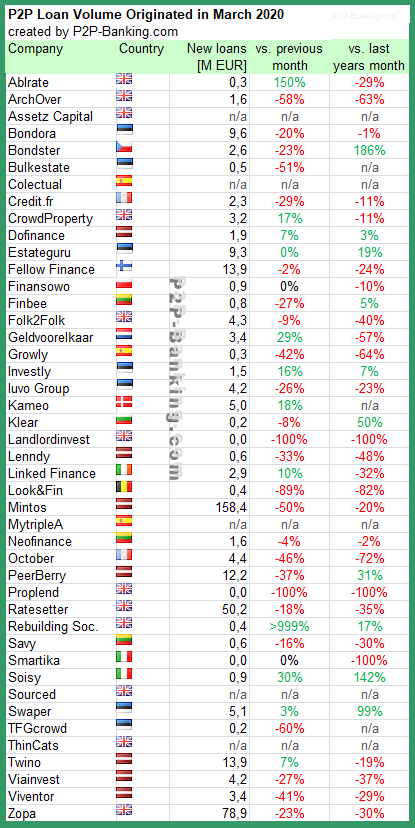

The table lists the loan originations of p2p lending marketplaces for last month. Mintos* leads ahead of Zopa and Ratesetter*. The total volume for the reported marketplaces in the table adds up to 397 million Euro, down 40% to the previous month. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file, I can publish statistics on the monthly loan originations for selected p2p lending platforms. This month I added Lenndy*.

Milestones achieved:

- Mintos* crossed 5 billion EUR originated loan volume since inception

The effect of the current crisis is impacting nearly all marketplaces significantly in the second half of March. Read my previous article ‘Hunger for Liquidity – State of P2P Lending in Times of the Coronavirus‘ for further observations on this. To counter the effect the sinking volumes has on revenues of the marketplace company, Mintos* and Assetz Capital* announced the introduction of new fees for investors.

Investors living in national markets with no or limited selection of local p2p lending services can check this list of international investing on p2p lending services. Investors can also explore how to make use of current p2p lending cashback offers available. UK investors can compare IFISA rates.

Table: P2P Lending Volumes in March 2020. Source: own research

Note that volumes have been converted from local currency to Euro for the purpose of comparison. Some figures are estimates/approximations.

Links to the platforms listed in the table: Ablrate*, Archover*, Assetz Capital*, Bondora*, Bondster*, Bulkestate*, Colectual*, Credit.fr*, Crowdproperty*, Dofinance*, Estateguru*, Fellow Finance*, Finansowo*, Finbee*, Folk2Folk*, Geldvoorelkaar*, Growly*, Investly*, Iuvo Group*, Kameo*, Klear*, Landlordinvest*, Linked Finance*, Lenndy* Look&Fin*, Mintos*, MyTrippleA*, Neofinance* , October*, Peerberry*, Proplend*, Ratesetter*, Rebuilding Society*, Savy*, Smartika*, Soisy*, Sourced*, Swaper*, TFGcrowd*, ThinCats*, Twino*, Viainvest*, Viventor*, Zopa*.

Notice to p2p lending services not listed:

For new companies a small listing fee applies. If you want to be included in this chart in future, please contact me for more information.

Notice to representatives of press/media: If you are interested in publishing a branded version of this table in your own layout/design, which will make a nice addendum to your coverage of p2p lending, please contact me.

Great to see asset-backed lending platforms like EstateGuru and Investly not pulling back but managing to grow even in the times of crisis. And great job as always Claus reporting it!