact me for more information.

Notice to representatives of press/media: If you are interested in publishing a branded version of this table in your own layout/design, which will make a nice addendum to your coverage of p2p lending, please contact me.

Any particular reason practically no German platforms are included in your survey (Auxmoney, kapilendo, Bergfuerst, Eporo, E&V,…)?

If you go a few years back, you’ll see Auxmoney and Smava included. Auxmoney discontinued monthy reporting of loan originations and Smava changed business model. The other ones you mentioned are mostly doing subordinated debt (‘Nachrangdarlehen’) which I do not consider comparable to loans.

Why is Grupeer identified with the flag of Italy if it is a P2P platform from Latvia?

Hi Dave,

that’s the flag of Ireland, not Italy? The company running the marketplace is now officially in Ireland (until a few months ago it was Latvia). Vast majority of staff is still in Latvia.

Thanks for the info, I thought it was a red stripe instead of orange.