Non profit Wokai.org will allow contributers to donate to give microfinance loans to borrowers in China. Like Kiva and MyC4, Wokai partners with local MFIs which identify and screen potential microentrepreneur clients. Selected clients are then posted on the Wokai website through profiles that outline their business ventures and loan request. Contributers can select borrowers to fund and pay via Google Checkout, the money is then transferred to the MFI who disperse the capital to the microentrepreneurs. Field partners charge interest rates typically ranging from 8-20% to cover the high costs associated with providing loans, training, monitoring and support services to our borrowers. At the end of the loan-cycle the money is collected and re-issued by the MFI for new loans – so there is no payback to the contributers.

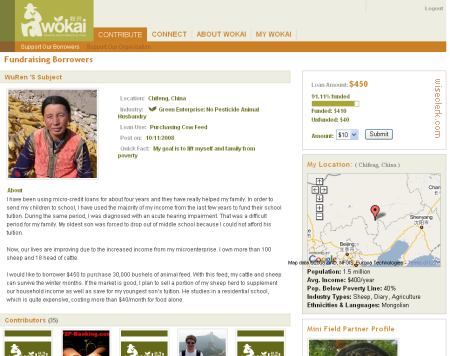

Non profit Wokai.org will allow contributers to donate to give microfinance loans to borrowers in China. Like Kiva and MyC4, Wokai partners with local MFIs which identify and screen potential microentrepreneur clients. Selected clients are then posted on the Wokai website through profiles that outline their business ventures and loan request. Contributers can select borrowers to fund and pay via Google Checkout, the money is then transferred to the MFI who disperse the capital to the microentrepreneurs. Field partners charge interest rates typically ranging from 8-20% to cover the high costs associated with providing loans, training, monitoring and support services to our borrowers. At the end of the loan-cycle the money is collected and re-issued by the MFI for new loans – so there is no payback to the contributers.

See this video for a good overview on Wokai.

The name “Wokai” means “I start” in Chinese.

Wokai has not launched yet, but I could participate in a pre-launch test drive. The platform has more social networking features then other platforms allowing for discussions and users asking questions to the MFIs/borrowers.

Wokai began in the fall of 2006 when Wokai co-founders Courtney McColgan and Casey Wilson met while studying advanced Chinese at Tsinghua University. The idea of Wokai gradually transformed into a plan of action and, with the help of a team of supporters, evolved into a startup nonprofit.

Wokai screenshot (pre-launch 10/20/08)

Thanks for the shout out in blogosphere. A cool fact: Wokai would liek to be able to 100% repay contirbutors funds, as the borrowers are actually repaying the loan capital. The problem comes with the Chinese government. There are some major hurdles transferring capital back and forth from the US to China without being a regulated financial institution. We expect those to realx in the long term.

Good news is, we don’t think this will affect user participation much. About 90% of Kiva’s borrowers never take their money out, according to my conversations with Matt, Kiva Founder.

Thanks again!

We are working to enable loans for microfinance in China for RMB loans.

In summary both sites are helping microfinance in China, one via international donations, the other via local (Chinese) rmb loans