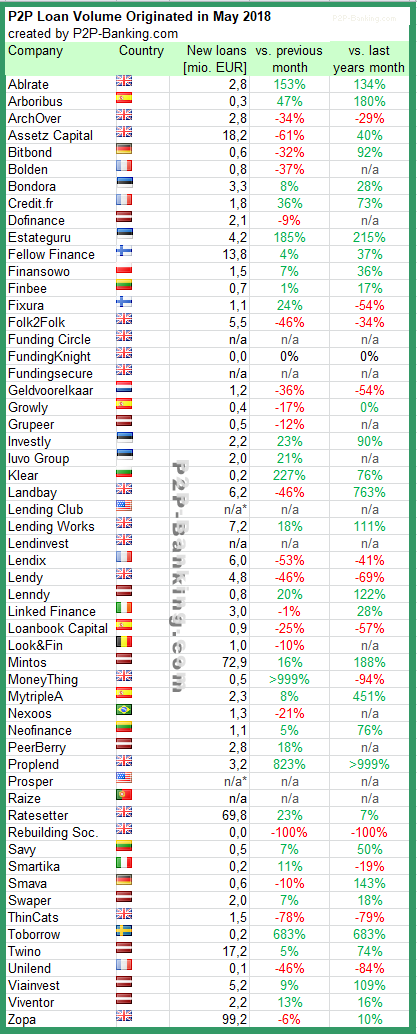

The table lists the loan originations of p2p lending marketplaces for last month. With the most recent Funding Circle figures not available at the moment, Zopa leads before Mintos. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file, I can publish statistics on the monthly loan originations for selected p2p lending platforms.

This month I added Grupeer.

Milestones achieved this month (overall volume since launch):

- Linked Finance reached 50M EUR

- Ratesetter reached 2.5 billion GBP

Investors living in national markets with no or limited selection of local p2p lending services can check this list of international investing on p2p lending services. Investors can also explore how to make use of current p2p lending cashback offers available. UK investors can compare IFISA rates.

Table: P2P Lending Volumes in May 2018. Source: own research

Note that volumes have been converted from local currency to Euro for the purpose of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

Notice to p2p lending services not listed:

For new companies a small listing fee applies. If you want to be included in this chart in future, please contact me for more information.

Notice to representatives of press/media: If you are interested in publishing a branded version of this table in your own layout/design, which will make a nice addendum to your coverage of p2p lending, please contact me.

How much P2P buy-side volume that funded are from institutions vs individuals.

Hi Paul,

while there are some figures/indications on this by the individual marketplaces listed, overall figures on this are not available. The percentage funded by institutional investors is higher on UK marketplaces than on the others listed here, but still lower than on the US marketplaces.

Is there a reason why Auxmoney is not featured?

Auxmoney does not publish/supply monthly volumes

Hi, could you add robocash into this list as well?