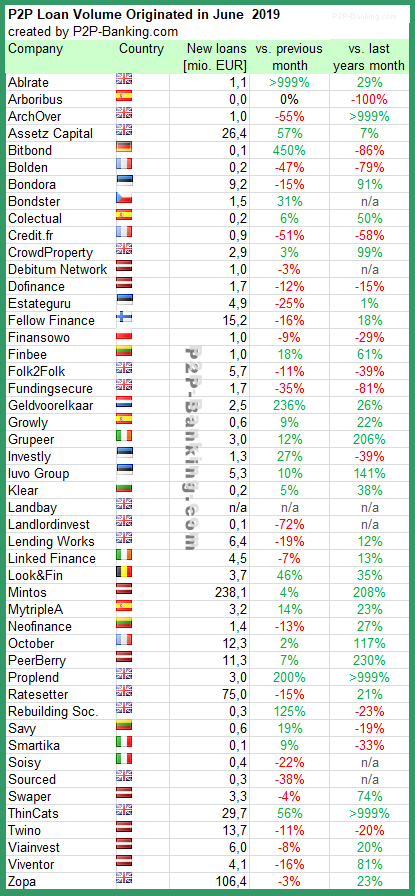

The table lists the loan originations of p2p lending marketplaces for last month. Mintos* leads ahead of Zopa and Ratesetter*. The total volume for the reported marketplaces in the table adds up to 613 million Euro. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file, I can publish statistics on the monthly loan originations for selected p2p lending platforms.

Milestones achieved this month (total volume since launch):

- Archover crossed 100M GBP

- Credit.fr crossed 50M EUR

Arboribus is listed for the last time, as the platform will cease to originate new loans.

Investors living in national markets with no or limited selection of local p2p lending services can check this list of international investing on p2p lending services. Investors can also explore how to make use of current p2p lending cashback offers available. UK investors can compare IFISA rates.

Table: P2P Lending Volumes in June 2019. Source: own research

Note that volumes have been converted from local currency to Euro for the purpose of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

For new companies a small listing fee applies. If you want to be included in this chart in future, please contact me for more information.

Notice to representatives of press/media: If you are interested in publishing a branded version of this table in your own layout/design, which will make a nice addendum to your coverage of p2p lending, please contact me.

Very interesting overview. It seems like there can be large variations from month to month. I was wondering if it would make sense to make a new column called something like “latest annual growthâ€. I guess you also have the data for that

can you comment on Mintos? What on earth is going on there – how can a platform in such a relatively small jurisdiction be underwriting so much volume..?

Sure Rob.

If you look in more detail at the Mintos model, you will see that the loans originate from over 50 ‘loan originators’ which operate in very diverse markets all over Europe, in Asia and in some Latin American and Africn countries. So while the company Mintos is headquartered in the small “jurisdiction” of Latvia, the vast marjority of loans originate outside Latvia. Hope that helps.

And not sure if you meant “underwriting” in a literal sense. Mintos is a platform, it does not “underwrite” the loans.